Long thesis summary: Blackberry is the most undervalued tech platform on Earth, but it has 12 months to begin generating cash.

I find that out some point during a bear market, prices are so obviously disconnected from fundamentals that it becomes incrementally easier to navigate it. A focus on fundamentals does not guarantee future returns, but it does help to not be deprived of returns when you are right. Often, the fundamentals do not show in the numbers, however. Many young investors read about the tenacity required to hold stocks during downturns but are only for the first time grasping just how difficult it is. This is only my second time but I find that, once again, a focus on the fundamentals makes situations like this perfectly tolerable and sometimes, quite rewarding.

Blackberry is a strange pick, even for myself. As most (if not all) of my other investments, it was initially motivated by an intuitive urge that I then cross-checked with the rational part of my brain. I must admit, however, that it has taken me almost 2 years now to fully understand what triggered my intuition in such an unignorable way. I break it down in this part of my Crowdstrike deep dive, but essentially it comes down to distribution. More and more parts of the economy are increasingly about:

Picking up data.

Processing it to train AI models and automate tasks.

If you have preferential access to a valuable data pool, then you can automate tasks that others cannot. The more moated the access to the data is, the more likely it is that you are the only one automating said tasks and hence, the more value you can capture. If you look at the XDR space in depth it all comes down to who can distribute best, in order to capture the most amount of data and train the best AI possible. However, as the world continues to digitize, we continuously see new pockets of data emerge that require varying degrees of specialization to serve adequately and hence penetrate meaningfully.

Blackberry is essentially a highly moated and undervalued distribution channel, built on top of its QNX RT-OS, which we continue to see the world converging towards quarter after quarter due to safety. It dominates the auto space and it is branching out into other verticals that have similar safety requirements, like medical and now aviation. The company is simultaneously maturing its XDR offering, which it will be able to deploy on its QNX installed based at some point in the future. Meanwhile, the distribution moat that emerges from QNX is very valuable on its own, because it is the gateway to not just deploying XDR offerings, but any kind of software. The whole company trades for just under $2B and I would argue that, far below the value of its QNX installed base.

1.0 The IoT Business

This quarter we saw the first instance of Blackberry upselling an existing customer (Bosch) to IVY. This is a key variable of the thesis.

I see the world converging towards QNX and the IoT business now looks set to get back to prepandemic levels. During/after the pandemic, the IoT business slowed down due to (auto) supply chains faltering, according to management. Rather notable design wins kept coming in, but not showing in the numbers. This led to the narrative that QNX was perhaps just not relevant in the marketplace, but if you understand that design wins take some time to move into production and that indeed the design wins are real, then the narrative evaporates. Blackberry´s QNX is on more cars every quarter and the distribution channel continues to get stronger.

“(QNX) Demand is so strong right now that we're expanding our professional services team by hiring additional heads into QNX.” - John Chen, Blackberry CEO Q3 2022 ER

This quarter, Blackberry “entered a multi-year agreement with us to develop new Level 2 and 2 plus autonomous drive system on QNX for makes and models across the entire BMW Group”. We continue to see steps forward of this sort every quarter, with the company not posting very appealing financials, but not dying either. I see increasingly clearly that Chen is focused on maintaining the company´s financial balance whilst very silently growing the moat.

During the quarter, the company also announced a collaboration with Google and Qualcomm to “build a chipset that allows BlackBerry's Hypervisor to seamlessly integrate with Android automotive”. It is interesting to see Google continuing to lean into QNX (see last quarter). It looks like Google has done this to facilitate the distribution of Android auto, which apparently without this advancement takes quite a bit of time to integrate into QNX-based systems.

“Previously, to develop a digital cockpit with an Android automotive infotainment system running alongside safety critical application on a single chip will require hundreds of hours of extra developer time for building custom integrations. This collaboration takes care of this for the customers, saving them both costs and time to market as well as delivering a higher quality product.”- John Chen, Blackberry CEO Q3 2022 ER

Incidentally, this quarter we have what I believe is the first instance of IVY being up sold to a QNX customer: Bosch. This is quite promising, for without the conversion capacity the installed based is useless. Chen also disclosed that the company released “the early access version of IVY in October” as previously targeted.

