Note: This deep dive is not for my portfolio, but for a much larger and more diversified one.

Summary:

Alphabet is a large company with many components, but most of its cash flow stems from its advertising business (Google Search + Youtube), which is heavily moated.

This cashflow can be bought at a fair price today. Along with it, you get prime internet real estate which also generates cash, an emerging cloud company and some very promising AI-based experiments, such as Deep Mind, Waymo and Calico.

Google´s products and services have a long way to go, as the remaining 40% of the population joins the internet and as a online engagement continues to rise worldwide.

Due to the breadth and depth of the database $GOOG is generating, it is developing world class AI capabilities. This is likely to make the company even more valuable through time and it will be hard to catch up with them.

Introduction

$GOOG started off as a search engine that allowed people to search for things on the internet. Today, it is mostly just that, together with some prime internet real estate (G Maps, G Mail, Android and Play Store), a cloud play and some interesting experiments with negligible revenue (for now), that are nonetheless very promising. The whole organization is basically boot loading AI, as it generates the arguably most complete dataset in human history.

$GOOG makes most of its money (over 80%) through ads by allowing advertisers to capture the attention of Google Search and Youtube users, so most of $GOOG´s revenue stems from these two platforms. The ad business is essentially surrounded by top-of-mind products and services that helps funnel users back into the ad business, by keeping them within the $GOOG ecosystem.

I believe three main trends will continue to propel $GOOG´s existing products and services further:

Roughly, 40% of the world´s population is yet to come online. As these folks come online, they will tend to use Google products since they are dominant.

Online engagement continues to increase, as people do more things online. This will ultimately increase online advertiser spending through time.

$GOOG has arguably the world´s deepest and broadest data harvesting infrastructure, which sets it up to birth an AI of equivalent notoriety. This will help make the current products better and will help $GOOG create value in many more ways.

From an investment perspective, I think $GOOG will continue to grow and that there is an opportunity today to acquire $GOOG´s core advertising business and prime internet real estate at a fair price, whilst getting an option on capturing some of the value the company may create by getting really smart through AI. I will proceed by explaining how AI is tapping into our fundamental wealth creation process and how $GOOG is ideally positioned to birth a world class AI, giving it a good shot at what my be spectacular value creation over the next decade or two. Then, I will look at the specifics underlying $GOOG´s ad business and prime real estate, addressing its valuation at the end of this section. Finally, I will take a look at some of the other bets the company is making, that build on top of its core AI competency.

AI, Wealth and Google

“A few years ago, we placed a bet on AI, believing that it would be a fundamental technology that would underpin and dramatically improve all our products. That vision was on full display at our I/O event in May, where we announced new advancements that will be helpful to people and businesses everywhere.” - Sundar Pichai, CEO Alphabet & Google, on the Q2 2021 earnings call.

It is hard to explain, but I think there are a number of levels at which you can understand what AI is and what it really means for humanity. For the past few years, I understood it at a technical level. I was myopically close to neural networks (NNs), the technology underlying AI and I really enjoyed exploring it. As time went by, I began to see the bigger picture and to understand that in order for NNs to add value in the world, they need a source of abundant, high quality and relevant data. If I want to train a NN to recognize melanomas in radiographs, for instance, I need to show the NN plenty of images with positive and negative cases. Getting data of this sort is often a challenge in the real world and so, companies with prominent data harvesting infrastructures, seen from a very abstract perspective, seem to be something akin to boot loaders for AI. AI is already tapping into and going to defeat us at our own game of generating wealth. Let me explain.

Only a month or so ago, it clicked in my mind that what we humans do to create wealth is simply unlock new ways to configure atoms that yield some kind of benefit to us, which then translate into wealth. Semiconductors are one such notable example in our recent history - we figured out a way to arrange atoms so that we could perform computations faster, which in turn made us wealthier. Generally, it follows that the name of the game for humanity is to get better at unlocking new atom configurations, so we can speed up in this sense and generate more wealth with less input. Post semiconductors, it seems we have embarked on an unstoppable process to digitize our physical world, turning everything into a flow of digital information. To our brains, these flows of information are hard to process, but NNs feel right at home in them and can learn to perform predictions based on them, which to the untrained eye look like intelligence. As NNs commoditize predictions, we will get a lot better at unlocking new atom configurations. In this way, AI is tapping into our wealth creation process and is likely to accelerate it dramatically.

