Welcome back! Today, I bring you my deep dive on BOX 0.00%↑ , a company that I believe is widely under-appreciated. I hope that you enjoy it as much as I have enjoyed researching and writing about it.

Below is the format for this week´s write up. Feel free to skip to whatever section may be of your interest.

1.0 What Makes Box an Asymmetric Bet?

2.0 The Transformation

2.1 Organizational Culture

2.2 Product Additions and Go-to-Market

2.3 Operational Optimizations

2.4 Financials and Key Performance Indicators

2.5 Competitors and My Long Term Vision

3.0 Capital Allocation

4.0 Valuation and Framing the Investment

1.0 What Makes Box an Asymmetric Bet?

Box has figured out a way to implement higher value added features to its platform, which is enabling it to bring in more dollars at a marginal cost.

At this point in time, Box has a fairly capped downside with a pretty much unlimited upside, specially looking out into the long term. Box is a content management system, that enables client companies to safely store and collaborate around content - write ups, presentations, images, graphs and a long list of content types.

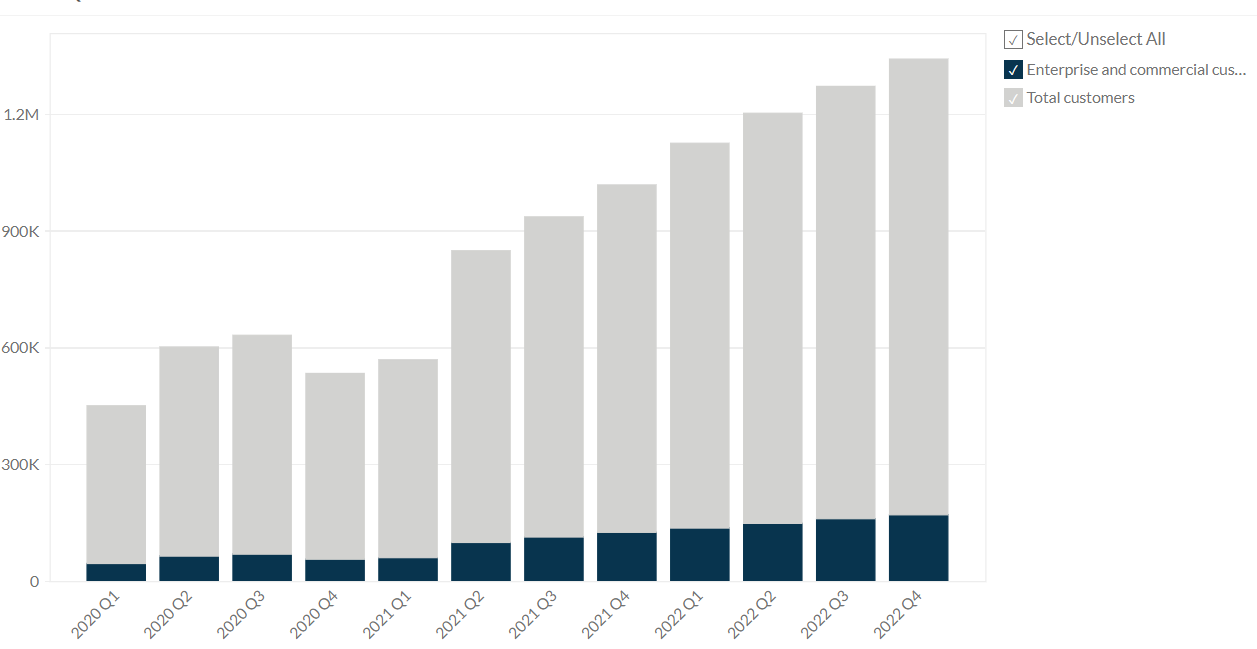

Firstly, addressing the downside, by end FY2022 Box had 100,000 paying customers (individual companies), including 67% of the Fortune 500. There are a number of things to unpack about the latter statement. Firstly, consider the following statistics about the Fortune 500:

“In total, Fortune 500 companies represent two-thirds of the U.S. GDP with $13.7 trillion in revenues, $1.1 trillion in profits, $22.6 trillion in market value, and employ 28.7 million people worldwide.” - Fortune.com

These companies account for a very large portion of the world´s wealth and Box has 67% of them onboard, making the company quite well off. Also, I have been reading their 10-Ks back and forth and the % of the F500 that Box serves has remained quite stable through time. In FY2018 and FY2019 they served 69% and 70% of the F500, respectively. In FY2020 and FY2021, unless I am mistaken, they did not disclose this metric.

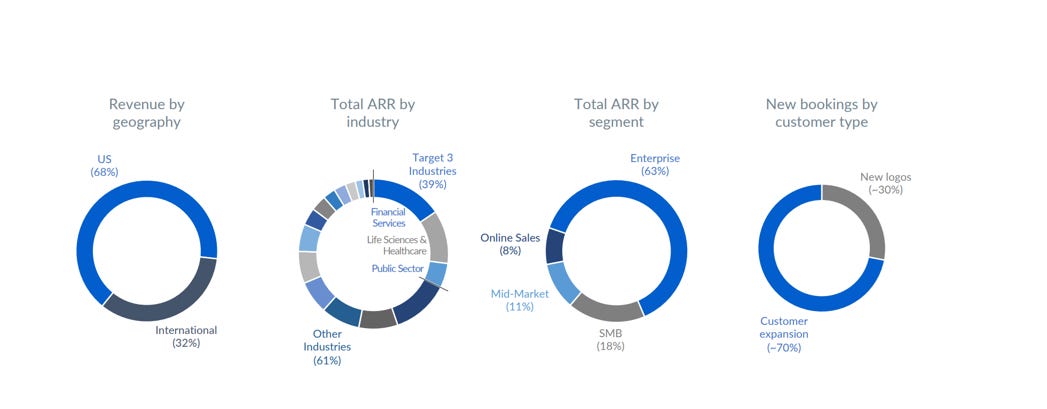

Digging a bit deeper, it seems that 63% of Box´s revenue comes from enterprise, whilst the rest comes from online sales (8%), mid-market (11%) and SMBs (18%). Whilst not all revenue comes from the F500, the overall distribution looks like quite a resilient one. For all these companies, Box is an essential service and the reason they hire it over other alternatives is security.