“Bosch, the world's largest auto Tier 1 supplier, announced that their new software integration platform will support IVY. This platform is built on QNX RTOS and Hypervisor, showing the potential for upselling IVY and future design to the large and growing QNX installed base.” - John Chen, Blackberry CEO Q3 2022 ER

I could nitpick at details all day long, but do you see the industry converging around QNX? I do and I may be wrong, but at these valuations (and even the valuation that I bought into initially), the bet is highly asymmetric. Chen under-speaks every quarter, but I continue to see the company building out its distribution moat and now, there is quite compelling evidence of the company´s ability to convert the distribution into higher abstractions of software that deliver incremental value to its customers (Bosch) and can therefore increase ARPU. Electrons and Dollars coming up?

The company also announced that during the quarter it had a “total of 11 new auto design wins and 13 wins in the general embedded market, included a number of medical applications, such as a infectious disease diagnostic platform, as well as the next generation robotic surgical arm”. This is also the first time the company announces a design win in the aviation market:

“We also had wins in industrial applications as well as aviation, including an engine simulator with the leading aerospace company. With any luck we'll also be able to share details of further significant auto design wins with you all at the CES in January.” - John Chen, Blackberry CEO Q3 2022 ER

When I first wrote about Blackberry, I shared my vision of QNX becoming the core of Industry 4.0, when it made little mention of it being installed in devices beyond automobiles. The company is not sharing metrics beyond the auto industry, but is getting increasingly vocal about it and I believe that when it does we will likely be surprised at just how present it is in these verticals that Chen brushes over quarterly. I believe that the same dynamics that are compelling players in the auto industry to default to QNX will apply in other verticals/industries.

2.0 The Cybersecurity Business

The sales operation seems to be accelerating, although signals are diffuse.

The one thing that has been catching my attention most over the last few quarters and specially so this one, is that Chen has been getting more vocal about the competitive wins on the cyber side. With a more than consolidated tendency to under-speak I find this increasing resonance quite telling. Further, as I explained at the beginning of this write up I think that the Blackberry play is more about deploying Cylance on their QNX base than beating Crowdstrike and Sentinel One at their highly competitive distribution games, but I do see a chance of Blackberry getting into the game.

“When we factor a POC, our technology performs well. As illustrated by competitive wins against CrowdStrike and SentinelOne, as well as other older signature based players like Microsoft, McAfee and Symantec.” - John Chen, Blackberry CEO Q3 2022 ER

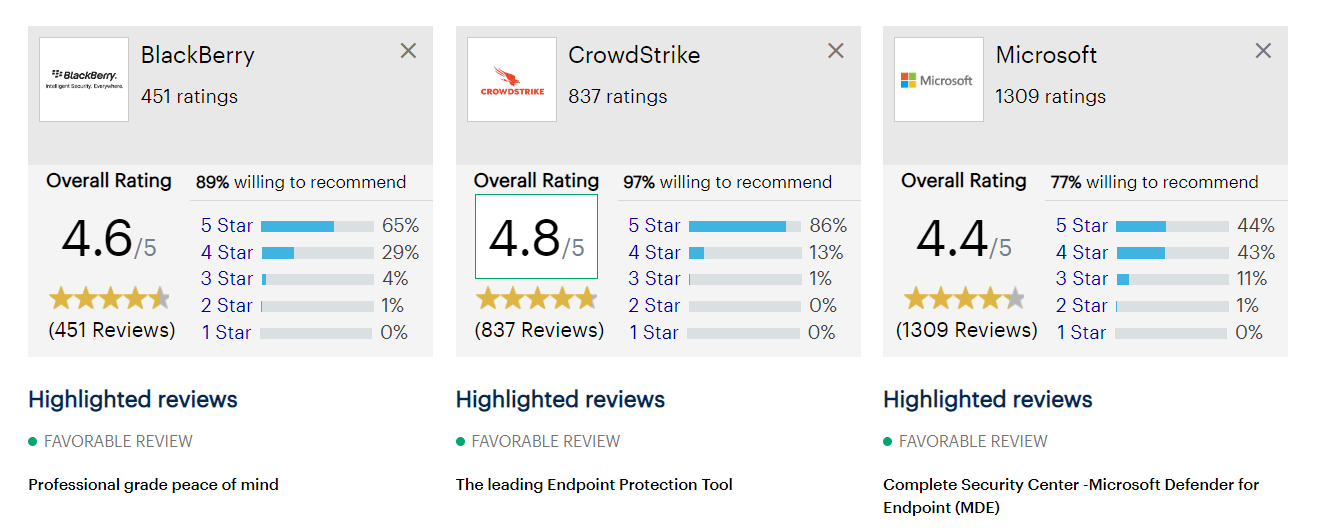

Microsoft leads the XDR space together with Crowdstrike, but having looked at its offerings and reviews, its lead seems to stem to be mostly from a distribution advantage. A few weeks ago, it surprised me to see that Blackberry´s XDR rating on Gartner has shot up to 4.6, from just 4.2 when I wrote my first deep dive on the company. Chen´s words and the reviews could be fake, however, but is the same company that signed a 50:50 joint venture with Amazon, serves almost all of the world´s top auto OEMs and Spacex and is responsible of other noteworthy feats lying? This is not out of the question, but the probability seems low to me at this point.

It is also quite confusing that billings and revenue are going up, but ARR is not. This is creating a narrative similar to that of design wins not bringing in actual money, but I believe that it is only a matter of time for ARR growth to peak its head. Billings are up for the second quarter in a row and per the definition of ARR, it seems that some part of the cyber business is currently on fire and management is not talking about it too openly. When management issued its multi year guidance, it did disclose that the company was seeing churn on the UEM lower segment customers, but that is all we know for now.

ARR = $ from Annual Subscriptions + $ from Expansion Revenue – $ from Churn

What seems to be driving billings is an increased sales effort and generally, Blackberry has been experiencing go-to-market issues with its cyber business. Whilst I have great clarity on the IoT side, here the operation is quite cryptic with management not disclosing any of the technical advancements that they may or may not have regarding distribution. Crowdstrike´s and Sentinel One´s public filings are full of mentions of their lightweight agents and Blackberry has not discussed this aspect once, unless I am mistaken.

In the Q&A section, Chen revealed that the cyber division now has “10% more direct quota carrier” than at the beginning of the year, meaning that sales people are now expected to sell 10% than they were expected to sell at the beginning of the year. Per this metric, it seems that the sales operation is picking up and it somewhat correlates to the improved reviews on Gartner. Are the sales people leaving reviews themselves? Only time will tell, but what is certain is that they are doing something.

It also caught my attention that it seemed like most of the wins this quarter came from larger organizations (like governments, where Blackberry continues to do quite well), when last quarter Chen seemed quite upbeat about the opportunity ahead with SMBs. He does mention SMBs in the cc, but it is not quite the star of the show this time, as it seemed to be last quarter.

“In addition to success with larger companies, we're seeing a lot of interest from small and medium sized business too. And this will continue to be an area of focus for us as the market opportunity is large.” - John Chen, Blackberry CEO Q3 2022 ER

Lastly, for the first time that I can remember Chen enumerates Blackberry´s competitive advantages in cybersecurity, which sound very similar to that which Crowdstrike and Sentinel One profess, except for the advantage in mobile. It will be interesting to see if Blackberry can translate its history in mobile to somehow gain a distribution advantage and perhaps, also translate it into the company getting better at deploying its XDR offering into its QNX base - a lot of the devices that run on it are mobile after all.

“Nobody in this space knows mobile as better than Blackberry. I hope you agree with that, and is rapidly becoming one of the largest threats surfaces.” - John Chen, Blackberry CEO Q3 2022 ER

3.0 Financials

At this stage of Blackberry´s turnaround, my focus continues to be on whether the company is financially stable or not, to afford it a long runway, so that it is able to:

Continue expanding its QNX base and then upsell it to IVY.

Mature its XDR offering and then deploy it on its QNX base.

Per the current structure of the I/S, which currently yields an indistinct net income (bordering 0, quarter after quarter), the increase in ARPU resulting from the above would likely be highly accretive to the company´s cashflow profile.

At the end of the quarter, the company had $772 million total cash, cash equivalents and investments. It also had a net cash position of $407 million, but its debt is due on 11/13/2023. As I have discussed in other updates, this debt is:

Entirely owned by Fairfax, which in turn owns around 10% of the overall equity.

Convertible, with a strike price of $6.

The stock price is currently around half the strike price, which means that converting it is probably not too appealing for Fairfax and in turn, Fairfax is the largest Blackberry shareholder so despite the relatively urgent maturity of the debt, interests are currently alligned. It would be in the best interest of all shareholders for the company to begin generating cash in the coming year, however.

Further, in Q3 2022 cash used by operations was $19m and FCF was negative $21M. The company is not bleeding cash and so the situation is not critical. According to Chen, demand in IoT is strong and cyber is picking up, but this alone will not be enough for the company to take off. Within a reasonable time frame now, the two conditions above must be gradually met for shareholder dilution to be avoided. Per the details analyzed in sections 1.0 and 2.0, I believe the odds are favourable.

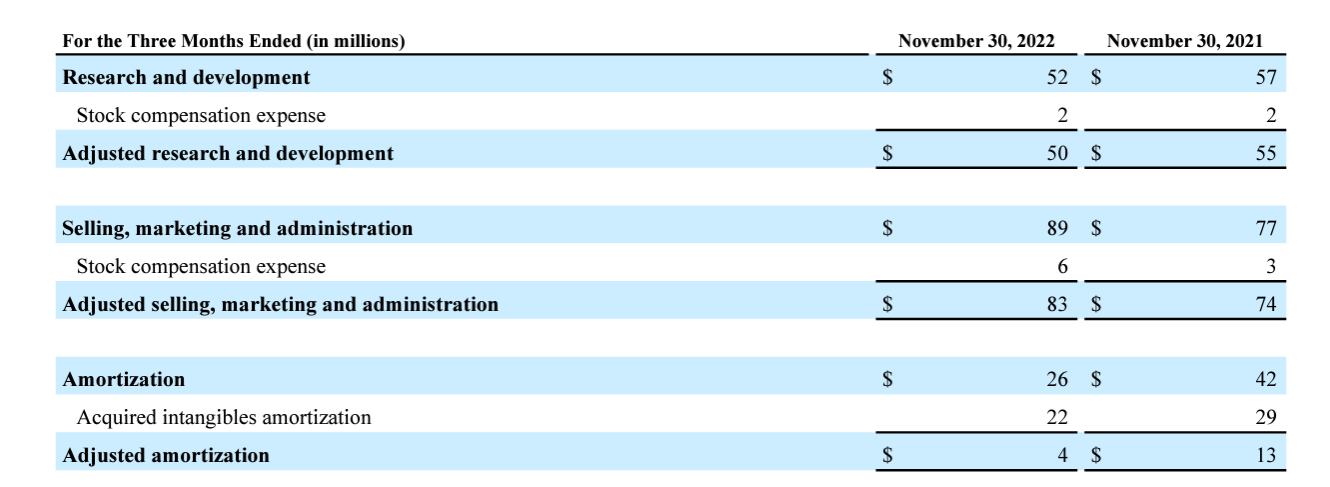

Also note the jump in selling, marketing and administration YoY in the graph above. All evidence currently suggests that Blackberry is ramping sales up.

4.0 Conclusion

This is a rather uneventful quarter, except for:

The BMW deal, which I find meaningful.

The early access launch of IVY in October 2022.

The first instance of a (very big, prominent) QNX customer being upsold to IVY.

I continue to wait to see further progress on the cybersecurity side, but so far it looks like the company is taking the right steps.

“If you think about a sales cycle, let's say, two to maybe three quarters, call it three, I should be seeing some results in either the second quarter or the third quarter next year.”

“So, I feel pretty good about mathematically that we're looking for a good ARR growth next year.” - John Chen, Blackberry CEO Q3 2022 ER

Whilst the bear market can feel awful at times, it is evident to me that the QNX moat continues to grow very well and that, if we take the billings and quota carrier metrics as being true, the company is dutifully advancing on the cyber side aswell. Blackberry has roughly 12 months to begin to take flight, else it will likely have to refinance.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Great insight Antonio. Todays news further cemented the BB moat. I am so thrilled to avg down into the single CDN digits today. I and many others appreciate your work!