Whilst it merely seems that Spotify enables people to listen to music, for example, as it embarks on a journey to become an audio company it is generating vast amounts of data about what people like to listen to. This allows Spotify to make some amazing music recommendations, because it can predict what audio content you will like. If it can do that, then it can eventually predict what songs will be succesful where and when and just generally, it will have the knowledge to run circles around market incumbents, in a cost effective way. The same is happening with companies that gather vast amounts of data in other contexts. They are preparing the raw material for AI to then come in, learn everything and beat us at our own game of unlocking new beneficial atom configurations. This will manifest in the world in the form of computers beating humans at an growing list of valuable tasks, at a decreasing marginal cost. This is already happening if you look close enough.

AI is therefore likely to therefore generate vast amounts of value and incidentally, Google is very well positioned to capitalize on this. Google has two main data harvesting units: its original search engine and Youtube. Both search engines have billions of people a day asking questions and receiving answers. Per the behaviour of a given user, Google can infer whether the answer was satisfactory or not and so it gradually learns more and more about a broad range of topics every day. Google is arguably generating the broadest and deepest dataset in the world, as it learns about all sorts of topics every day. Have you ever heard that catch phrase that says “Google knows more about you than you do?”. It does and the dataset that it is developing is one hell of a boot loader for AI. Ultimately, such an AI would eventually know more about a whole set of industries than their incumbents. This will allow / is allowing Google to make its existing products better and to continue adding value in new ways. Per the above definition of wealth, $GOOG´s AI is very likely to make the generation of wealth cheaper and ultimately, this value will accrue to the company´s shares outstanding, on top of the core ad business, which I will dissect below.

The Future of Search

Before moving onto the next section, I want to address how I think search will evolve going forward. I believe that what we have seen up to date is the early innings of search as we know it today. Since all we do as a species is work with information, search is and has been a fundamental aspect of our civilization. Before the internet and Google came along, we were simply using more rudimentary forms of search, such as libraries. If you study the history of western civilization, you can clearly see a correlation between the rise in expected lifespan and the ease of flow of information. The more the west has has advanced in terms of sharing information, the wealthier it has become through time.

What we are seeing now is an acceleration of this, a sort of information Cambrian explosion if you will. It is happening right in front of our eyes and for this reason, it is kind of hard to tell that it is going on. Today´s search engines allow us to sift through information in a radically efficient way, but they still do not understand what we actually mean or what we are actually thinking about when we enter a search query. They do not understand the content they retrieve at the same level at which we do and so search engines are still largely dissociated from human cognition. However, with the advance of AI, I believe search engines will gradually get on par with human minds and we will be able to interact with them naturally, feeling like they really understand us. History suggests this will lead to a wealth explosion.

Alphabet

Structure

In my opinion, much of the restructuring is intended to make it look like $GOOG is not a search monopoly. This is what the structure currently looks like:

Management

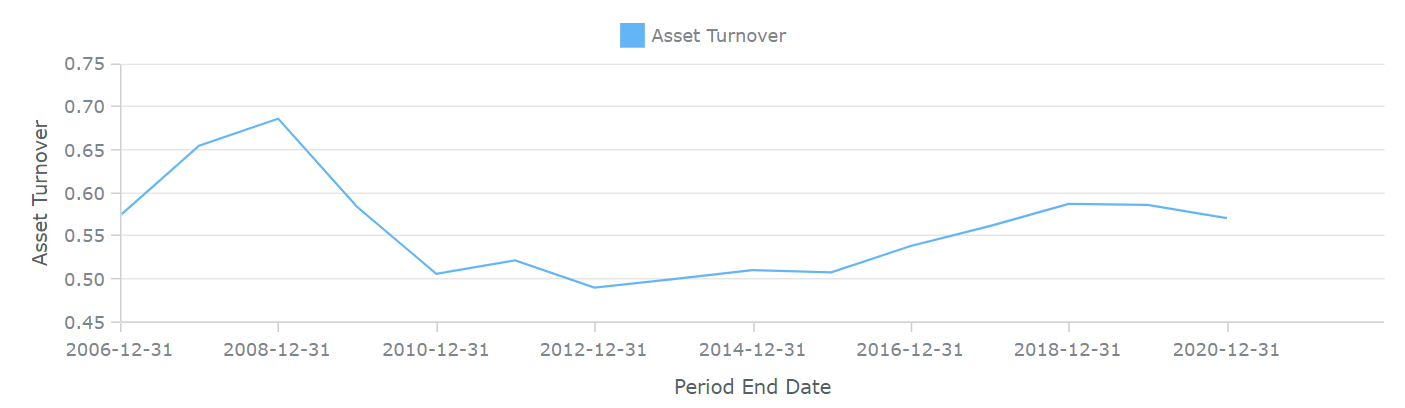

I have only recently begun to research $GOOG, so I think it will take some time to get a feeling for the management. However, I think Sundar Pichai (CEO of Alphabet and Google) has the right vision, pointing the company towards AI. He joined $GOOG in 2004 and then became CEO of both Alphabet and Google in 2014. Although there are some qualitative inferences I can make about his management by listening to him speak, I think it is worth pointing out first that there seem to be a number of historically reliable quantitative indicators that suggest the company is increasingly well managed.

Roughly, it seems fair to say that both RoE + RoA and asset turnover where on a downtrend until Pichai came along. Since, all three metrics seem to have changed course. A rising RoE reflects the company´s growing ability to generate profits with less capital. A rising RoA suggests the company is getting good at investing the right amount in assets and a rising asset turnover reflects a growing ability to use its assets to generate sales. The seemingly changing trend suggests an improved and more efficient management.

Qualitatively, what I like the most about Pichai is his gentleness. A think that a giant like $GOOG has to do its best to not scare the population and he has the right vibe for that. Another thing I am on the lookout for is how the different divisions within $GOOG (specifically the core of the business) are incentivized to achieve goals. With its current size, $GOOG needs to be placing a lot of emphasis on how it motivates people, to avoid breeding ill fated incentive structures like the ones that led to the downfall of $GE, which I learnt extensively about by reading “Lights Out”, by Thomas Gryta and Ted Mann. What I want to see for $GOOG is a commitment to accountability and transparency. I will post updates on this as I pick up signals going forward.

Revenue Segments and Balance Sheet

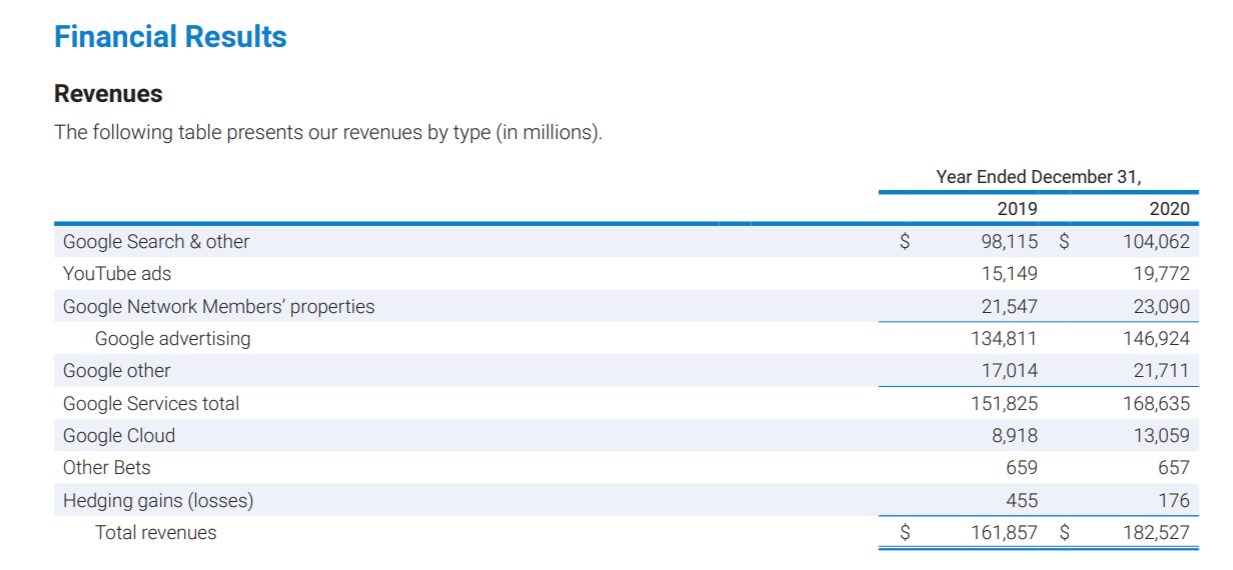

As mentioned, most of the revenue comes from Alphabet>Google>G (Search) and Alphabet>Google>YouTube, so it seems fair to conclude that $GOOG is basically an advertising business.

Youtube and Google Cloud have been accounting for a growing share of the total revenue. Youtube seems to be the fastest growing segment within $GOOG, revenue wise.

$GOOG has a market cap of 1880b$, LT-debt of 12b$, capital leases of 13b$ and 23b$ of cash in hand. In the TTM, it has yielded 44.6b$ of levered FCF. This essentially means that its balance sheet and cash generation capacity are rock solid.

Main Business Components Breakdown: Search, Youtube + Google others

Simplifying the Thesis

Google Search, Youtube and Google others make up for the revenue sources referred to as “Google Search + other”, “Youtube Ads”, and “Google Network” on $GOOG´s I/S. These 3 components compose the segment Google services, which is the segment in which $GOOG makes an operating profit. The remaining “Google Cloud” and “Other bets” (which includes companies like Deep Mind and Calico - right hand side of the diagram in the Alphabet section) actually turn an operating loss and so depend on the profits generated by Google Services to keep going.

In essence, the components of Google services currently determine $GOOG´s financials, so by understanding Google services well, we can gain a benchmark understanding of whether going long $GOOG is a good idea or not. After much research, the components of Google services seem to me:

Heavily moated.

Pegged to the growth of the internet, in terms of active users.

If this is true, this means that we are likely looking at a company that still has a long runway ahead, as the internet continues to permeate the global population, since these components will likely be embraced by new internet users. Let´s examine this.