I have talked to close friends of mine that work at companies that use Box. Time and time again, the key feature they bring up is security - companies trust Box enough to train their employees to constantly default to storing content on the company´s platform. This may not sound like much, but it will after you read the next few paragraphs.

About the upside: what is content really, in the context of enterprise? If you think about it, work beyond the secondary sector is about processing information and sharing it with folks, so they can do the same. The way we share that information is through content of different sorts (presentations etc) and for this reason, content is the core of modern work. It follows that content management is an essential activity, deeply embedded in the DNA of modern organizations.

Additionally, the tertiary sector alone accounts for 51% of GDP, so indeed, content is basically what supports half of the world´s wealth plus. Although it does not feel like it, most companies across the world today still rely on pen/cil and paper. As the world continues to gradually digitize, a company (like Box) that has earned the trust of some of the world´s largest companies in terms of content management is likely to do very well going forward. The upside is large.

Up until this day, the predominant narrative has been that content management systems like Box are a commodity. Moving forward, the key thing to understand is that Box has figured out a way to provide value to customers beyond simply storing content safely, meaning that it can bring in more dollars at a marginal cost by simply adding new features.

Its current financials already reflect this transformation and the company is only just getting started. All the above is yielding a scenario that is worth a deeper look.

2.0 The Transformation

A boring company, on its way to becoming a world class business.

Box was founded in 2005 and initially, it was all about storing content safely. As I explained above, the company has through the years acquired a reputation to be the safest content management solution and this has translated into an impressive customer line up. Indeed, Box´s security primacy has translated and continues to do so into the world´s top organizations gravitating towards its solutions and then sticking around. Box´s security is its moat.

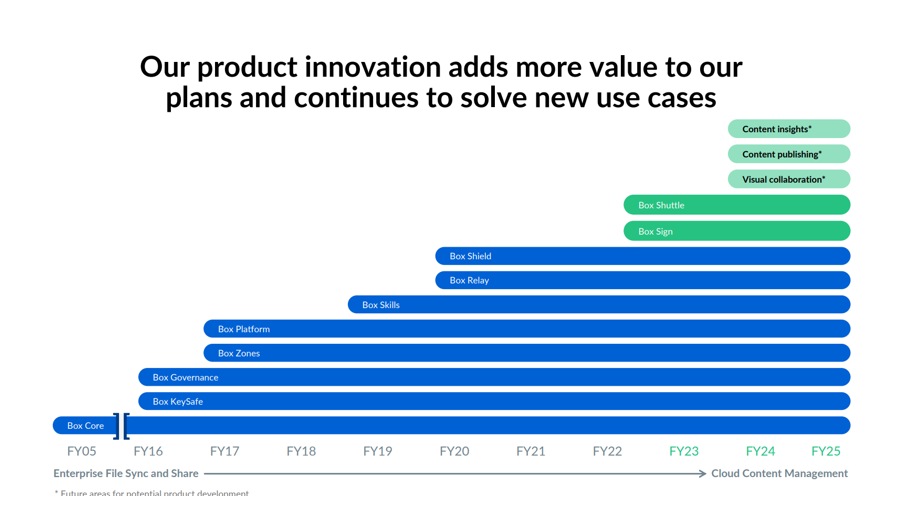

Since its inception, Box has been adding new features to the platform but for most of its journey, customers only really cared about storing content. That is not a great business per se and so for a long time, Box has been trading sideways, tracking its operating income. Now, since 2020, the company is transitioning towards delivering higher valued added services on top of its core storage offering. You can see that “Box Sign” is one of the latest additions and it may remind you of Docusign.

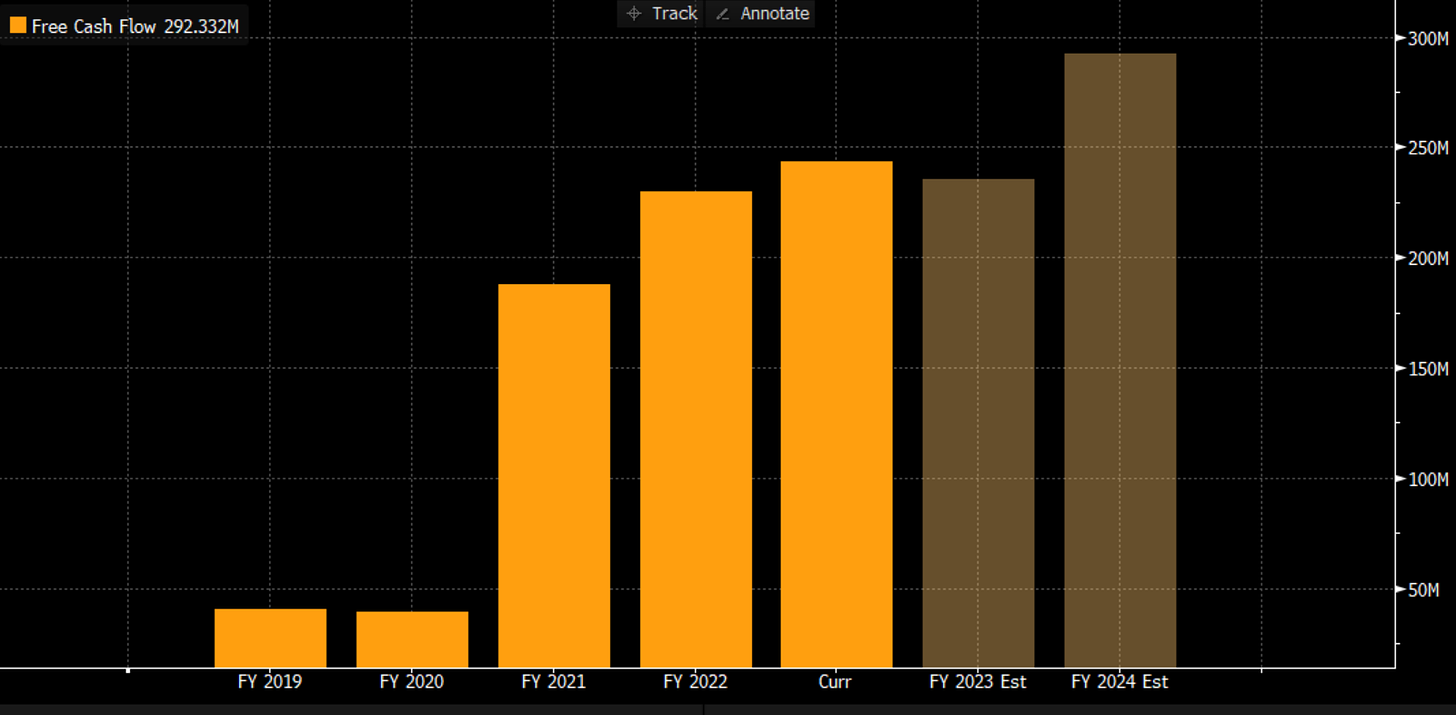

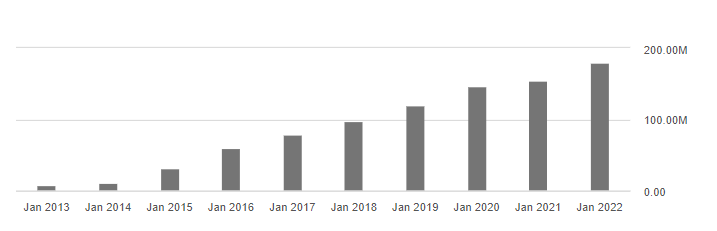

The situation here is a bit like the one I see happening with Spotify (deep dive) in the coming years. Box has been silently acquiring customers, getting into the heart of their operations and consequently building a world class platform / moat, whilst looking totally harmless and financially uninteresting. Now, it is “simply” slapping on new software features which are exploding free cashflow generation, as you may see below:

The overall financial health of the company is tracking free cashflow generation, as I will explore in section 2.4. Yet, before I do so, perhaps the most important dimension to explore is how the company has achieved this, in order to address whether the underlying mechanisms are likely to continue producing this level of success going forward. As you may know if you have been reading my work for some time, I do not like to bet on a company´s output at a given point in time as much as I do on its underlying properties, from which its output then emerges.

2.1 Organizational Culture

Box is a great place to work at. This makes the current innovation we are seeing sustainable.

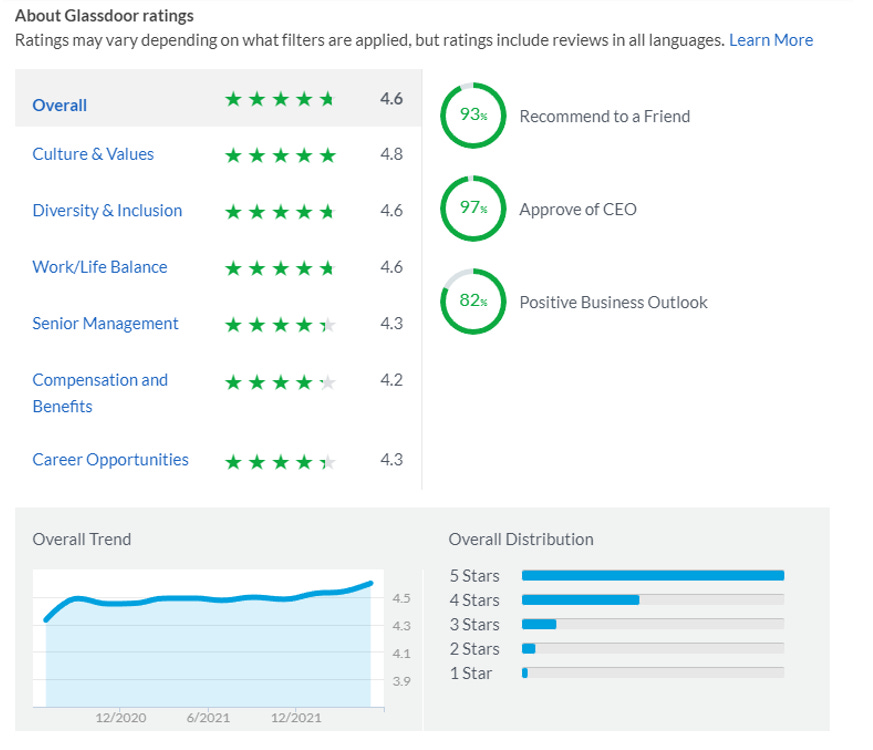

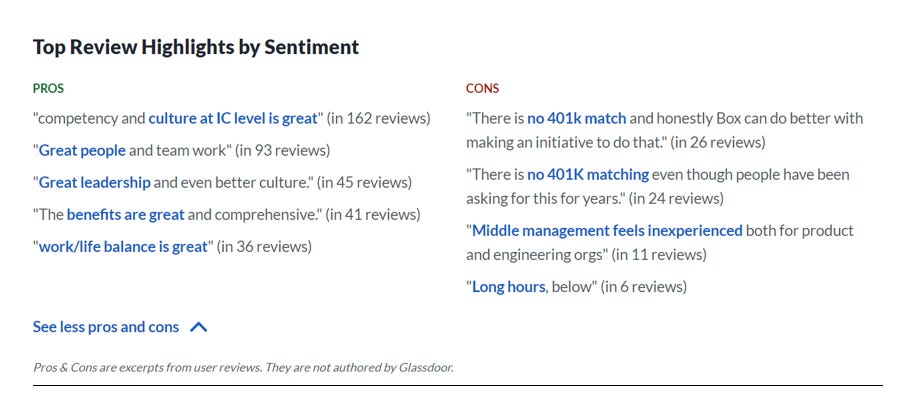

One thing that struck me when I first looked at Box is how much of a balanced guy Aaron Levie (CEO) seems. This is very qualitative, but there is something about the way he talks that immediately makes me feel like Box is a good place to work at. He does not seem to lean towards wokeness or narcissism of any kind - he is spot on in the middle and this is quite rare.

I checked on Glassdoor and similarly, the reviews on Box stand out as unusually high. Most comments talk about how good the culture is and how Box is an awesome place to work at. I encourage you to check it out and contrast it with some other companies you may hold in high esteem or know for a fact are great places to work at. Box is superior across the board and specially in terms of the CEO´s approval.

Diving deeper into the topic, it turns out that since its foundation Box has been making particular emphasis on building “culture-first”. Much emphasis is placed on creating a sense of belonging amongst employees together with an “inspiring work environment” in which Boxers can engage in meaningful and challenging tasks. In most cases the above are all buzzwords, but in Box´s cases it really works. People love working at Box.

Additionally, whilst I have not been able to pick up much on the organizational culture (yet), it seems that great emphasis is also placed on sharing information, good news and bad news. This starts with allowing people to take risks and make mistakes, such that doing so or delivering some kind of bad news will not get you sacked. This is crucial to optimize information flow across the organization, to make sure the right decisions are taken at the right time.

One of Box´s core principles is “be an owner”. Employees are empowered and held accountable for their decisions as well as encouraged to take risks. This is the key aspect that I think drives Box forward and a lot of it is inherited for Levie´s personality. The company puts its money where its mouth is and gives out plenty of stock options too.

On its own, culture means nothing to me. However, if I see a culture with unique properties that is accompanied by equally noteworthy business dynamics, then I know something is up. Merging the next section with the cultural aspects I have outlined, Box seems like a robust and resilient innovation machine, that is likely to continue outputting valuable novelties going forward.

2.2 Product Additions and Go-to-Market

Box has figured out a way to make the lives of IT managers way easier and in their business, that is all that matters.

For all these years, the number of end users (employees at customer companies) has been growing steadily at Box, albeit with relatively poor unit economics. The most valuable thing the company has developed in the mean time is, however, “I won´t get fired for hiring Box”.

The way the world works, when people have to hire external services at companies they tend to weigh the risks far more than the potential upside, except when we are talking about companies like Tesla. So, if you are the average person in an IT department you are going to tend to gravitate towards the solutions that you know are accepted by everyone, so that you do not get fired in case something goes wrong.

This should not be an excuse for mediocrity, but in Box´s case once you have the reputation for secure content management, that distribution channel, as if it were, can extend to plenty of other services. Consider Docusign, which has grown rapidly over the past few years. People undoubtedly want esignature in their organizations, but if you are an IT manager, you just want to get it all over with quickly. You want a bundle.

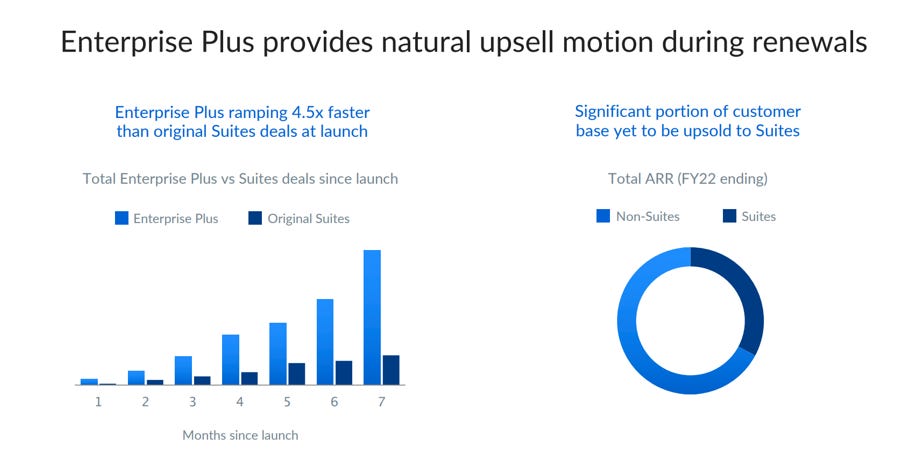

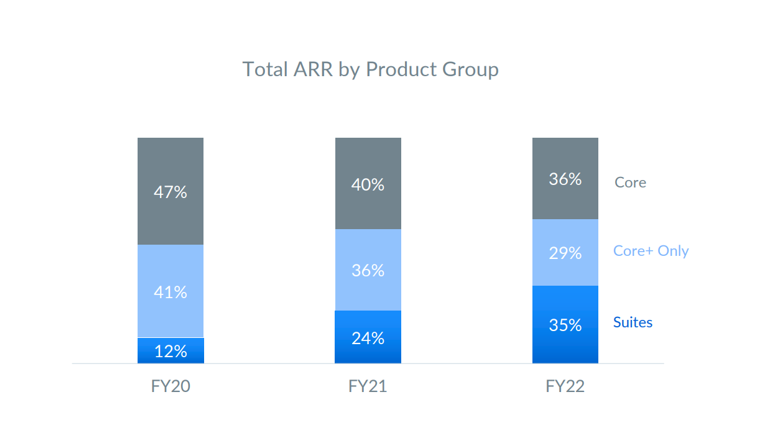

This is precisely what Box is doing with its bundle, Enterprise Plus, with “optimized pricing and packaging offerings, as we continue to double down on key verticals”. Since the new features (like Box Sign) are marginally less expensive to develop that an entire platform on its own, the company is able to bundle these new features with the old ones and bring in extra dollars at a marginal cost. As it continues to add features which deliver incremental value, it is able to drive prices up. 7% YoY, according to management:

“[we are able to] increase our pricing by about 7% year-on-year, driven by the same trends that we continue to see in the business based on what our customers are using and the value they are increasingly getting from Box.”

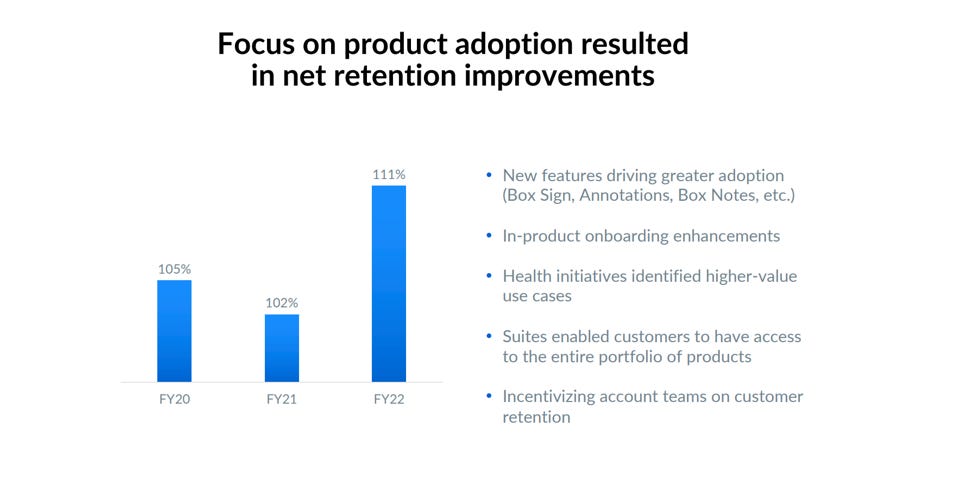

This enables IT departments to “consolidate expenses into a single platform” and abstract away more of their work, whilst being cocooned from entropy. In turn, this is showing up in the key metrics:

“And we know that when a customer adopts our multi-product offerings, we see a greater total account value, higher net retention, higher gross margin and a more efficient sales process.”

This fundamental property I think is going to take Box a long way. The market will have more and more specific solutions as the years go by, but the core tenet of IT employees wanting to do more for less and more safely will persist and if anything, accentuate through time. So long as Box continues to stick to its core pillars (below), it will do fine:

1. Frictionless security and compliance,

2. seamless collaboration and workflow,

3. and an open platform that’s integrated into every application.

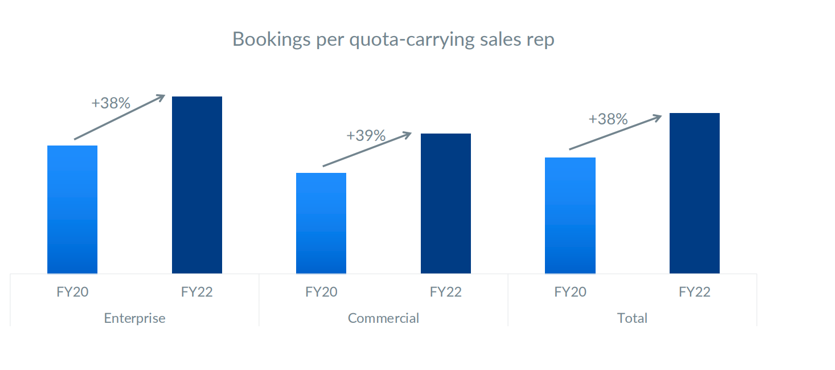

Box had 2,046 employees in 2020 and in the last FY, it had 2,172. That is a delta of 126, whilst the FCF has gone up by 5.8X. This is perhaps the best evidence for the idea of the company now bringing in more dollars at a marginal cost, but then we also have clear sign of increased sales efficiency, which also seem to be largely due to this bundling. Sales are more efficient because the overall offering makes that much more sense to the buyers. It is a coherent strategy.

2.3 Operational Optimizations

Box is also cutting costs. The question going forward is, will its culture stand the test of time?

Box is not only boosting its top line by leveraging its platform, but it is also improving its bottom line by spending its dollars better. The company is doing two fundamental things in this sense, which translate into a higher capital efficiency across the board:

Migrating to the public cloud, transitioning from its proprietary servers.

Hiring engineering talent in low cost locations, like Poland, where they already have 100 employees to date.

Primarily as a result of these two measures, capex as a % of revenue is trending down, with operating cashflow trending up:

“For the full-year of FY'22, we continue to expect capex and capital lease payments combined to be roughly 7% of revenue as compared to 9% of revenue last year.”

“For the full year of FY ‘23, we continue to expect CapEx and capital lease payments combined to be roughly 5% of revenue in Q2 and roughly 5% of revenue for the full year of FY ‘23 as compared to 6% of revenue last year.”

When I first looked at Box in 2020, attracted by what seemed like an asymmetric situation in the making, the dollar amount of capital leases the company had ($286m) surprised me. At the time, I was already aware of the economic advantages of the public cloud and the datapoint seemed indicative of perhaps not so careful management. Today the company is taking the right steps.

As it refers to hiring talent in other locations, there are some interesting implications to this. Firstly, the fact that the labor market now is not what it was in the 1970's, when we had a full decade of rising inflation - it is much more flexible, with remote work being a reality. Much of that was due to labor market rigidity i.e. companies were forced to raise salaries, which assisted in the inflation becoming persistent.

The second implication is that, I explained in section 2.1, Box´s output is largely a function of its organizational culture. How the company maintains that when hiring overseas is yet an unknown, specially dealing with the engineering team, although management seems to have plenty of experience on making the culture persist as the company expands. See this Aaron Levie interview.

2.4 Financials and Key Performance Indicators

The financials and KPIs reflect what is undeniably a succesful turnaround.

To sum up Box´s transformation, the company has simply turned into a cash machine by adding at a marginal cost new and valuable features to its platform. There is a big lesson to be learned here and in fact goes straight back to what I wrote about investing in the 21st century a few months ago. A lot of tomorrow´s great businesses look silly today, because intangibles compound suddenly.

Fundamentally, however, the qualitative element that merits most of the attention here is how the company has found a way to make the lives of IT managers much easier. Box now taps right into the instinct of self preservation of IT employees and that is a very powerful force. This is evident across the board when looking at the evolution of Box´s KPIs, which you can check out at the bottom of this section. It is self explanatory.

Whilst the company is still not profitable today, all metrics are pointing in this direction.

