Below, the structure for today´s post. As always, feel free to skip to any section that may be of your interest.

1.0 Thesis Recap and Digest Summary

2.0 IoT

3.0 Cyber-security

4.0 Financials

5.0 Conclusion

1.0 Thesis Recap and Digest Summary

Blackberry is uniquely positioned to dominate in a world in which moving data around safely is as fundamental as a secure food supply. This positioning stems from two key increasingly visible domains of expertise:

IoT: A leading RT-OS, that runs in 210M+ cars on the road today and a growing number of devices across verticals.

Cyber-security: predictive cyber-security, that the most consequential organizations in the world use to protect themselves (17 of G20 govs).

The combination of the two is delineating a highly moated perimeter that is invisible to most at this stage, in which machines are gradually connected to one another, data is the core asset and knowing whether to trust a network or not is a consideration of existential magnitude. Essentially, 10-20 years from now, this perimeter will encircle the world, like semis do today.

What will it look like? Machines will be smart and they will get smarter as data is sent back and forth across the network. These machines will take and suggest decisions based on what information they receive and so a compromised network can lead to nefarious consequences, like millions of cars being hacked at once and crashed into each other. Fundamentally, these machines will need an operating system that never fails and is hard to hack, in a highly connected and porous environment.

Blackberry´s core asset is its highly secure operating system, QNX, which the biggest industrial and technological players in the world continue to bow down to, quarter after quarter - and this quarter is no exception. As it keeps making its way through various industries, Blackberry is setting itself up as the lowest level, most essential component of the software stack, on top of which all other players will build on, to guarantee the secure operations of their machines.

Today, the business looks financially meek, because it sells its RT-OS QNX for a small, one time fee, but as this future gets closer it has endless opportunities to monetize, by deploying additional verticals at a marginal cost, being the key provider of data value chains across industry that existing and future market participants will rely on to stay competitive.

Beyond governments and top financial institutions, its cyber offerings are still immature in terms of achieving product-market-fit in the broader market segments, but the company continues to make good progress and seems to be achieving traction. On to the quarterly results now.

2.0 IoT

IoT continues to advance well (28% YoY revenue growth), although it has not made it back to pre-pandemic levels, in tandem with auto supply chains - Chen said China was picking back up and EU and US were seeing a “short-term contraction”. Most importantly, however, we continue to see particularly strong signs of the superiority of BB 0.00%↑ ´s QNX in terms of security:

Volkswagen “selected BlackBerry QNX for its new VW.OS platform. This platform will be deployed in all brands across the Volkswagen group”. Apparently, VW intended to build out its stack by itself, but ended up choosing QNX as the OS.

“BlackBerry QNX is now embedded in 7 of the China's 10 largest EV OEMs.”

“Google, I think a quarter ago or two quarters ago, has adopted our Hypervisor as their Google Android Auto play”.

The market is relatively tired of seeing design wins that seemingly do no translate into revenue, but this forgoes the nature of the industry, which I have discussed before. It takes a long time for vehicles to go from design to production. This time around, John Chen has clarified this matter:

“Say we have a $1m deal. 10% upfront probably is something that we should expect and could expect on development seats […], some professional services revenue in the range of 5% to 10%. […] Now, the bulk of the production will come in year normally four, five, six, seven, eight. However […], the electric vehicle market turns the product cycle a lot faster and particularly with the Chinese. The Chinese is turning it around a cycle of 3 to 5 years instead of 7 to 10.” - John Chen, CEO, Q2 2023 ER

About deploying further verticals at a marginal cost, the company expects to see IVY design wins throughout calendar year 2023. IVY basically enables auto OEMs to use the data that cars generate via QNX to do useful things with it - namely driving further revenue. This is how Blackberry moves beyond one-time-fees.

Throughout the call, I sensed a tone of positive surprise on behalf of analysts listening to how VW and Google both leaned into QNX, but Trip Chowdhry, the last analyst to ask a question, seemed to have an “aha” moment thinking about how the VW deal actually sets Blackberry up quite nicely. John Chen´s answer, which cannot be fully conveyed via text, was priceless to hear:

Trip Chowdhry: “[…] if there’s a customer who is like Volkswagen, which is already standardized on OS, are there any plans you may have to make migration or at least experimentation with IVY, like just a mouse click away? Do we have anything like that in plans?”

John Chen: “It will be -- maybe put it differently. It will be illogical for BlackBerry not to take advantage of all the assets. And there is a good reason why both IVY and QNX is in the same IoT group.”

