Edited by Brian Birnbaum.

You can listen to this deep dive for free on Spotify:

1.0 Spotify’s Apprentice

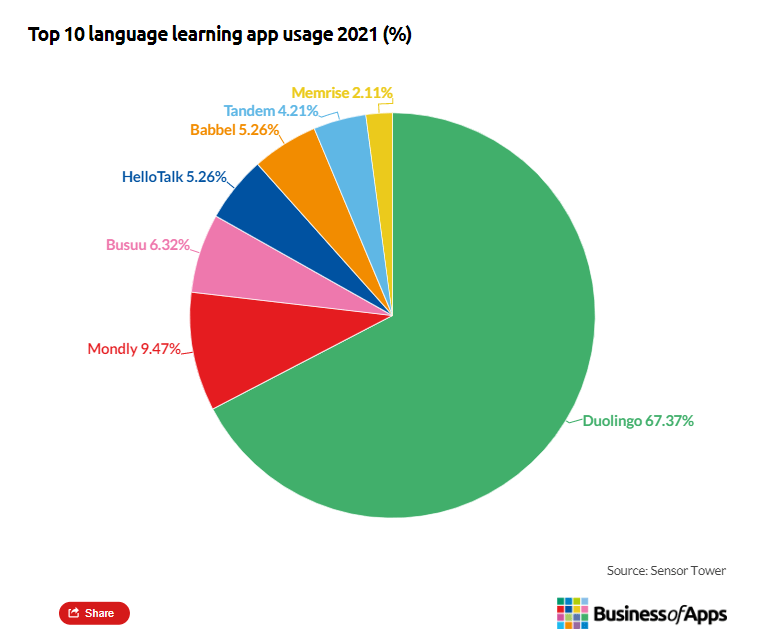

Duolingo seems like a silly language learning app, but it is quickly evolving into something far more significant.

The only reason Duolingo exists is that it has unstoppable process power.

The internet is full of free information. In theory, anyone can learn anything.

Gigantic information gatekeepers like Google know almost everything there is to know about every individual that’s connected to the internet, including their learning aspirations.

Despite this reality, Duolingo continues to amass users. Year after year, a growing percentage of them choose to go paid.

From Q3 2020 to Q3 2023, MAUs (monthly active users) have risen from 37M to 83.1M. That is a 224% increase in just three years.

But, DAUs (daily active users) are what really matter. Duolingo teaches subjects that require people to practice every day.

At just over 24M DAUs in Q3 2023, Duolingo is barely scratching the surface.

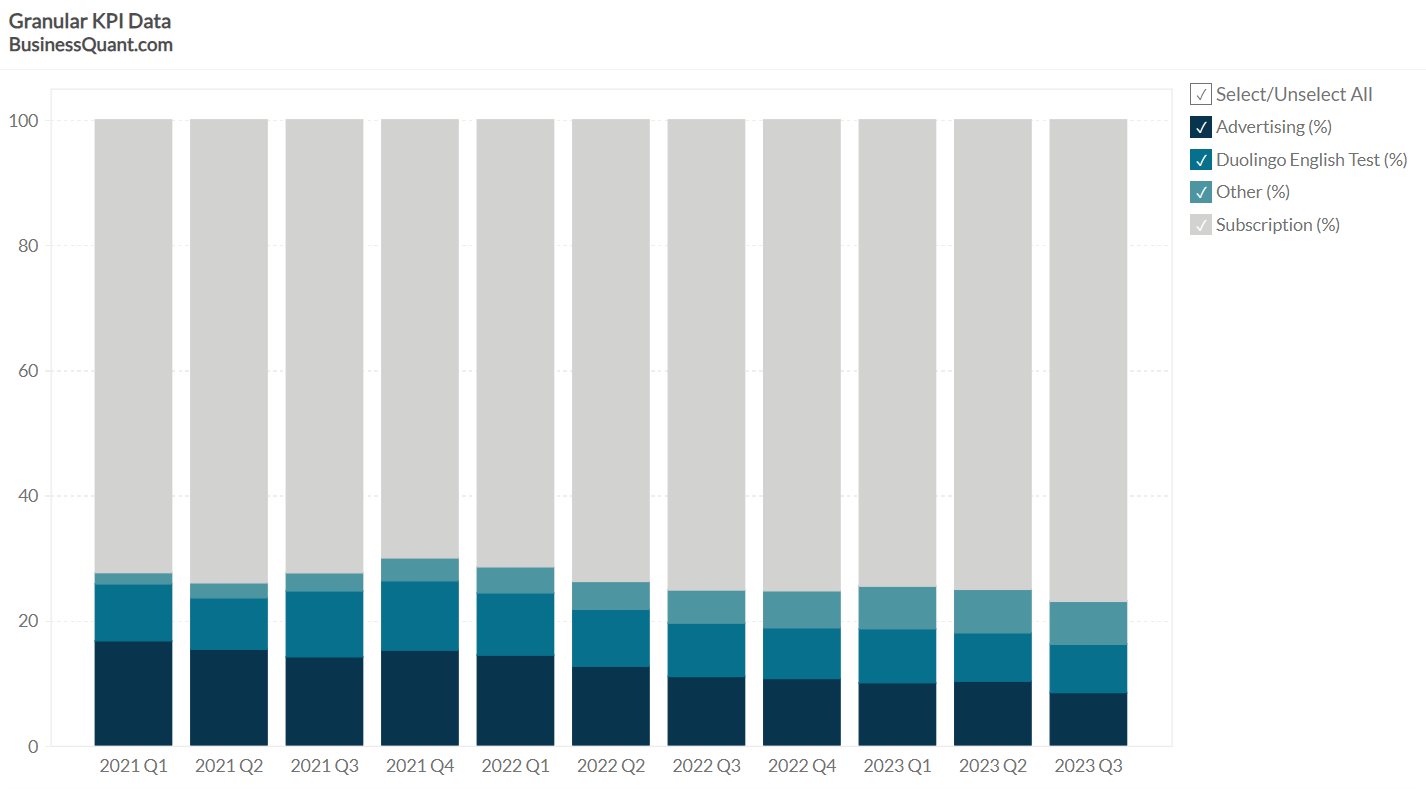

Paid subscribers as a percentage of MAUs have gone from 4.5% in Q1 2021 to 7% in Q3 2023. That’s an increase of 55.5% in three years.

Why?

Having researched the company in depth, I have learned that Duolingo excels at motivating people throughout the learning process.

Information on any topic is abundant today–but this was also the case before the internet came into our lives.

We had books.

Still, the average human needed to attend a school, in order to subject himself to a repetitive process designed to maximize learning. Most people are not self-learners and this is still the case today.

As we spend more of our lives on our smartphones, they become the next logical storefront for schools. This is Duolingo.

Duolingo is building the foundation for Internet University.

From the outside, Duolingo looks like a silly, harmless language app. But,didactic mechanism underlying Duolingo’s capacity to teach languages can be used to teach anything that requires repetition.

Duolingo seems to have nailed this mechanism to such an extent that, further than capturing market share, it’s expanding the TAM of the language learning market itself. In the Q3 2023 earnings call, for example, management shared that, in the US, 80% of all users were not learning a language before Duolingo.

Over the long term, by leveraging its process power, Duolingo will repeat this model across a growing range of subjects. Any subject or skill that requires repetition, Duolingo can teach at scale.

At this stage, you may be wondering how process power fits into this equation.

Every time an analyst asks management how they achieved something, the answer is ‘lots of A/B testing.’ See this example from Q3 2023:

Analyst: What are the two or three things that have driven such [MAU growth]?

Luis von Ahn (CEO): The first one is just product improvements. I mean, we run hundreds of A/B tests every quarter and they compound. And so our product is just significantly better than it was two years ago. And so that's the biggest thing.

Then the second biggest thing is we just got a lot better with our marketing.

Further, if you refer to the MAU chart, which I include again for your convenience, you will notice that growth was fairly stale from Q1 2021 to Q2 2022. After that, MAUs took off.

This shift reveals one of the better examples of process power that I have seen in a long time.

In this article by Lenny Rachitsky, former CPO of Duolingo Jorge Mazal explains how they revived DAU/MAU growth by building an exhaustive model of the user flow.

The model led the team to identify a metric that increased at a 2% rate every quarter for three years and would have an outsized impact on DAU growth:

CURR (current user retention).

Duolingo got to work on building features that would drive CURR and, through trial and error, eventually found three broad vectors that worked:

A league system that incentivized users to compete and therefore made the app stickier.

A much higher level of flexibility in push notifications.

The streak system, which shows users how many consecutive days they’ve done activity on the app.

These three vectors have meaningfully increased CURR, which have largely led to the rapid growth that you see in the graph above.

Yet, none of these vectors could have been predicted by anyone at Duolingo before the A/B testing showed promise. That’s why management always has A/B tests to thank when asked about fast product improvements.

Currently user retention rate is probably the biggest lever that we've had. It's not the only one but it's the biggest lever that we have to move. We expect there's still a lot of room there for us to improve.

For user growth, we believe that the main thing that has affected user growth is improvements in free user retention. That's it.

-Duolingo CEO Luis von Ahn during the Q3 2023 earnings call.

Duolingo also disclosed in Q2 2023 the Family Plan, which allegedly increases LTV (user life time value). This is because even if you stop using the app, so long as one of your kids is using it you still pay for the Family Plan.

It’s no coincidence that DAUs as a percentage of MAUs continue to grow robustly.

Evidence of Duolingo’s process power extends beyond intrinsic product features.

During Q3 2023 Duolingo was referenced in the latest Barbie movie, which aided growth during the quarter. In the Q&A section, CEO Luis von Ahn said the following:

And the combination of getting much better with marketing and the getting better has made it so that Duolingo has really struck a cord with this.

Part of the reason that we've exceeded our expectations is because things have happened that there was no way for us to expect. We could not expect that, the Barbie movie was going to add Duolingo in there.

Reading Duolingo’s quarterly transcripts forward, I can see management expressing more confidence in the company’s ability to market itself. And then, all of a sudden, the app is featured in a blockbuster movie.

It is hard to describe process power, but it is hard to miss when in motion.

A company with this level of process power is rare. It is no surprise to me, however, that they continue to mention Spotify in their quarterly earnings calls.

Since IPO, Duolingo management has mentioned Spotify 13 times, and with a rather reverent tone at that. Why? Because if Amazon is king, Spotify is the prince of process power and heir apparent to the throne.

Spotify’s free-to-paid user conversion is 50%. Duolingo’s conversion, despite its rapid progress, is a sixth of that.

At a price to sales ratio of 20.5, the market is relatively aware of Duolingo’s excellent organizational capabilities. Yet the key question is, Where or even what can Duolingo become in a decade’s time?

Join me in the next section to explore this question.

2.0 An AI Moat

Duolingo has a strong proprietary data moat, which will likely lead to a teacher AI. An AI will decrease OpEx as a % of revenue over time.

As of Q3 2023, Duolingo users complete 10 billion exercises every week. As a fairly unique data set, I believe this will accelerate Duolingo’s process power over time.

Search engines do not have this dataset as they do not interact with learners at the same level of granularity. Google knows what you want to learn but Duolingo knows what you still get wrong, why you get it wrong, and how to fix it.

At first, the dataset will allow Duolingo to ship AI features that increase engagement. Over the long term, however, it will enable an AI that runs the company on autopilot.

An example of such a feature is Roleplay, which was released in Q1 2023. In the words of Luis, Roleplay was previously a ‘dry conversation’ with the AI. But now, it’s full-on role play in which users expect the unexpected.

Going from AI driven features to a broader AI that takes care of a large part of the iterative process seems far-fetched, but breaking down the shift into smaller components reveals that it is not.

All Duolingo does at its core is inexorably modify an interface and the content displayed within it so as to:

Increase user engagement.

As a result, make users learn faster than otherwise.

By feeding an AI a curriculum and copious data as to how interface and content iterations modify the above two variables, you eventually end up with a model that can do most of the (manual) work for you.

The model is unlikely to eliminate the need for human judgement, but it will gradually abstract away much of the labor required to A/B test.

Going forward, this means rising levels of operating leverage via automation, further amplifying the leverage Duolingo is set to gain by simply deploying new learning verticals (next section).