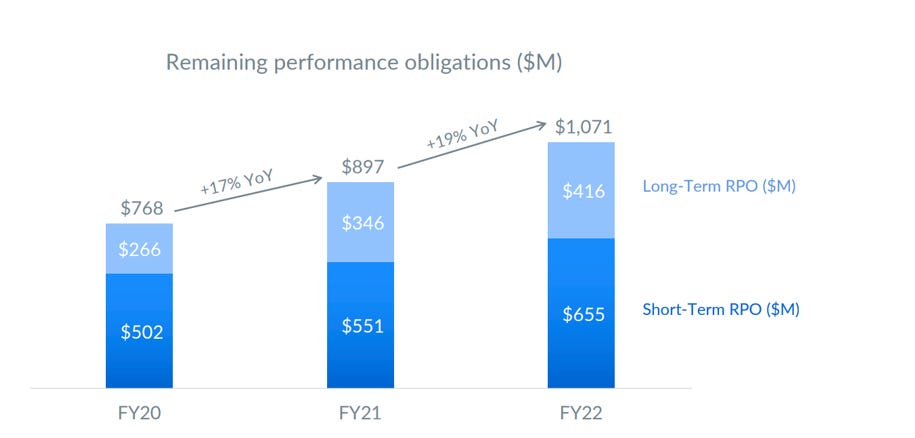

As it refers to the balance sheet, Box is looking reasonable. It currently has $391.4m cash in hand, with $367.9m in debt. Per the FCF it is generating, I do not think Box will have any problems managing its current debt profile.

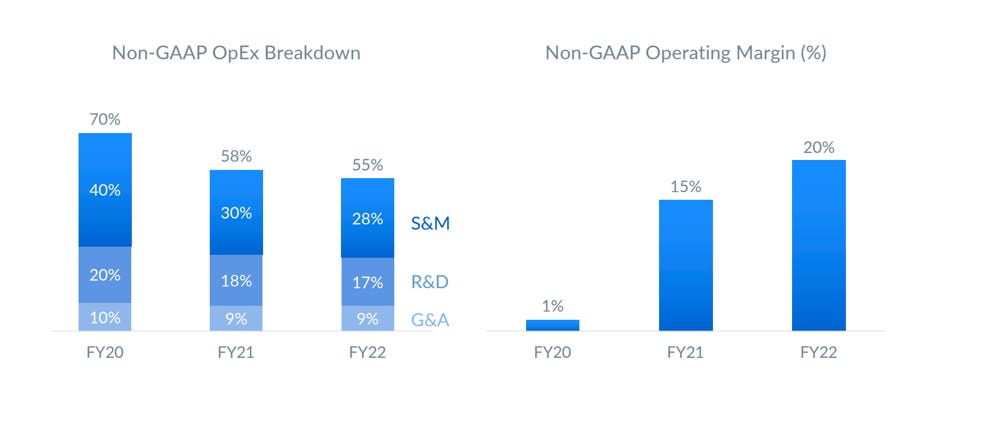

*Note: the below graphs are taken from Box´s Analyst Day presentation. Also, this is kind of confusing, but when Box shows Enterprise Plus and Suites in the same graph, Enterprise Plus is their new bundling effort. When Box shows Suites in a graph without Enterprise Plus, it is referring to bundling overall.

2.5 Competitors and My Long Term Vision

The Innovation Stack enters the scene, again.

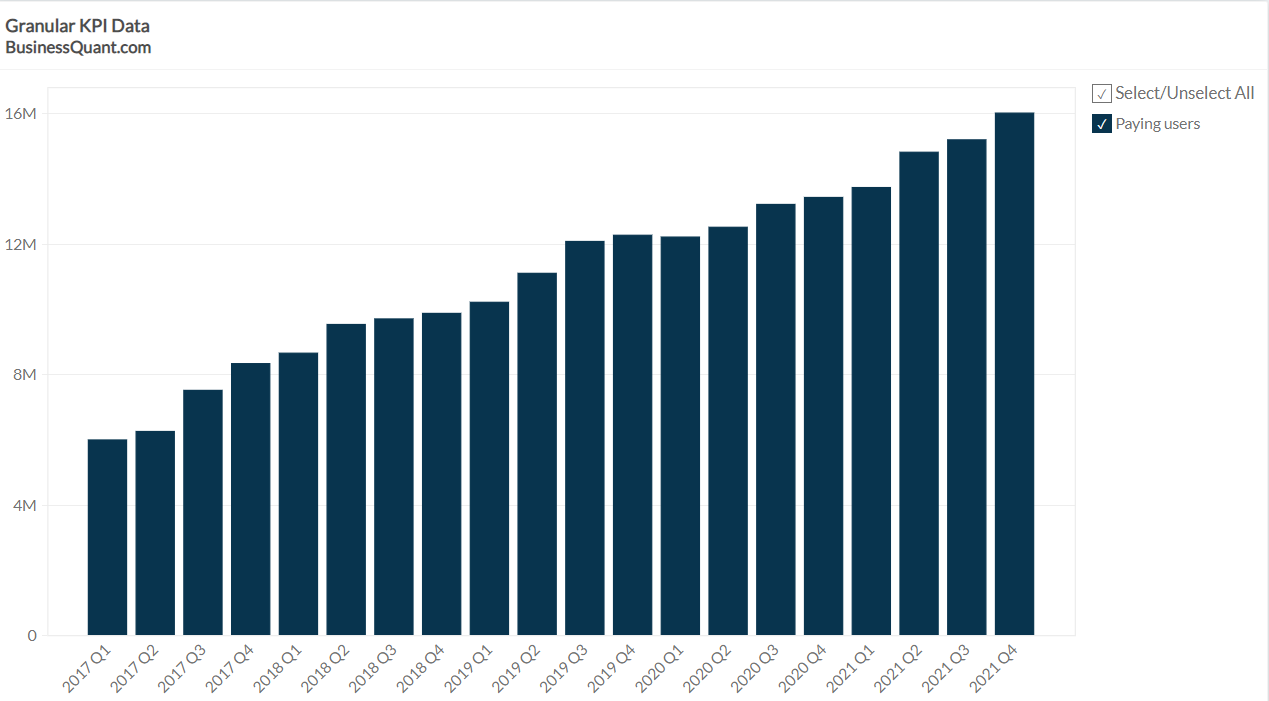

I am not an expert in content management systems, so take what I say in this section with a grain of salt. Still, my fundamental observation is that Box has been competitive ever since its foundation in 2005, in the face of strong competitors like Microsoft. To date, it has been steadily growing its end user base (number of client company employees) fantastically.