There was an awkward silence after John Chen´s remark that encapsulated so much information.

Also interesting to see Chen making explicit remarks about the company setting its sights on new verticals for IoT, specifically aerospace. This is an integral part of my long term thesis, which I laid out initially in my deep dive:

“This is a little early for us, but we do have the intent. And so, when we look at the success in our auto market, it’s really all rely on the highest level of safety certification. [So we think], which vertical exhibit the same requirements?; So, medical is one, industrial is one. […] And we likely will work through large system integrators like Raytheon and -- of the world, but that’s to the extent that I can share at this point.” - John Chen, Q2 2023 ER

2.0 Cyber-security

There are two key things to bear in mind with cyber:

Blackberry continues to serve and renew contracts with the world´s top institutions which have a lot to lose in case of a breach, denoting the quality of their offerings, but the broader market currently prefers to respond to threats instead of preventing them in the first place.

“In North America, we secured business with the Department of Treasury, the Federal Trade Commission, Department of Energy, the IRS, the New York Stock Exchange and the U.S. Mint…”

“Internationally, we secured business with UK Her Majesty -- I guess, we changed that now, Majesty Treasury, the UAE Ministry of Presidential Affairs, the New Zealand Parliamentary Services, the Australian Electoral Commission and the Polish Ministry of Foreign Affairs …”

“In financial services, we won new logos as well as renewal and upsells with leading banks in U.S., UK, Switzerland, Japan, Israel, Italy, and more …”

The company is looking to grow cyber, by finding segments of the market which cannot afford breaches and this is the first quarter that the company has explicitly mentioned that they have indeed spotted one:

“… we recorded a strong quarter for new business in the middle market. BlackBerry is very well placed to grow in this market for a number of reasons.

The level of Cylance risk for mid-market customers is high. With our current research team identifying that SMBs faces upwards of 11 cyber attacks per device per day.

SMBs are also often those with the lowest level of insurance against ransomware demands. As our study with the Corvus Insurance shows, meaning that they can often ill afford a breach. Customers in this segment, particularly like our lightweight agent and how effective our products are at detecting threats.” - John Chen, CEO, Q2 2023 ER

We see some of this traction in the numbers, mostly per the billings growth, that seems to nonetheless be muted in terms of revenue by the length of the sales cycle and some churn in the more price lower ends of the UEM market - just as management guided for. The company still expects to grow the cyber division at a 10% CAGR for the next 5 years, starting with calendar year 2023:

“Revenue for the quarter was in line with expectation at $111 million. The business also delivered sequential billing growth of 15% to $102 million. Cyber billing for the first half of this fiscal year grew 6% year-over-year. Gross margin was 55%, ARR came in at $321 million, dollar-based net retention rate was 85%.”

“As we described in previous quarters, there have been some headwinds for Cyber ARR [UEM churn in lower market]. However, we expect ARR to return to grow early next fiscal year.” - John Chen, CEO Q2 2023 ER

My take here is that, the cyber division continues to slowly pick up (there´s a lot of challenges around go-to-market) and we seem to be headed for a quarter or two in around 4-5 years in which both IoT and cyber will converge. They seem to be doing well with clients in the higher end of the market (govs and banks), so I do not see a reason here to invalidate my thesis. I am happy to continue waiting.

4.0 Financials

At this stage, what I look for across the board is financial stability, rather than immediately satisfying results, to give the company enough time for the IoT and cyber efforts to bear fruit. So far so good.

