Below, the structure for today´s post. As always, feel free to skip to any section that may be of your interest.

1.0 The Vision

2.0 The Moat => 2.1 IoT, 2.2 Cybersecurity

3.0 Revenue and 5 Year Targets

4.0 IVY and Other Call Options

5.0 Balance Sheet and the Catapult Deal

6.0 Other Financial Considerations => 6.1 Income Statement, 6.2 Cashflow Statement

7.0 Conclusion

1.0 The Vision

The vision that management is now actively depicting, mirrors the one I have been elaborating on for almost two years, since I invested in Blackberry and started writing about it. If and when this vision materializes, BB 0.00%↑ will be worth orders of magnitude more than it is today.

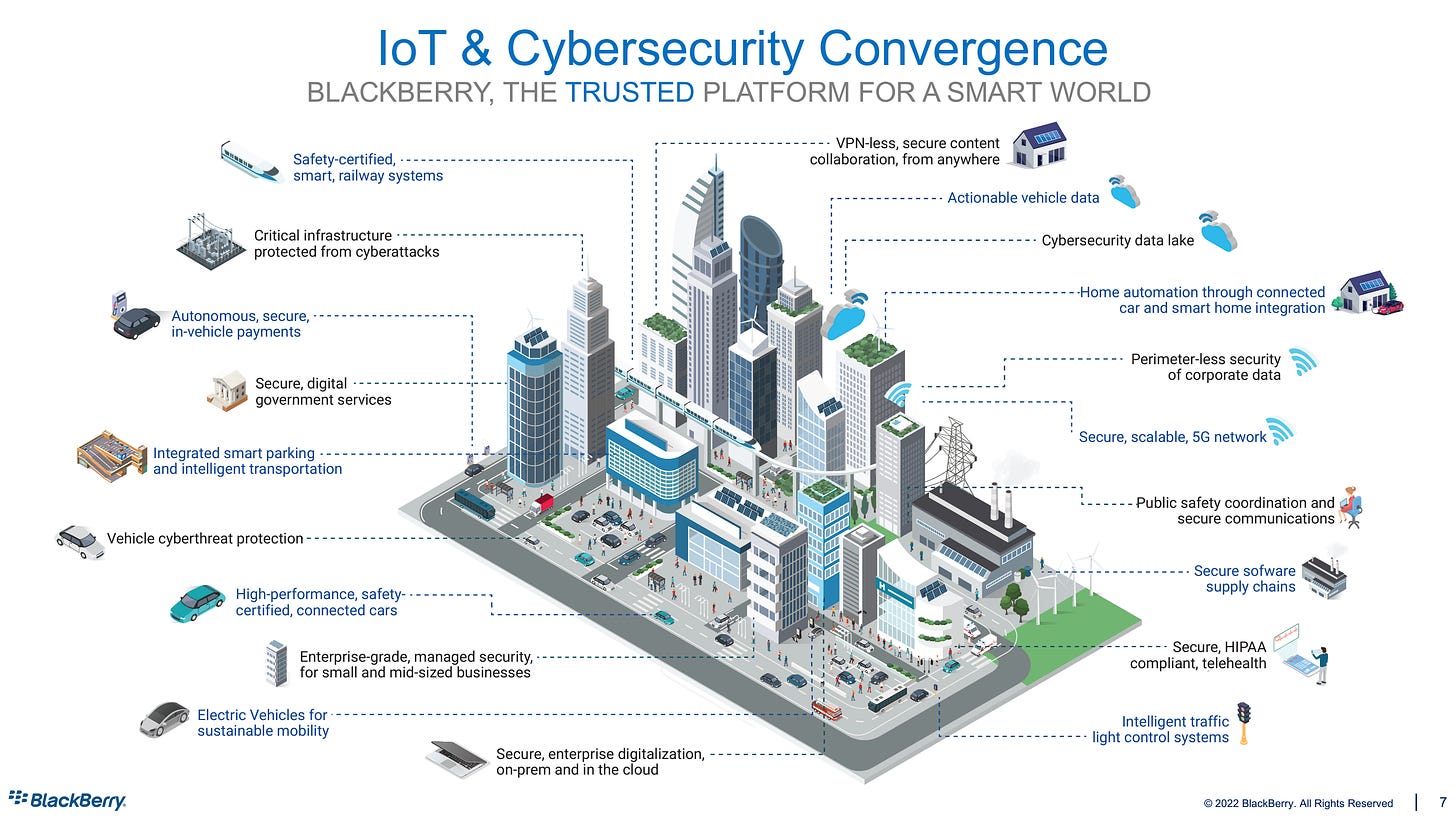

“Our strategy goes beyond the two operating units (cyber and IoT). We believe we are going to make a big difference in the world, by seeing the convergence of these two markets, which is going to create a very trusted platform that everything is going to be based on” - John Chen, CEO @ Retail Investor Conference.

“We expect the two markets to converge and our position in both IoT and cybersecurity will place us in a very strong position to capitalize on these growing market trends.” - John Chen @ Q1 2023 ER

Blackberry´s management and I finally coinciding in the long term vision of the company is a major milestone in my Blackberry thesis, for the reasons I explain below.

Firstly, the idea that cybersecurity and IoT will merge is an abstract one by itself. Yet, when an investment in a given company is based on such abstraction, without explicit mention of it by management, the abstraction is vertiginous and to many the thesis looks based on thin air. This has been the case until management has become more vocal about it.

Secondly, we now have a clear link between what present Blackberry is and a future in which it becomes a foundational element of our society. Management now has a roadmap to foster the company´s two business verticals, IoT and Cybersecurity, so that both will be mature enough to merge when the time is right. In my view, the merge will be driven by exogenous events.

Now, the fact that management and I coincide two years down the line may seem like blind luck if you have not been reading my work, but there is a mental framework that I have been relying on and that I expect to continue to be instrumental in assessing the company´s performance going forward. It is a simple, probabilistic framework which you can visualize below:

P(A) is the probability that in the future, Blackberry will turn into a platform that pretty much everything is built on. It rises exponentially as the intersection between B and C is greater:

P(B) is the probability that Blackberry will have a very strong moat by the time everything in the world is data driven and moving data around is as important as moving clean water around.

P(C) is the probability that such a data-centric future will arrive at all, which in all fairness I think is close to 1 by default.

In a future in which Blackberry has a world-class moat (B) and the world runs on data and therefore data needs to be moved around securely (C), the probability that the company will rise to the occasion is high and tends to 1. The above graph is simplified of course, because there is no such thing as certainty when modeling the future and note that B and C are modeled as independent events.

When I review the company quarterly, I am looking out for both P(B) and P(C). Is the world heading in the right direction and is Blackberry laying down the fundamental infrastructure, to create a moat that it can then leverage to bring in more dollars at a marginal cost and hence deliver outsized returns to investors? This is what preoccupies me and not price action.

Here, the term moat can be elusive. In Blackberry´s case, the moat is about their ability to durably position themselves as the most trusted security provider to enable key building blocks of our civilization to operate safely and as intended. So for instance, transport is very important to our civilization and they sit right at the heart of the matter, with their QNX RT-OS. So is government and they secure 17 of the G20 govs.

*Note: it used to be 18 of the G20 but they stopped serving Russia.

Generally, therefore, P(B) increases as they gradually consolidate the presence of their QNX RT-OS and their cybersecurity offerings across industrial verticals that are vital to humans. As I have explained in my previous quarterly update, when they obtain a design win on the IoT side, it takes years for it to translate into material differences at the production level. Hence, patience and a long term mindset are indispensable to analyze the moat.

2.0 The Moat

2.1 IoT

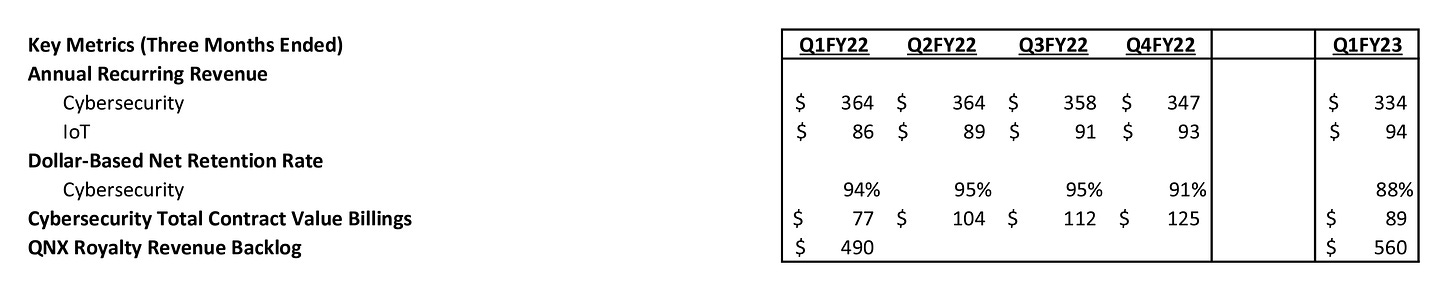

On the IoT side, we see the number of cars on the road with QNX installed hit 215m, together with the revenue backlog reaching $560m, a 14% increase from a year ago. Per the graph below, it is quite apparent that the moat is growing satisfactorily. Further, there are some interesting things to unpack here.

In the ER CC, one of the analysts asks Chen where the increase in the backlog comes from and I believe his answer to be quite revealing:

“Yes. It’s the result of the design wins we have been telling you folks every quarter” - John Chen

Quarter after quarter, Blackberry tells its shareholders about design wins whilst the frustration mounts. Still, if we take a step back, P(B) continues to advance gradually through time, very much in line with the cycle times of the industry. I often compare this to really wanting summer to come - no matter how vigorously you count the days, it will arrive in its own time.

This quarter is no different (except that supply chains seem to be easing, at least temporarily) and the company announces some new design wins, which will translate into revenue further on, adding to the moat. If you are new to my work on Blackberry, please be aware that the company´s RT-OS goes way beyond auto, into general industrial machines like wind turbines and medical devices.

“In the quarter, we gained a total of 14 new design wins with 9 in auto and 5 in the general embedded market.” - John Chen, ER CC

“In the quarter, we had a number of large design wins in Digital Cockpit. In addition to wins with leading Tier 1 Bosch and Visteon, we secured a win with a global automaker based in North America as well as BICV, a leading Chinese Tier 1 for an augmented reality, AI and hologram-enabled Digital Cockpit to be deployed in Renault- Jiangling’s latest fully electric sedan. That’s quite a bit of technology. Furthermore, despite lockdown challenges, we are able to secure a number of new design wins with major Chinese automakers, including autonomous drive design with Great Wall Motor and others. Outside of auto, this quarter, our QNX Hypervisor – sorry, QNX Hypervisor, was pre-certified by the independent auditor at TÜV Rheinland to the highest level of safety for medical device software. We continue to make progress with medical design wins.” - John Chen, ER CC

An interesting datapoint that Chen disclosed is that QNX is mostly embedded in premium cars, which I was previously getting a sense of by looking at the brands that have been adopting it. What is interesting in this sense is that sales of luxury cars tend to wither less in recessions that lower segment ones. Should we see a recession, QNX sales may slow down less than otherwise. Regardless, a recession should not affect the long term thesis much.

2.2 Cybersecurity

On the cyber side, the qualitative data points that initially enabled me to see Blackberry´s cybersecurity potential continue to trend in the same direction. Namely, they continue to renew contracts with big banks and with governments - the two types of organizations that have the most to loose in case of a breach. Blackberry continues to have solid footing with these types of clients, that tend to operate in regulated spaces:

“…this quarter, we secured renewal with some of our largest customers, including the U.S. Air Force, U.S. Navy, U.S. Special Ops Command, the Canadian Senate, the Supreme Court of Canada and the Royal Canadian Mint. We booked a great amount of business with law enforcement agency in the quarter, such as with the UK Serious Fraud Office, the London and Manchester Police Services as well as the Vancouver Police Department. We were pleased to both increase the number of UEM license and deploy additional products to these customers.” - John Chen, ER CC

“In addition to government, we secure, renew and upsell a number of leading financial services customers, including leading banks MUFG – I believe they are the largest Japanese bank, Mizuho and Sumitomo Mitsui Banking Corporation, three of the large Japan’s four largest banks, Switzerland’s Julius Baer Group, First Citizens Bank and Liberty Bank in the United States as well as other leading banks in both Germany and Canada.” - John Chen, ER CC

Revenue came in at $113 million, a 6% growth year-over-year. Billings on a total contract value basis, was $89 million, a 16% year-over-year increase. Gross margin was 53%, ARR was $334 million, dollar-based net retention rate was 88%. Apparently, the ARR number does not include wins with government, because you cannot account for perpetual licenses like that.

The growth per se seems to be coming from the security side:

“As growth in our Guard MDR solution has shown, this is a very large demand – there is a very large demand for managed service in cybersecurity and MSSP allow us to greatly scale out our go-to-market.”

“We had a good SecuSUITE quarter selling to the government and it’s perpetual because of the way the government purchase the technology.”

In all, billings show a very healthy growth, yet ARR is not reflecting it. This seems to be due to the perpetual license issue outlined above and due to some churn in the UEM side in the SMB space.

“The Company defines TCV billings as amounts invoiced less credits issued. The Company considers TCV billings to be a useful metric because billings drive deferred revenue, which is an important indicator of the health and visibility of the business, and represents a significant percentage of future revenue.

Cybersecurity TCV billings was $89 million in the first quarter of fiscal 2023, an increase of $12 million compared to $77 in the first quarter of fiscal 2022.” - page 39.

Chen clarifies during the call that the churn is mostly seen in the non-regulated space, where customers do not have so much to lose as in the regulated space, where according to management the company continues to see healthy renewals. Management disclosed the same issue during the Retail Investor Conference.

The churn in the SMB must actually be quite pronounced, judging by the sharp drop in Dollar-Based Net Retention rate in cybersecurity. I will monitor this closely going forward.

Further, Blackberry closed a deal with Midis Group which may or may not help boost sales:

“During the past quarter, we also expanded our channel presence. We added Midis Group, a partner with over 5,000 employees and a presence in over 70 countries across the Middle East, Europe and Africa. This significantly expands our reach in those markets. Midis brings a lot of experience in cyber, having been distributed with McAfee, Symantec and Trend Micro which also made a number of enhancements to our managed service – managed security service provider or MSSP program.” -JC

3.0 Revenue and 5 Year Targets

Overall, I get the impression that the company´s increasing focus on sales is beginning to drive progress, specially on the cyber side with billings growth. Still, there is nothing to show for it in the financial statements. The company has been and is hiring aggressively, however, and per the duration of sales cycles we are yet to see the new additions really kicking in:

Given this backdrop, we continue to invest in go to market. […] We are pleased with how these additions to the team are ramping up. And of course, it will take a few quarters for them to reach full productivity. - JC

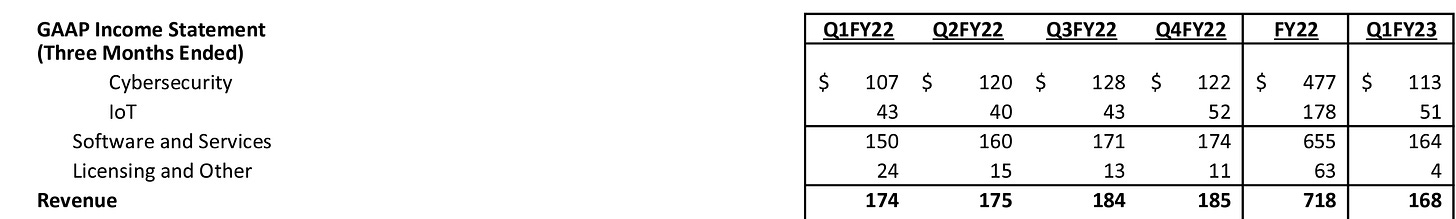

Note that Licensing revenue has come down to a mere $4m for the quarter, as Blackberry is moving away from this business (more comments on this in Section 5.0). It is now a negligible part of the business and explains for much of the apparent overall revenue decline YoY.

One key thing here is understanding how John Chen operates. If there is one thing I totally underestimated when I bought $AMD in 2014 (and I have said this many time sin public now) is Lisa Su. I spotted the technology / moat P(B) and I understood that the world would need exponentially more computing power for decades to come P(C), but I got really lucky with management.