Further, the fact that it has the largest share in the Fortune 500 is very telling and this seems to correlate with how some well known consulting firms value Box´s offerings. On the other hand, whilst the market signals seem clear, I have a major blindspot here in the sense that I have never tried the product myself, nor do I know if someone can show up one day with a drastically superior product.

Looking at this from a different angle, what seems clear to me is that Box has the trust of organizations that have a lot to lose if their content gets compromised in any way. This moat that I was referring to at the start of this write up I believe is likely to accompany Box for many years, because it is not easy to tap into the whole “I won´t get fired if I hire Box” phenomenon. It takes years and it is expensive.

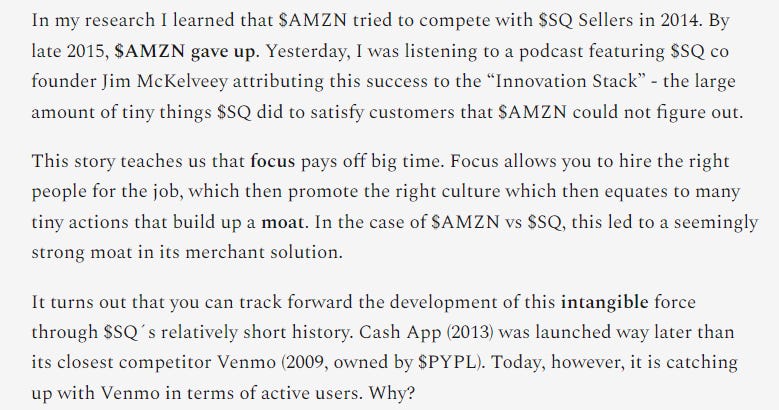

Incidentally, you see in the graph above that Microsoft is a strong competitor to Box, but it cannot quite displace it. This is yet another instance of the Innovation Stack, in which a company with fewer resources but a 100% laser focus on the task beats a company with far more resources and a more dispersed attention. I wrote about this previously in my $SQ deep dive and in general, many of the companies I write about are great examples of this dynamic.

About the long term vision, I have already outline at the beginning of this write up the importance I consider content has in the world. After the pandemic, the nature of work itself has changed to a far more remote and asynchronous one. It is now acceptable for people to work from anywhere at anytime they choose to and for this reason, content becomes even more of an enabler.

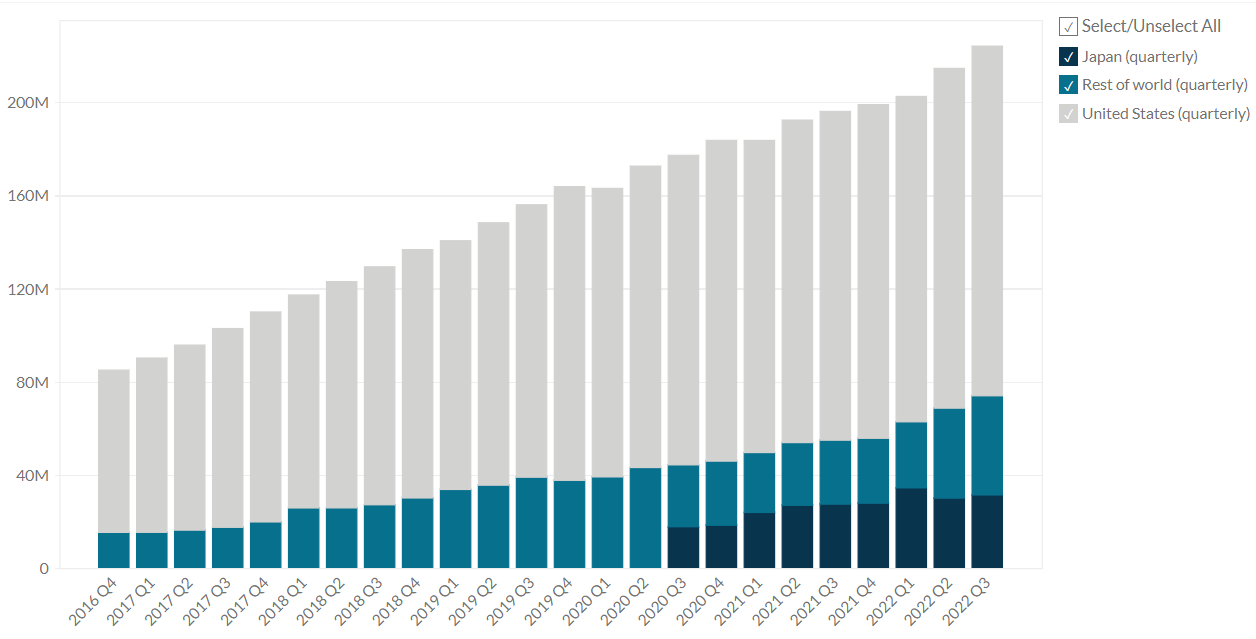

To fit people´s lifestyles, content must be accessible and workable from any device too and this makes a platform like Box all the more essential. Digital enterprises are far more prevalent in the United States than anywhere else in the world and in fact, most of the globe´s enterprises still operate in an analogue fashion. Box makes most of its money today from US customers, so as the way people continue to work changes around the planet, Box´s revenue will likely continue to grow.

“We believe we’re well positioned for the environment. If we think about businesses that are looking to be more efficient, automate more business processes, continue to drive digital operations or even consolidate and retire expenses. We think our platform is well positioned to capture more of the spend that would have gone into various point solutions across e-signature, workflow, collaboration, security and compliance. So I think the combination of just how we are positioned in terms of the macro tailwinds on digital transformation and hybrid work as well as our ability to consolidate expenses into a single platform mode” - Aaron Levie, Q1 2023 ER

3.0 Capital Allocation

Buybacks are on their way and as the business continues to improve its ability to generate cash, more buybacks will come.