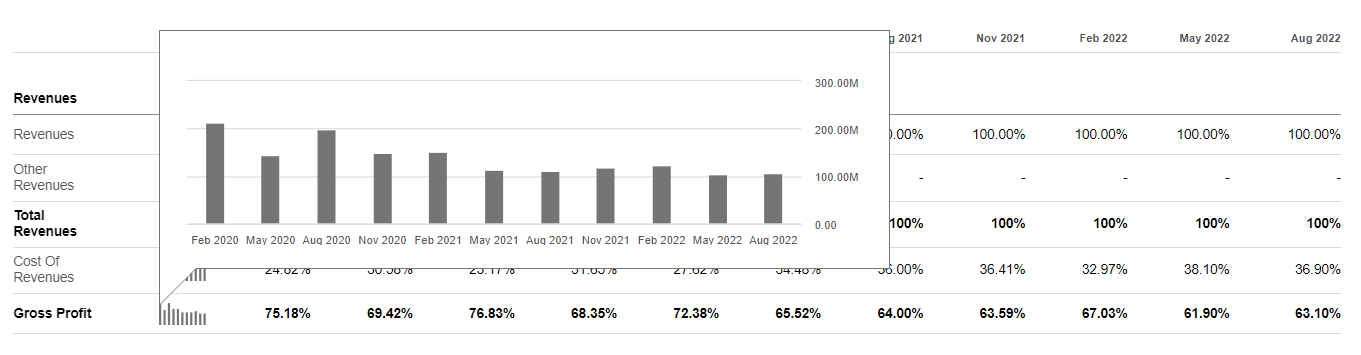

Income Statement

Looking back a few years, revenue is clearly declining sequentially. However, much of it can be attributed to the supply chain issues in auto. During this time, gross margin has remained relatively stable, with net income hovering around $0:

Balance Sheet

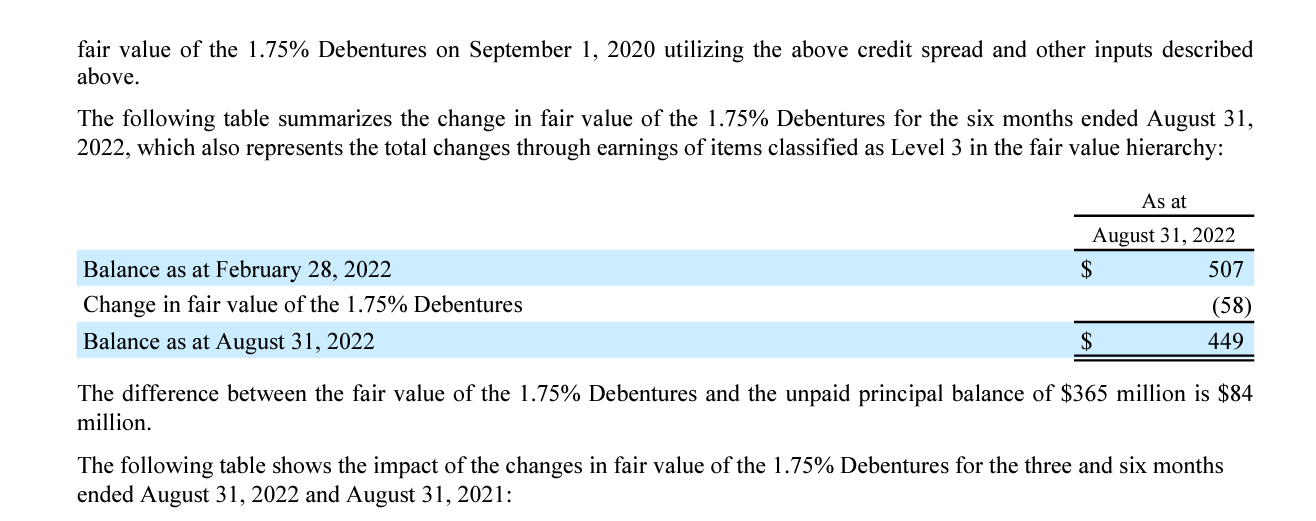

The company ended the quarter with $669m in cash and equivalents and $507M in convertible debt, which is still owned entirely by Fairfax (in turn, a major shareholder of Blackberry).

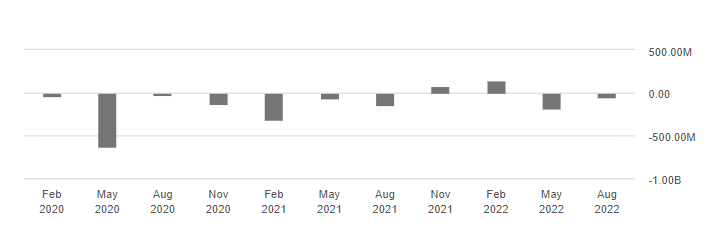

Cashflow Statement

Cash from operations continues to hover around 0 too which, put together with the I/S and B/S really conveys a picture of financial stability. On a similar note, free cash flow was negative $26 million.

5.0 Conclusion

Both IoT and Cyber continue to advance well. The duration of the processes that drive progress in these two businesses is much larger than the average investors wants to hear, however.

Financially, the company is in a good place to continue executing and guidance remains unchanged, which coming from Chen means quite something in this environment.

In all, my original thesis remains unchanged and I look forward to seeing the company´s progress.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc