How I Think About Inflation

A number of conditions must hold for inflation to persist through time. By looking at the problem via first principles we can gain a lot of clarity.

Today, I bring you a simple mental model which I hope will help you see through all the collective hysteria. People keep talking about the 1970s and how we may be heading towards a “lost decade”, based on what a I think is narrative based on fear and imitation more than anything else. Below follows my reasoning.

Firstly, per the multiples compression we have seen in the tech space, the market is effectively factoring in persistent inflation and rates going up way above where they are today, so the discussion is a relative one. The question is, is inflation going to continue trending upwards? I believe not.

Let me propose a very simple definition. No matter how many complicated charts and witty tweets cerebral doomsday advocates make,

inflation is the result of money supply growth exceeding that of good and services.

If you have more money chasing relatively less goods and services, prices go up. So, in order to drive inflation, you can do two things so long as the above condition holds:

Make more money available in the system.

Generate scarcity.

In order for inflation to persist through time, the above condition most also get worse through time. You need to keep pumping money into the system and couple that with some relative scarcity. Else, the economy eventually reaches equilibrium at higher price points and inflation stops, seen on a month over month basis. In yearly terms, if you look back to t=0 when the inflation started, you still see a clear price hike.

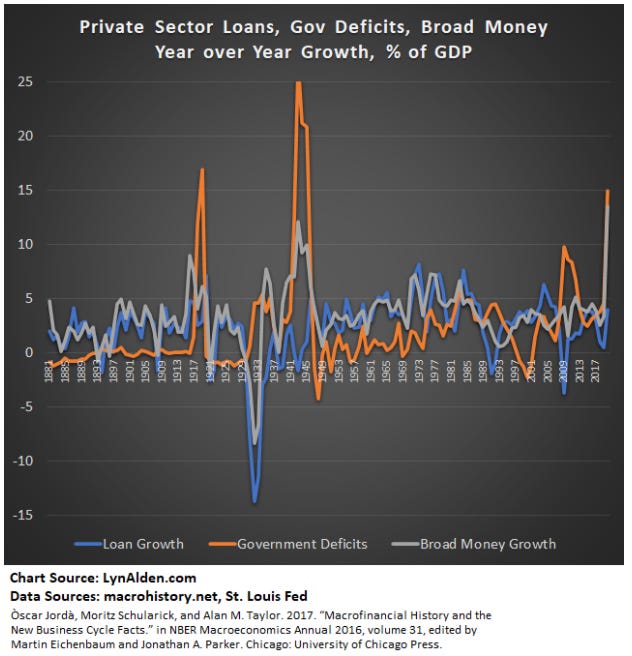

Contrary to what many believe, the inflation of the 1970s was not the result of some misunderstood, ethereal force. It was the result of money getting pumped into the system continuously, together with a rigid labor market that saw lockstep salary increases, as liquidity increased. In the below graph (taken from this post, by @FallacyAlarm), you can see how loan growth was accompanied by a growing governmental deficit, resulting in a steady broad money growth (more money in the system).

When Paul Volcker hiked rates to 20%, inflation ceased soon after, because much of the inflation stemmed from increased loans. With rates up like that, banks took their foot of the pedal and they pumped less money into the system. Today we have a different scenario, in which rate hikes perhaps are not as useful. In the last two years, we have pumped a lot of money into the economy primarily via printing and also have essentially wrecked supply chains, causing considerable material scarcity.