In Q1 2023, the company repurchased 4.2M shares for around $110M. At the end of the quarter, Box had $148m of remaining buyback capacity and it remains committed to “return capital to shareholders”. In the long term, buybacks of this sort can be highly lucrative to shareholders. By reducing the amount of shares outstanding, buybacks concentrate the growing (ideally) earning power of a company into less and less shares and the results can be spectacular.

Fundamentally, I believe Box´s ability to produce cash and fund buybacks will continue to grow through the years. The key here is whether the corporate culture and the management enable for the company to sensibly continue adding features that deliver incremental value to shareholders and continue to drive excellent economics.

Additionally, management remains committed to being highly “surgical” when addressing M&A. M&A is always a one by one kind of thing, but per the way management runs the company and the results obtained in the past few years, I think they have the ability to pounce on coherent opportunities when it makes more sense than internally developing an alternative. This becomes really apparent when reading their 10-Ks going back in time - they really have achieved what they set their intentions to years back.

It will be interesting to see how management deploys the capital going forward.

4.0 Framing the Investment

Big upside, moderate downside.

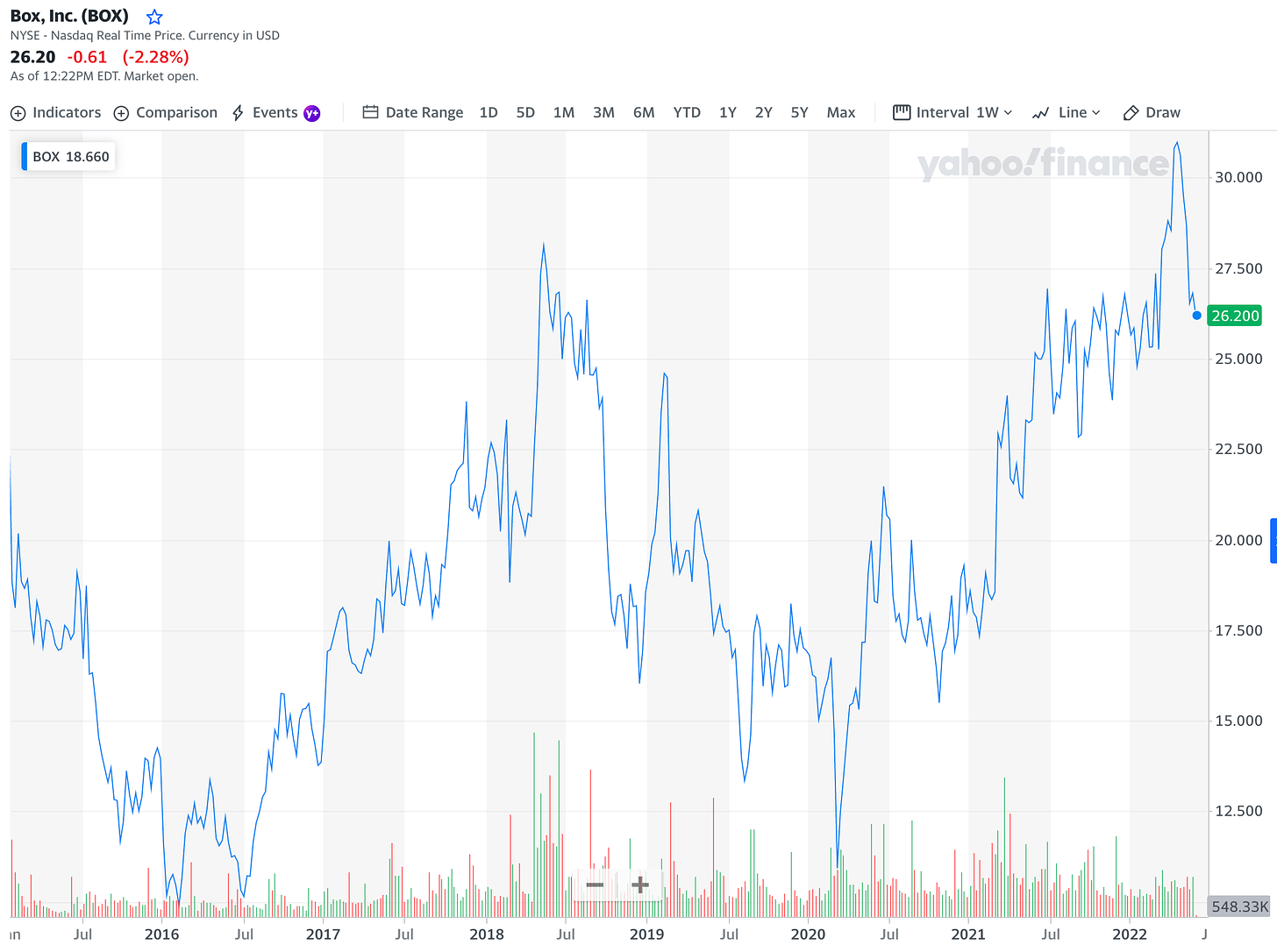

Box is priced today for moderate growth, if any at all. With a P/FCF ratio of 18.60 and a P/S of 4.82, it looks asymmetrically priced to me, although perhaps far less so than when I first looked at it in 2020.

The stock has been trading sideways since IPO and during this time, fundamentals were way worse than today. Box really was “stuck” in a commoditized corner of the internet. If, going forward, Box fails to develop further features that continue to drive its financials into the green, then there is not much to lose. It will likely head back to the 15-20$ range.

Still, it looks like the company has figured out how to drive better financials across the board by leveraging that platform it has created over the last decade. Financially and fundamentally, the company looks healthy and so risk of permanent loss of capital is quite low. Meanwhile, the runaway ahead looks very long, as Box continues to ride the secular digitalization tailwinds. Together with the buybacks, the runway could deliver some meaningful returns.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Weird, just read about this business in Zero to One by Peter Thiel.