Carefully reading Duolingo’s quarterly transcripts reveals that this dynamic is already occurring.

In the Q3 2023 call, CEO Luis von Ahn states that generative AI is enabling the company to ‘create new content dramatically faster.’ Creating content via generative AI is therefore already decreasing OpEx as a % of revenue.

The difference between an AI creating new content faster and new content that drives further engagement, for example, is simply more parameters in the underlying AI model and more data.

As new models with more parameters and an increased ability to generalize come online, the cost of inference will drop, enabling Duolingo to use AI more generally across the board.

Now over the last few months, we've had this amazing thing of generative AI. And ever since that came out, ever since we got early access to it, we started developing features for it. And what's amazing about it is it's like having a really good writer on staff.

It allows us to just have a really good language that can come pretty quickly.

-Duolingo CEO Luis von Ahn during the Q1 2023 earnings call.

Duolingo has three subscription tiers: Free, Super and Max. The company is now actively looking for way to embed AI features in all three subscription tiers.

It’s quite interesting how AI features started out in Max. Initially, running the models was expensive. But this has changed as inference has become cheaper.

Even more interestingly, this was foreseen by Luis when they first launched Max, which speaks to the quality of his thinking.

Here is what Luis said about Max in Q1 2023, when the subscription tier was launched:

Now the one thing that I'll mention, which is important to mention is providing particularly live access to large language models is not super cheap. For example, in our case, we use OpenAI, we have to pay them for GPT-4, etcetera.

So for now, we keep these features in the highest paid tiers so that we can actually pay for that cost

Over time, though, we expect that the cost of querying large language models is going to go down quite significantly, and that may allow us to do certain other things, for example, for the free tier.

3.0 Driving LTV, Decreasing CAC

Duolingo is now executing the same playbook as other excellent networks, like Uber: deploying new verticals to increase ARPU and thus drive operating leverage.

Duolingo is executing the same strategy that has enabled Uber to transform from charity to cash machine.

The company is leveraging its dominance in the language learning app market to deploy additional verticals to its user base–very much like Spotify, which is leveraging its lead in music to tap into other audio verticals.

This particular strategy has given Uber much higher levels of operating leverage, which has led to an impressively rapid improvements to the income and cash flow statements.

Perhaps most fascinating, additional verticals drive a disproportionately higher frequency of engagement between the demand and supply sides of the network and, in turn, reduce CAC (cost of acquisition).

With verticals, Uber has access to a broader audience, which ultimately drives down the cost of acquisition. Users that join via one vertical get funnelled into other verticals, driving LTV up.

Duolingo is on the same path with the deployment of its math and music verticals–except its income statement is already evolving in the right direction.

Duolingo decided to deploy these verticals in the main app, together with languages, in pursuit of synergies described above. Per the comments of CEO Luis von Ahn in the Q3 2023 conference call:

We decided the best strategy was to put both the math and music course inside our main app.

There's many reasons for this, but the biggest reason is that we can immediately take advantage of any positive change that we do in the main app for engagement or for monetization or for anything immediately you take advantage of those because math and music are just going to be other courses in the app just like French or Spanish, just as if we were adding another language.

The math and music verticals will neither drive financial outperformance now nor for the whole of next year. Most investment will continue toward core language verticals. These verticals were only launched for iOS users the day after the Q3 2023 earnings release, for example.

In fact, as of Q3 2023, ARPU has dropped by 7-8% for the previous three quarters as Duolingo has grown in foreign markets, where the price of subscription is lower. Note that this was nonetheless in line with management’s expectations.

Meaning, ARPU is not the source of operating leverage at present. I suspect it’s ultimately the result of faster organic growth, stemming from the process power described in Section 1.0.

Duolingo is now onboarding more users per dollar invested. Along with relatively prudent cost cuts, management’s decisions are accumulating on the bottom line.

Going forward, I foresee this trend continuing.

4.0 Financials

Income Statement

Teaching English is Duolingo`s fundamental value proposition. It’s the language people learn across the world to essentially increase their value to the marketplace.

But this also presents questions.

50% of revenue comes from the US, in which almost everyone speaks English. According to management, these users are learning foreign languages like French for fun, which includes travel.

Therefore, half of Duolingo’s revenue is hypothetically at risk of withering should a severe economic contraction come.

I am still uncertain about what we have lived through in the past few years, in that consumer activity has been mixed. The purchase of consumer electronics has at one point stalled and there has arguably been an attention economy recession, exiting the pandemic.

The pandemic initially fueled a surge in digital engagement, as people spent more time at home and turned to online activities for entertainment, information, and connection.

However, as lock-downs eased and normalcy began to return, this trend began to reverse. Consumers' attention has become more fragmented, and they are increasingly selective about the content they consume.

But, there are no signs of weakness in Duolingo’s metrics reflecting any of the weakness we saw in other attention-based industries. It very well may be that the subscription is sticky through bad times.

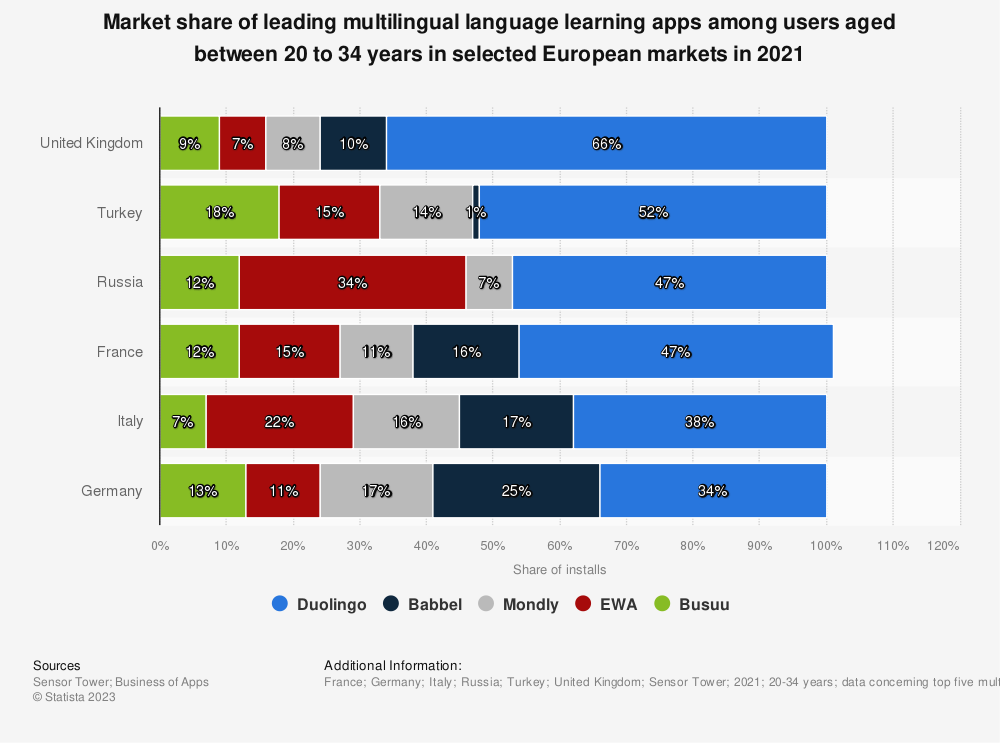

Further, there is a big difference in paid subscriber penetration per country. Naturally, poorer nations pay less frequently. Therefore, to unlock revenue from these regions Duolingo has to engage in a fair bit of A/B testing, which is nonetheless the house’s specialty.

In Q2 2022, Duolingo modified prices. Previously, prices were the same all over the world. Keeping prices stable in wealthy countries, they were lowered ‘significantly’ in poorer ones.

In Q3 2023, Duolingo ran experiments that, allegedly, quite effectively increased paid conversion. Yet simultaneously implemented price modifications kept the conversion metric ‘rangebound.’

Management now expects conversion to continue trending up, as the company laps the price increases.

As Duolingo continues to improve its ability to convert free users to paid ones, subscription accounts for a growing percentage of all revenues. As a result, other streams are shrinking in percentage terms, although growth in absolute terms remains healthy across the board.

It’s of particular note that, in India, the majority of revenue comes from DET (Duolingo’s English Test). Over 3,000 universities accept the test as proof of English proficiency, including Columbia, Yale, and MIT.

Another thing to bear in mind about Duolingo’s revenue is that, at the end of every December, the company discounts the annual subscription. This is only done once per year, which makes Q4 sales seasonally higher.

Additionally, according to management, Duolingo also obtained a 50% higher RoI on marketing during Q3 2023 as a result of a series of experiments. This adds to the rising operating leverage described in the previous section and is also further proof of the company’s process power.

CEO Luis von Ahn added the following remarks in the last earnings call:

So, there's a number of things. I mean we've just gotten a lot better at figuring out what to say in our ads.

So, one of the things that we've gotten really good at is being able to shift budget between countries. If prices get higher in one country and lower than another we just shift budget because for us it doesn't matter all that much whether a user comes from Vietnam or from Thailand or something.

It should be noted that most of Duolingo’s new users come from organic growth, but the 50% QoQ efficiency gain in paid marketing gives us visibility into how Duolingo iterates on its marketing abilities.

Operating income is converging back upwards, as OpEx as a % of revenue continues to decline with cost cuts. Note that Duolingo has capitalized more R&D expenses this quarter, versus Q3 2022, as the innovation continues on Max, math, and music.

Note that not all R&D expenses can be capitalized. For example, routinely recurring R&D costs and expenses incurred for the exploration of potential new products cannot be capitalized.

Further, R&D expenses incurred for the purpose of duplicating or improving existing products (as opposed to developing new products or processes) cannot be capitalized either.

Adjusted EBITDA came in at 16.3% in Q3 2023, up from 2.2% a year ago. Without said capitalization, the number would have come in at 14.2%, implying an impressive 12% margin expansion YoY.

Other than cost cuts, another driver of margin expansion worth mentioning is that as retention goes up, people stay longer on the app, which reduces app store fees. Apple takes a 30% fee and Google takes 15%–not negligible.

Lastly, in Q3 2023 the company achieved net profitability, but this is mostly due to $8.6M in interest and investment income, which offsets the negative operating income.

I have no particular issue with this, nonetheless, since cash flow is healthy.

Cash Flow Statement

Cash from operations is tracking the converging bottom line, coming in at $37.7M. In turn, free cash flow came in at $33.5M, up from $6.1M a year ago.

The potential for automation described in the previous section, together with the likely effect on CAC and LTV of additional verticals, is likely to amplify Duolingo’s ability to produce cash over the coming decade.

So long as Duolingo’s dataset continues to be highly differentiated, I believe that the odds of the company evolving in a positive direction are high.

On top of attractive financials, I have found plenty of instances that demonstrate management’s focus on long-term value creation.

Firstly, when user growth stalled through Q2 2022, management did not resort to burning money. They instead focused on the customer to drive retention and ultimately growth.

Secondly, Luis makes plenty of mentions of how he believes the company is only getting started. Here’s a few from the Q2 2023 earnings call:

As we said before, we're glad that the business is both getting more profitable, more cash generative, etcetera. And the way we think about it is we always want to invest back in the business first because the growth opportunities ahead of us are so robust.

I mean we're at the start of monetizing our own user base and monetizing a very large market. So we're going to continue to invest.

Balance Sheet

Duolingo ended Q3 2023 with $701.7M in cash and equivalents and just $21M in capital leases. As always, investors pay the price for this pristine balance sheet in the form of shareholder dilution.

Stock based compensation came in at $25.4M in Q3 2023, representing 18.4% of total revenue.

5.0 Conclusion

Duolingo’s process power is outstanding.

The probability of the company evolving from a language app into an environment in which people can learn anything that requires repetition is therefore high.

Having listened to a number of interviews of Luis von Ahn, I believe that the company has been created and is iterating in the image of his own mind. He is an extremely energetic individual and, arguably, an iteration machine himself.

Although the company is richly valued at a price to sales ratio of 20, I am tempted to make an investment. Companies with this level of process power tend to do well over time and especially so in a winner-takes-all economy, defined by networks.

I can clearly see what Duolingo is going to evolve into, and I wish that I had spotted this company earlier.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Brilliant deep dive. Thank you Antonio.

Amazing company and excellent CEO. Thanks for covering and explaining it so well