Chen has been building a very strong moat for a decade now and he has not hyped it up once. He quickly shoots down both overly positive and negative remarks, which is at times quite frustrating to see as a shareholder. Yet, if you zoom out P(B) continues to go up, quarter after quarter and this is specially visible when you look at the company´s track record over the last decade, specially in terms of its moat - that cannot be adequately expressed in a financial statement.

I have been generally reflecting these past few months on how great companies get built and the truth of the matter is that, the general public only sees stock prices skyrocket at the very end of this process, in case of success. Companies like Tesla and Nvidia that have dazzled the world lately have spent decades building the necessary moat and underlying dynamics to take on the world. The process seems to require prolonged, un-relentless focus on something that the world does not see yet.

Now, Chen has issued guidance and per his track record, I am inclined to take it seriously. On the one end, I think we have more than enough evidence on IoT to believe him - the company is executing very well on this front, bouncing back from a “depression” in car sales during the pandemic, which got extend by the semiconductor / overall supply chain driven shortage. On the cyber end, the company still has to work stuff out, but billings growth is a healthy sign.

One key datapoint to have in mind is that “the Company’s cost of sales does not significantly fluctuate based on business volume” (page 40). This is the case with most good software businesses: OPEX does not have to scale for the top line to scale.

“…while the IoT TAM is expected to grow in the range of 8% to 12% over the next 3 years, we expect to grow IoT revenue at a 5-year CAGR of approximately 20%. This faster than market growth rate, is primarily in our core safety critical auto domains. In addition to auto, we also expect growth from adjacent verticals, particularly medical and industrial, broadening our addressable market.” - John Chen, ER CC

“…given the strong market condition, our technology portfolio and the road map, we expect revenue to grow with a 5-year CAGR of approximately 10%. The cyber business unit includes both the more mature endpoint management products as well as the higher growth endpoint security products. We target cybersecurity revenue of $579 million in FY ‘25 and $770 million in FY ‘27.” - John Chen, ER CC

“We expect operating leverage for the business, expanding gross margin by over 100 basis points per year on average and trending towards our 20% operating margin by FY ‘27. Given the investment we’re making, we expect moderately negative EPS and cash flow this current fiscal year, approximately – approaching EPS and cash flow breakeven in FY ‘24 and becoming EPS and cash flow positive from FY ‘25 onwards.” - John Chen, ER CC

