Note: this is an update to my deep dive on $BB.

Blackberry is Focused on Growth Now

$BB reported its Q3 2022 earnings on 21/12/2021. Overall, my impression is that cybersecurity part of the business is seeing traction and that the business has now reached a point of homeostasis, after years of unwinding the legacy business and positioning itself for the future. $BB looks like it is already in expansion mode, although this is not showing in the numbers yet. Revenues came in at 184m$, above 176.58m$ expected, but as always, the devil is in the details.

Financials

The balance sheet looks quite healthy, with 184m$ in cash and 673m$ in debt, which is convertible and entirely owned by Fairfax, which is in turn a large shareholder of $BB. In this sense, $BB looks quite de-risked.

Regarding the income statement, the gross margin in Q3 is at 63.59% which is the lowest we have seen in a while. I am not sure why this is the case and will continue to try and figure it out. Further, when I first looked at $BB, it caught my eye that much of the red in the bottom line was caused by “unusual items”, which John Chen has accredited to costs of unwinding the legacy business. Q3 is the first time we see unusual items not drag the bottom line with it. To me this signals that $BB has finished unwinding the legacy business or is close to doing so.

Sales and Moat

I was hoping to see sales ramping up this quarter. Chen says the new hires and organizational structure will take 3 to 4 quarters to show up in the numbers. I am happy to wait.

In IoT $BB continues to experience plenty of design wins, as revenue creeps its way back up to pre-pandemic levels, the most notable one being with BMW. “BMW entered a multi-year agreement with us to develop new Level 2 and 2 plus autonomous drive system on QNX for makes and models across the entire BMW Group”. This, adds to $BB´s moat in auto. Further, Blackberry IVY is progressing adequately and we will be seeing more of that at CES. If you look around you in the street, connected cars are not here yet. IVY will take 5 years + to really show up in the numbers. All in all, however, $BB looks set to capture the below:

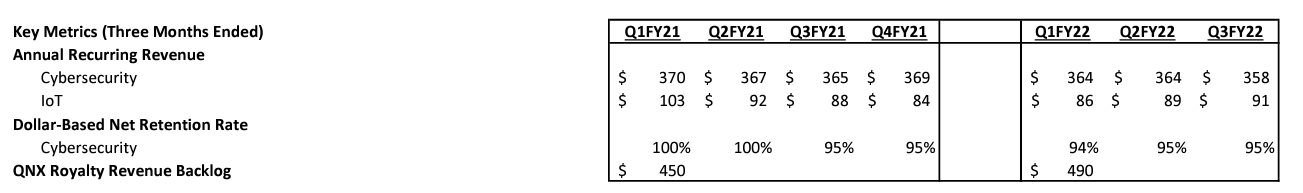

Cybersecurity looks flat with respect to a year ago and dollar-based net retention has slowly dropped from 100% to 95% since Q1 2021. However, Chen has said $BB now has 10% more clients in cybersecurity than a year ago and I have seen increasingly quote over the last few quarters “competitive wins against CrowdStrike and SentinelOne, as well as other older signature based players like Microsoft, McAfee and Symantec”. The way he is getting louder about the competitive wins, the increase in carrier quota and $BB´s ability to be unaffected by major cybersecurity incidents (such as the recent Log4Shell) give me the impression that we are seeing traction in cybersecurity. I am excited to see what John Gianmatteo, the man in charge of cyber at $BB, can do going forward.

Further, he quotes new cybersecurity wins with “the US Navy, who became a new SecuVOICE customer. The Department of Homeland Security, the Dutch government, the US Department of Education, which was -- happened to be a new logo wins for our AtHoc, the spacing of key competitors, as well as Scottish government, US Central Command, the Federal Aviation Authority, FAA and the IRS just to name a few”. This again points back to the original idea that for $BB to protect 18 of G20 govs when I first wrote about it, it must be doing something right.

Conclusion

My original $BB thesis is that the company is good at combining a series of technologies to run machines (move data around) securely when they are connected to the internet and that this will become a very large business, as we move to embed semiconductors in everything. I believe we continue to see new market signals that point to this during Q3, such as the BMW deal and the cybersecurity wins with all the public entities listed above. Meanwhile, the company looks de-risked in terms of its balance sheet and seems to be ready to now focus on growth.

Over the next few quarters, we are likely to see cybersercurity sales growth and far better numbers in the bottom line, if “unusual items” do not make it back into the scene. As sales ramp up, I believe the market will eventually recognize $BB as being quite an undervalued tech platform.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Gross margin is lower due to all the extra staffing no yet up to speed re sales/revenue also we have quadrupled our advertising in last few quarters. That number should creep back up as our customer base grows

Good thoughts Antonio. Thanks! Even though they don’t reflect true operating expenses, I would like to see the following continue to decrease and go away. Restructuring charges from moving from a legacy hardware manufacturer to a licensing driven software business, debenture fair value adjustments and goodwill impairment charges. Have a great 2022.