2020 to Present: Money supply > > Goods and services supply

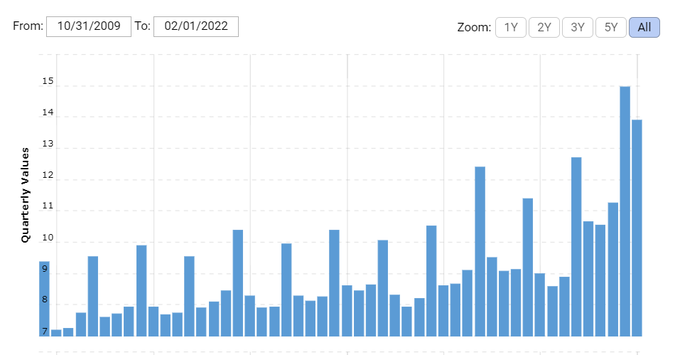

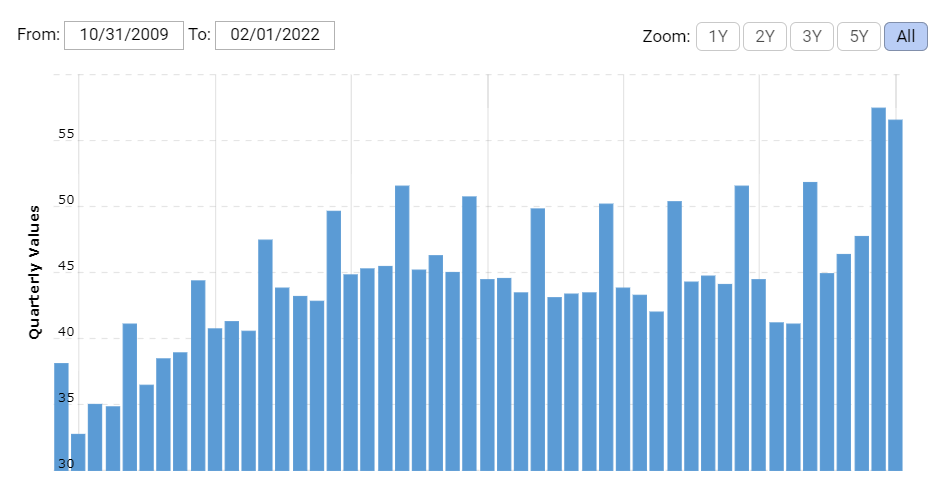

This combination is the perfect recipe for inflation. People are forced and quite empowered (stim checks) to overpay to get what they want and so prices go up. However, for that to continue happening, the situation must continue to get worse and the fact is that folks have been hard at work to fix supply chains. Inventory levels rising across the board in retail may be an early sign:

Whilst both Target and Walmart reported having issues with the supply chain, the truth is both companies are stocking up big time. Their inventory levels are rising rapidly and in order to bring it down, they are going to have to bring prices down too. This overall scenario has a number of implications:

The profits of retail companies may be hurt going forward.

For these companies to stock up in this way, the supply chains must be in at least marginally better shape than last year.

There is no telling exactly when supply chains will be back to normal and the Ukraine way does not help either, but the point is, supply chains will not be down forever, because capitalism and companies strive to be more competitive. Eventually they will be back and scarcity will fade accordingly. Indeed, we may just be seeing that right now with CPI maybe peaking.

Another issue here is that China is the factory of the West, but they keep locking down causing further supply chain disruptions. I have a number of speculations about why the CCP does this, but the end result is that it continues to aggravate scarcity. The sooner they move on regarding Covid the better, but they know all to well the equation we are subject to at the moment. We need to localize manufacturing asap.

The other aspect of this scenario that we must also consider is the deflationary macro backdrop we are in. Every innovation that comes to market is deflationary. This is not evident at first sight, but if you think about it we pay much less for things than we would have just 5 years ago. Computation has done wonders in this sense and now we have a number of technologies coming up which will magnify this trend considerably. 5 minutes ago the Fed was struggling to keep inflation high enough.

To sum up this mental model, in order for inflation to persist in the manner the market is factoring in we need to see any or both of these conditions happening:

More money being pumped into the system

Supply chains getting worse

With the exception of the war in Ukraine, which will either end soon or perhaps end in a nuclear war, I see supply chains slowly crawling back and I see the Fed doing its part to reduce the liquidity in the system. By looking at the problem through first principles, it seems that inflation is unlikely to persist much longer. With any luck, by mid 2023 we see supply chains well on their way back to normality and we are left with perhaps some inflation due to energy costs.

Note: if you bought $XOM and $CVX back when it was not correct to do so and we were facing a different end of the world scenario, you would be quite well hedged today. End of the world situations are buying opportunities, unless the world does end in which case stocks do not matter.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Great work Antonio. I see a 3rd scenario with Ukraine being that this conflict is protracted as currently neither side seems to have a realistic off ramp. One side will seemingly not back down at anything short of getting their entire country back, including Crimea, as they have already lost too much, while the other will refuse to go home with their tail between their legs. What are your speculations regarding the CCP?