4.0 IVY and Other Call Options

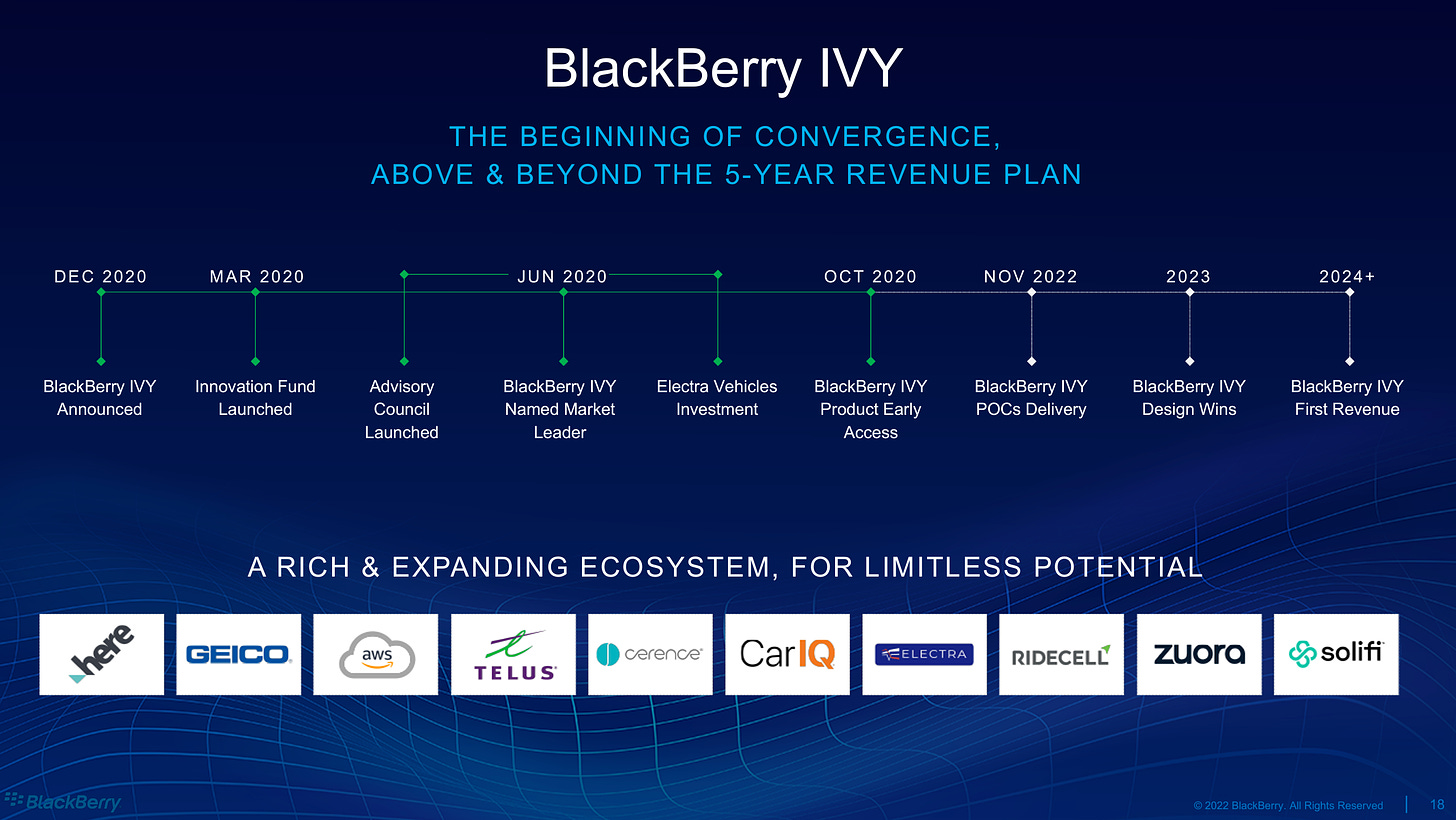

As P(A) approaches 1, the company will be able to gradually build a series of software-enabled call options. In fact, segments of the company can approach P(A) = 1 before others - such is the case of auto. QNX is now installed in 215m cars on the road P(B) and it is extremely likely that the connected car will become the industry´s default P(C).

*In this scenario, Blackberry is able to launch IVY, which in case you are new here, is a 50:50 joint venture with Amazon to create a sort of app store for cars. IVY gathers data from cars and allows external developers to build and sell apps that do useful things with said data. OEMs benefit from a new revenue stream at a marginal cost.

IVY is in effect a call option, in that it may or it may not work, but Blackberry can develop it at a marginal cost, relative to the cost of getting QNX into 215m cars out there. It is once more, the business playbook of our time that I write about so often and that has built the biggest and most powerful businesses in the planet, to date:

Apparently, during the quarter the company commenced some POCs with “leading global automakers and Tier 1s”. We have little data on the matter, so we just have to go with what management says, but my point is that Blackberry will not be limited to IVY. As it approaches P(A) = 1 in medical devices, for instance, it will be able to launch a similar call option. Through time, this dynamic will extend itself to a number of highly relevant components of our society, in which Blackberry is gradually embedding itself - from traffic lights, to cars, medical devices and wind turbines.

I believe (and it will be fun to read this in 5-10 years time), that this is what will enable Blackberry´s revenues to skyrocket, with a lot of cash accruing to shareholders. Note that the projections in Section 3.0 exclude potential revenue from IVY.

Note that management refers to IVY as “the beginning of the convergence”. Also, bear in mind that Blackberry´s fiscal calendar is one year ahead of the natural calendar, so 2024+ means in 2023 and beyond.

5.0 Balance Sheet and the Catapult Deal

To start off with, I do not like that management disclosed the deal to sell its legacy patents to Catapult as totally closed. I personally was convinced that it was a done deal and so were many. Some of you very adequately brought up some concerns about Catapult securing the financing for the deal - so kudos to you. I consider this miscommunication to be unfortunate and detrimental to the management´s reputation.

