No time to read the update? Watch/listen for free:

Edited by Brian Birnbaum.

Duolingo shares fundamental genetic traits with Costco. This means Duolingo will likely get much larger over time.

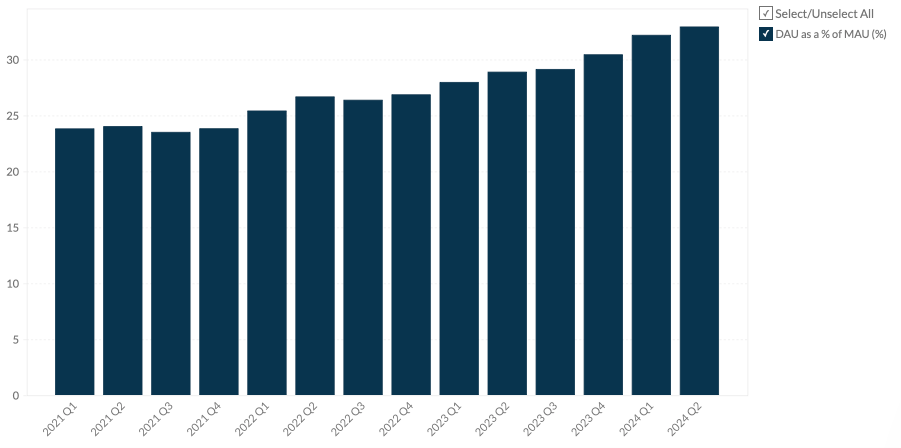

Duolingo’s KPIs continue to hit new record levels, driven by extraordinary process power. This is best evidenced by the record level of DAUs as a percentage of MAUs, as you can see in the graph below. The higher this metric goes, the more engaged the user base is and ultimately the more earning power Duolingo has. Simultaneously, earnings from continuing operations have risen from 8.03% in Q4 2023 to 13.66% in Q2 2024. This demonstrates that Duolingo is capable of converting engagement into bottom line performance, which wasn’t clear to me at first.

CFO Matthew Skaruppa explained in the Q2 earnings call how he sees Duolingo’s ability to convert engagement into a healthy bottom line performance continuing over time:

But your point notwithstanding, we think that we can do both. We -- the business has scaled really nicely. It’s got high gross margins, so we can achieve our capital allocation strategy, which is first and foremost, investing in R&D in the business to drive organic growth in that flywheel and drop a good portion down to the bottomline. So I don’t see it changing in the near-term or any updating of that long-term target, but we’re happy with it.

But Duolingo’s financial performance is just a high level indicator. What matters most is the company’s genetic composition, which suggests that Duolingo has a large runway ahead and is likely to evolve into something much bigger and meaningful than a language-learning-app.

When researching Duolingo, one cannot attribute the improved metrics to any particular driver. Management cannot pinpoint any particular factor either and meanwhile, the attainment of higher KPI levels is relentless. This is the hallmark of process power, by which a company eventually builds a moat by focusing on something more intensely than its competitors over a long period of time. It’s a highly intangible force that is nonetheless material in that it leaves a trail behind. It’s also the force behind my Palantir (5X+ return) and Spotify (4X+ return) picks.

Process power is first and foremost the main driver behind Costco’s colossal return over the past few decades, as I explain my recent Costco deep dive. I now begin to suspect that Duolingo is a success similar success story in the making, directionally speaking, with reasonable odds of the company evolving into a large education company that is far more attuned to the expectations of today’s customers than are traditional institutions. Although Duolingo is valued at just over 20 times sales, the long term potential is appealing.

The main takeaway from my Costco deep dive is that they have succeeded by executing and improving the same algorithm for decades. They constantly seek to deliver more value to shoppers at a lower real price, while taking care of stakeholders. In doing so, they’ve created a strong moat, which essentially consists in the place they occupy in their customers’ and providers’ minds as the place they come to get awesome deals. Costco’s algorithm works anywhere, which has propelled the company’s international expansion.

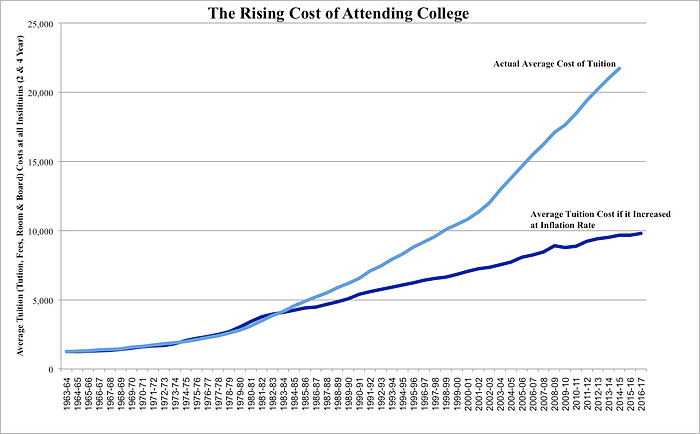

In my view, Duolingo is running a similar algorithm but with a different end application, which is to help people learn new things online. They’ve ultimately created an environment which makes learning addictive, thus solving the most important problem in education: student motivation. Instead of leveraging the addictive power of algorithms to kook people on useless content, they’ve done so to help them learn faster. In effect, Duolingo gives you better outcomes as a student per dollar invested on your behalf over time, which is the inverse of what the traditional educational system does:

Beyond the steadily rising DAUs as a percentage of MAUs metric, Duolingo’s proces power is best evidenced by the number of Duolingo users that have a streak (number of consecutive days they’ve been on the app for) longer than 365 days. The number is currently over 7 million, while it was only 3 million a year and a half ago. While Duolingo’s engagement may not grow at this rate every year, what’s evident to me is that they have the fundamental organizational properties to drive this sort of growth often enough for Duolingo to get much bigger.

Duolingo’s history is full of events in which the company inexplicably outperformed, like when they organically managed to get their app featured on the Barbie movie. In this particular instance, it’s worth revisiting the words of Luis von Ahn during the Q3 2023 earnings call when asked how they did it. He couldn’t point to anything specific:

And the combination of getting much better with marketing and the getting better has made it so that Duolingo has really struck a cord with this.

Part of the reason that we've exceeded our expectations is because things have happened that there was no way for us to expect. We could not expect that, the Barbie movie was going to add Duolingo in there.

The rapid increase in the number of users with a streak longer than 365 days coincides with Duolingo using AI more to create content. While it could be argued that this company may be disrupted by AI, I view AI as enhancer of their operations. AI needs data to learn and automate processes. By making their app increasingly addictive, Duolingo is securing its spot as the top global education data reservoir. Here’s what co-founder and CEO Luis von Ahn said about the matter during the Q2 earnings call:

Over the last year and a half, we’ve seen an amazing acceleration in terms of the speed of content that we can add.

A lot of it has to do with AI. Not entirely.

Some of it is just better processes from ourselves.

But a lot of it has to do with AI and we’re really excited about that. And it’s not just that it’s cheaper to add the content. That’s interesting and that’s good. It helps our margins and I’m sure Matt loves that.

But what I’m more excited about is that, nowadays we can create certain pieces of content so fast that these are things that just we couldn’t do before.

Although the long term potential is vast, Duolingo’s foundations still require particular attention.

Duolingo evolves into a broader education company from here by deploying new verticals and thus teaching a growing volume of subjects. Last year Duolingo launched the math and music verticals, which according to Luis are still small compared to languages but are growing well. However, there’s one fundamental issue with the company’s fundamental value proposition at present and this is that it’s largely a nice-to-have for its customers.

This is only not true for English learners in non-english speaking countries, since learning English means they get an almost immediate pay raise. Around half of Duolingo’s revenue comes from the US at present, where most folks can speak English.

As Luis said during the call, most users are hobbyists that want to learn languages for fun. In the Q2 earnings call an analyst asked Luis wether they were seeing changes in their users’s behaviour due to the (at the time) macroeconomic uncertainty. While his reply was assuring, they’ve actually never gone through a recession and so the top line’s resilience in a time of true economic hardship remains an unknown. This is what at present prevents me from making a major bet on this company.

Here’s what Luis said in the Q2 earnings call about this topic:

There’s a lot of uncertainty in the external world. When we look at our numbers, we’re not seeing anything. I mean, our consumers don’t seem to be reacting to anything. There’s nothing worrying.

In the past, we’ve had similar situations where there’s uncertainty in the world and when we look at our consumers, we just can’t see anything. And we don’t really know why that is. I’m not going to say that we are recession proof. We just don’t know because we’ve never really gone through a recession.

Duolingo Plus, their intermediate tier (above the free one and below the one packed with AI features) sells for just $6.99. This is a relatively small amount and indeed, the aforementioned engagement metrics are indicative of a user base that’s more than happy to pay this amount, presently. In the case of Spotify, for example, while I haven’t seen the company go through a severe recession it’s qualitatively clear to me that people will give up many other day-to-day essentials other than food, water and shelter before they give up on Spotify.

Perhaps this is the case with Duolingo, but this is not clear to me at present.By the time you read this, I will be writing my Amazon Q2 2024 update. Per Andy Jassy’s words, it seems that Amazon customers traded down in Q2 across the board, according to their analytics. It would therefore seem that Q2 did see customers pulling back on their expenses and thus, Luis’s remarks on Duolingo not seeing any behavioural changes is notable.

Per Luis’s words it seems that expanding the English vertical is a primary goal for Duolingo. Per their process power, I would be content betting money on them expanding the percentage of revenue that comes from English meaningfully. Over time, this should equate into a business with stronger foundations, thus increasing the odds that they do evolve into a large educational institution, that best caters for the expectations of modern students.

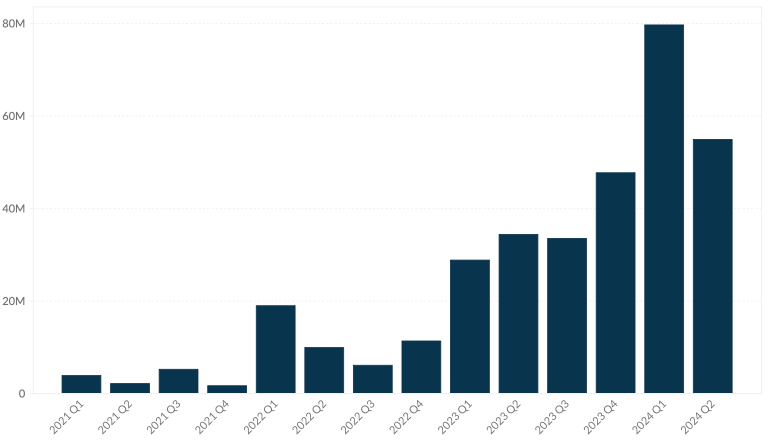

In the meantime, per the graph below, Duolingo’s free cash flow per share continues to skyrocket. There are certainly countless factors at the user experience level to describe their success. But the below graph simply screams process power, and companies with extraordinary process power tend to increase their free cash flow per share over time. Despite my concerns, I continue to be interested in potentially becoming a Duolingo shareholder.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Great writeup. Similar to your recent writeup on amazon’s culture, I think Duolingo has something special with a management so intensely focused on the end user and constant iterations to get better