The company is now open to other potential buyers, although JC said the following during the call:

“I am not actively looking for or starting from square one. As I said I want to make sure that the shareholder knows that we are not just stuck with one option, but we do expect the deal with Catapult to happen.”

Having said that, the balance sheet continues to look quite strong. Total cash, cash equivalents and investments were $721 million as of May 31, 2022. The company´s net cash position was $356 million. “Q1 is traditionally a seasonal high for use of cash given the payment of annual bonuses and other annual items, and together with the ongoing investment in the business, free cash usage was $43 million”.

The debt profile continues to be quite advantageous for long term investors, with total debt sitting at $459m vs $507m last quarter. The debt continues to be entirely owned by Fairfax and convertible. Fairfax continues to be a major shareholder of the company, so the interests are aligned and the probability of permanent loss of capital is fairly low, for an operation of this nature- which is of course quite risky, needless to say.

In all, the focus continues to be on whether Blackberry can ramp up sales and meet or exceed the guidance it has provided. Only time will tell, but the domino pieces are in place.

6.0 Other Financial Considerations

6.1 Income Statement

I wrote some time ago about “unusual items” dragging Blackberry´s bottom line into the red, which according to John Chen were costs associated to winding down the legacy business. They “disappeared” last quarter as the Catapult deal as announced and I assumed that this would be due to the company effectively exiting its legacy operations altogether.

The unusual items are back, however and this adds to my discontent with how the Catapult deal is being handled.

I will be getting in touch with their IR department to try and figure out what is going on with these items, although I read in the quarter´s financial information annex that:

“The net loss was primarily due to a litigation settlement, as discussed above in ‘Business Overview - Pearlstein Settlement’” - page 34.

There has also been a sharp decline in gross margin QoQ, from 67.03% in Q4 2022 to 61.93% in Q1 2023. I note however that this seems to be a historical trend for the company and it seems to be due to the fact that Q1 is bonus season. The drop with respect to Q1 2022 is due to the Licensing business dying away:

“Q1 is traditionally a seasonal high for use of cash given the payment of annual bonuses and other annual items, and together with the ongoing investment in the business, free cash usage was $43 million.”

“The [gross margin] decrease was primarily due to a decrease in revenue from Licensing and Other and BlackBerry Spark, partially offset by an increase in revenue from BlackBerry QNX and Secusmart.” - page 40.

Operating income as a % of revenue suffers proportionately, but for a few years now it has been trending towards 0, coming from deep in the negative. This all seems to correlate with their hiring ramp up in cyber, which incidentally has seen its gross margin drop considerably, whilst IoT has not:

Beyond that, I see nothing concerning going on in the income statement. OPEX remains relatively stable, with R&D and SG&A trending flat.

6.2 Cashflow Statement

Nothing worth noting.

7.0 Conclusion

I remain optimistic about the prospects of the company and have confidence that its balance sheet will help keep the venture afloat. IoT looks firm and Cybersecurity seems to be picking up per the billings growth, while churn, NDR and ARR are looking wobbly.

Still, one thing is clear to me - the sales hires are driving meaningful progress. I look forward to seeing what they can do in the following quarters, as the natural sales cycle time elapses.

If the company manages to fully mature both the IoT and Cybersecurity verticals, there is a bright future ahead for the company. Else, not so much.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Hey Antonio, there's been rumblings online that Facebook/Meta may be taking up QNX, possibly as a foundation for a metaverse OS. Any thoughts? Have you come across anything?

I remember one of the BB executives saying the settlement with FB wasn't disclosed because it was not material. He seemed to put some emphasis on the word 'material.' At the time, I thought he might have just been disappointed with the result. However, it may have been a hint towards partnerships rather than cash settlement.

If this does happen, it would be as big as Ivy/auto, IMHO, and wouldn't be priced into the stock at all. It could be a step towards making QNX a standard for IOT.

Is there any activity about tracking shipping containers? Huge challenge: Containers, contents, shipping routes, where are the empty containers... Has one been broken into, where, when etc. The contents of a container maybe dangerous cargo, or contraband, or a fabrication, etc.

Just curious if Blackberry has plans to address this market.