Google Search

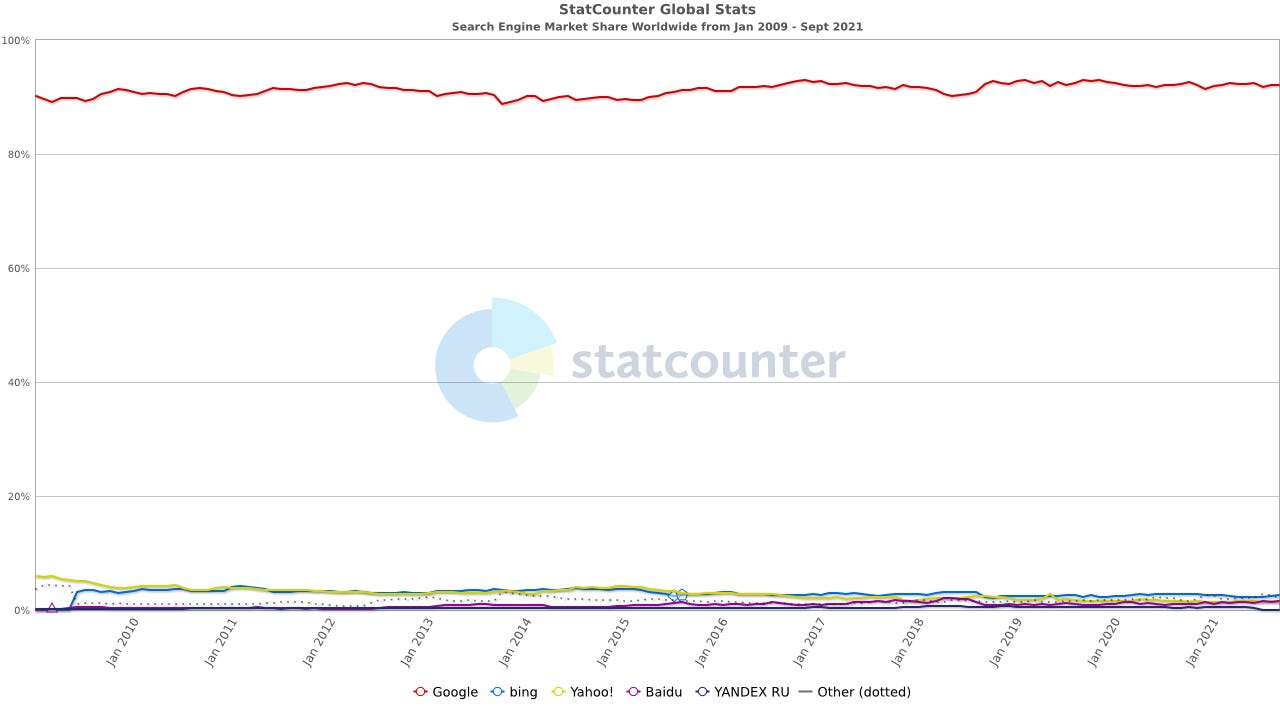

From Jan 2009 to Sep 2021, this is what the world´s search engine landscape has evolved like:

So long as the internet exists and people want to filtrate the information it contains, search engines are going to stick around. Search engines do one thing, which is return results for a given query. The more relevant the results, the more useful the search engine is to the end user. Ultimately, the higher the relevance of the search results, the stickier the product becomes and the more referrals it generates. $GOOG´s search engine is uncontested because it is a very efficient learning machine, that improves continuously its ability to return relevant results.

The more people use Google Search, the smarter it gets and the more users it is able to attract. The resulting flywheel keeps $GOOG high up in the graph above with no serious contestants. Since search engines are free for users and they may opt in or out at no cost, de-throning Google search requires building a smarter search engine which returns more relevant results, which is incredibly hard to do with the current technology we have. The moat is therefore strong and at this stage, I would say near impossible to destroy, so the portion of cashflows that come from Search seem castled and likely to keep growing, unless we see a fundamental technological advancement that makes creating a smarter search engine feasible.

Youtube

Youtube is a more complicated component to analyze. Mostly, people use it for:

Entertainment

Education

Music

To see people and vlogs

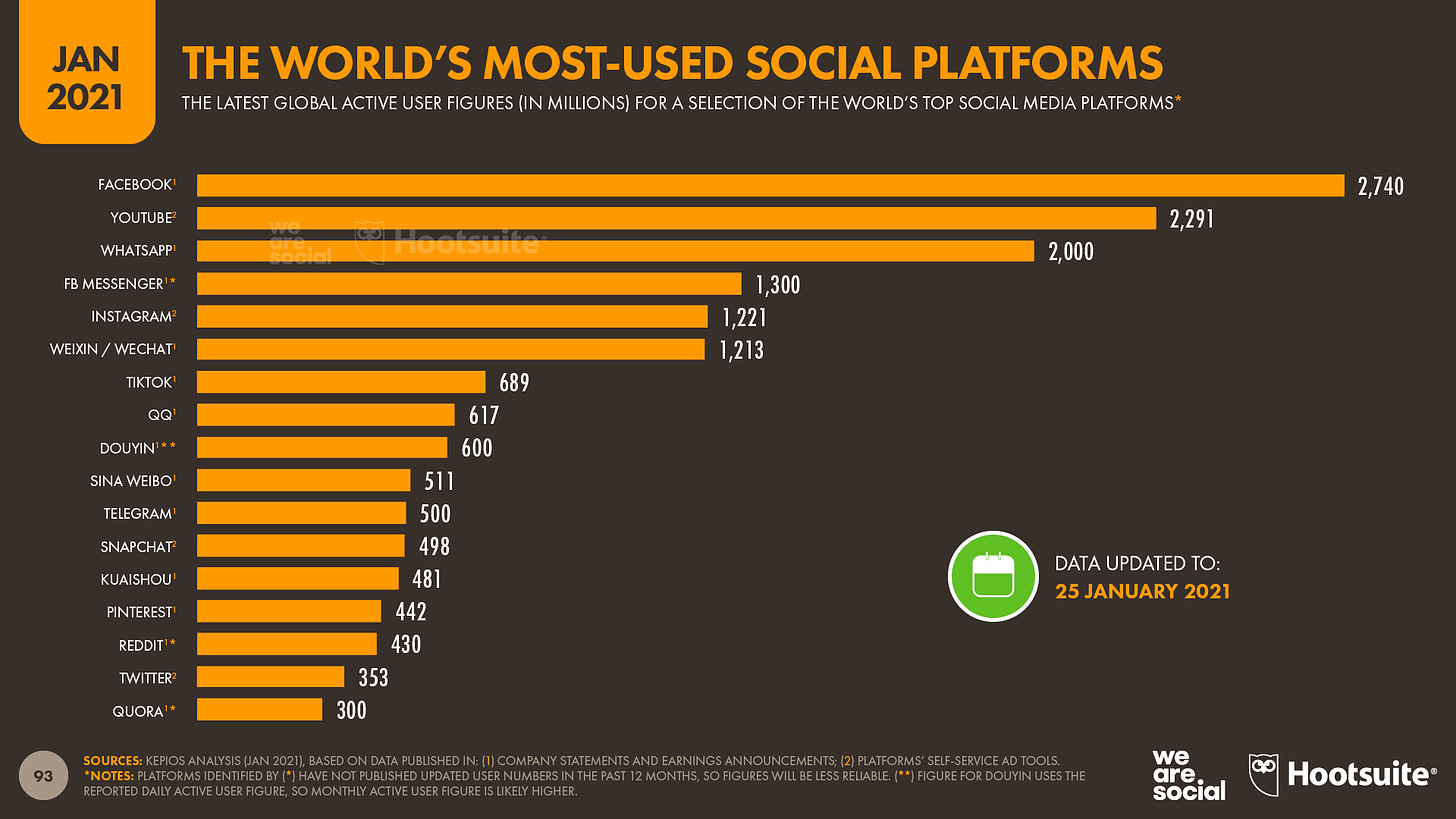

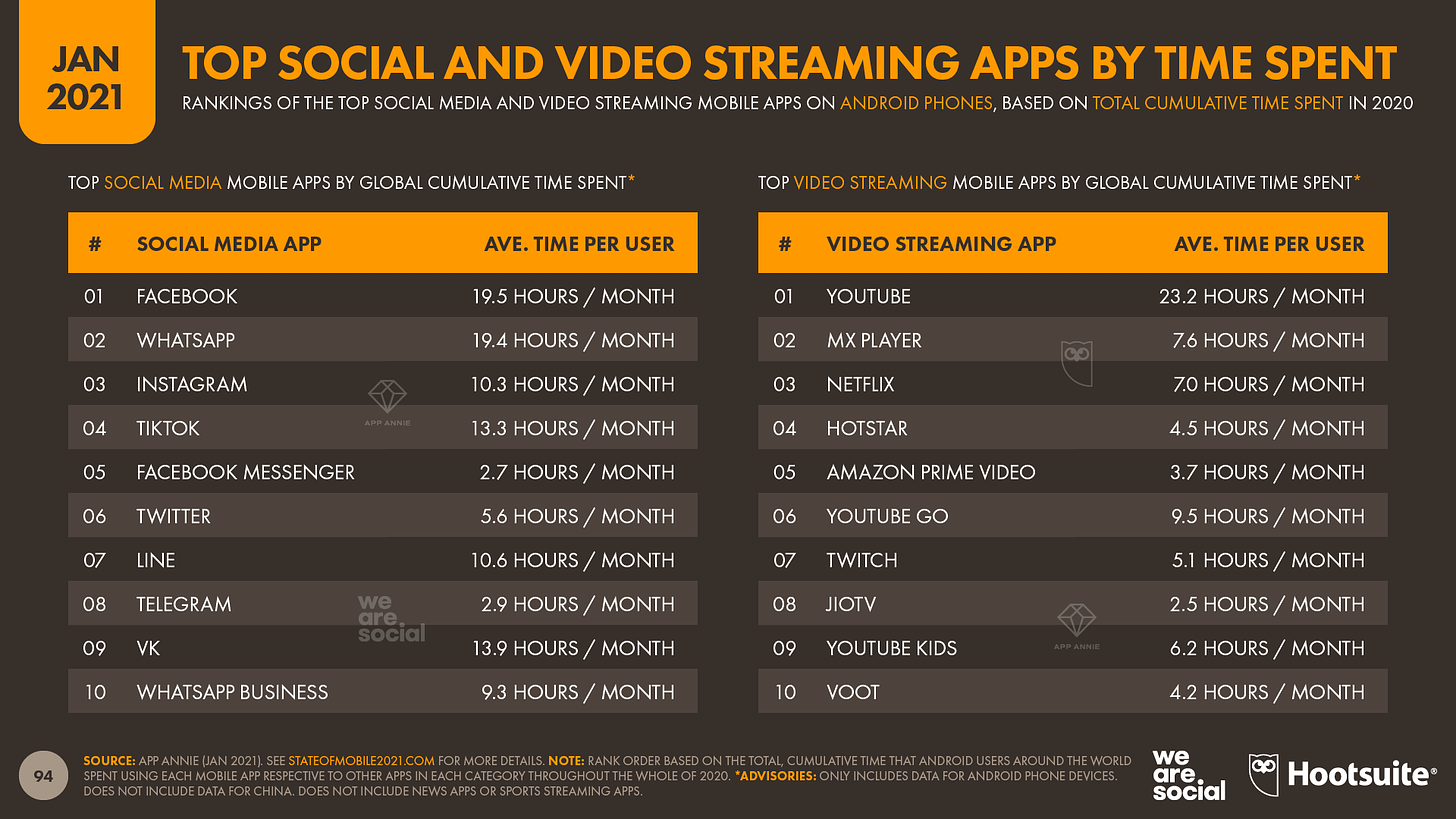

This means that in terms of the time users spend on the platform, Youtube competes with a large array of platforms specialized in media of all types. Here, the business is in clear leadership position but as uncontested as in the search engine space. Qualitatively, I find Youtube´s competitive advantage in this space to be that it helps people get smarter. Around 40% of people feel smarter after watching Youtube. 70% of users access Youtube to help solve problems related to studies, jobs and hobbies. 51% of all US adults find Youtube vital when learning how to do new things.

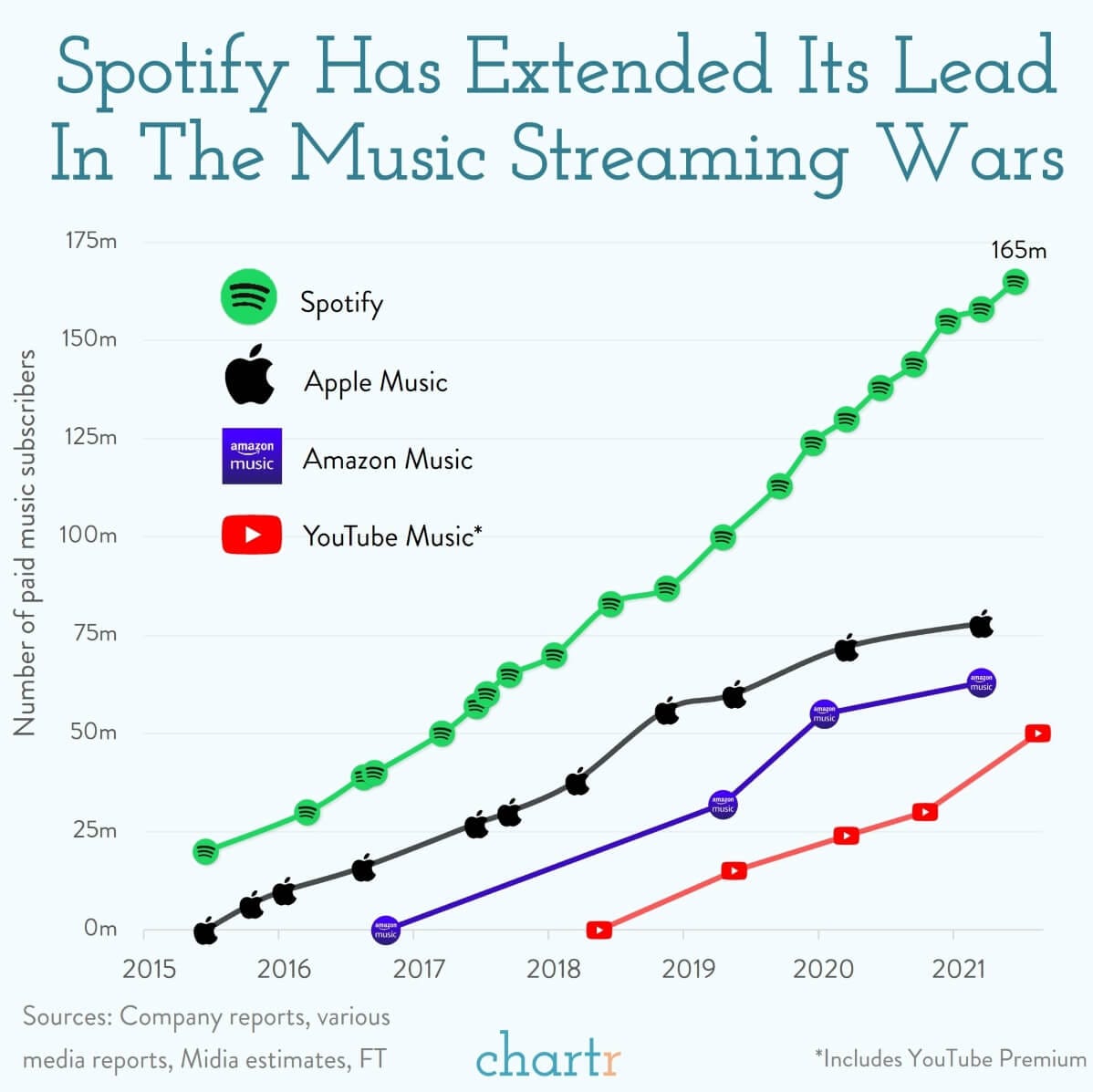

Learning / education is a tough space for many of the other platforms to compete in, except for Twitter maybe, whilst in entertainment, music and people and vlogs Youtube has a long list of competitors. For instance, it now competes in music with Spotify and other players.

Qualitatively, I have observed my behaviour in the past few weeks and I find that every time I want to learn something new, I end up on Youtube. Every time I want either entertainment or music, for instance, I end up splitting my time on a series of platforms, such as Youtube, Netflix, Amazon Prime, Spotify and Instagram. I believe this is the case with most people. I have, however, found myself to be spending more time on Youtube YoY and I believe the stats below suggest this is the case with many others too.

Whilst Youtube is not as dominant as Search, it looks to me like its going to continue growing through time. Much like Search, as it continues to learn from search queries and to broaden and deepen its content supply, I expect it to get much more useful to users through time and thus, continue to cement its leading position in the social media space.

Large % of People on Planet not on Internet

Google and Youtube account for most of $GOOG´s revenue, so we are now in a good spot to examine the prevailing winds pushing $GOOG further out to sea. Beyond $GOOG´s ability to please customers with its products, two trends have been driving its growth (according to the company´s disclosures in its annual letters):

Increased user engagement: people that are already online spend more time and do more things online as time goes by.

Increased % of population on the internet:

Given all the above (the dominance of $GOOG´s core products and the room left for the internet to grow), we can probably make 3 fair assumptions:

Google search is going to continue to dominate the search engine space.

Youtube will continue to be a significant part of the social media space, but not a dominant one.

Therefore, As more people get online, both Google Search and Youtube will continue to grow.

$GOOG´s revenue by customer location (% of total revenue) says it all, with most of its revenue coming from the US and the developed world.

The above demographic consideration is actually quite low dimensional for what the internet is likely to be. In estimating the room that the internet has to grow by looking at the % of people that are not yet on it, we fail to capture the fact that once you get on the internet, every year that goes by a larger portion of your life happens inside it. For this reason, I expect the internet to grow by much more than just 40%, but the above serves as a nice conservative benchmark. Regardless, the above seems to be a realistic picture of the path ahead for Search and Youtube. What about Google others?

Google others

This segment accounted for 22.711b$ in FY 2020. Its various components are in effect prime internet real estate that is likely to continue to grow and strengthen as more people join the internet and again, as engagement continues to rise. The other interesting property of the products I examine below is that they keep users within the $GOOG ecosystem, effectively funneling them into the more lucrative ad business. Per se, some of these units are very interesting businesses on their own and quite under monetized. To finish the intro of this section, I will add that I consider the below businesses to be somewhat less moated than Search and Youtube, with clear alternatives for users. Still, I believe them to be well set up to continue growing as the internet grows, as is the case with Google Search and Youtube.

G Maps

G Maps has 1b+ users and is the world´s top navigation app on all platforms, with a 60.84% market share. It is currently not being monetized by $GOOG. Since 46% of all Google searches are linked to something local, there is plenty of monetization potential to tap into here. People need accurate information to move around and this is likely to be the case going into the future.

Android and Play Store

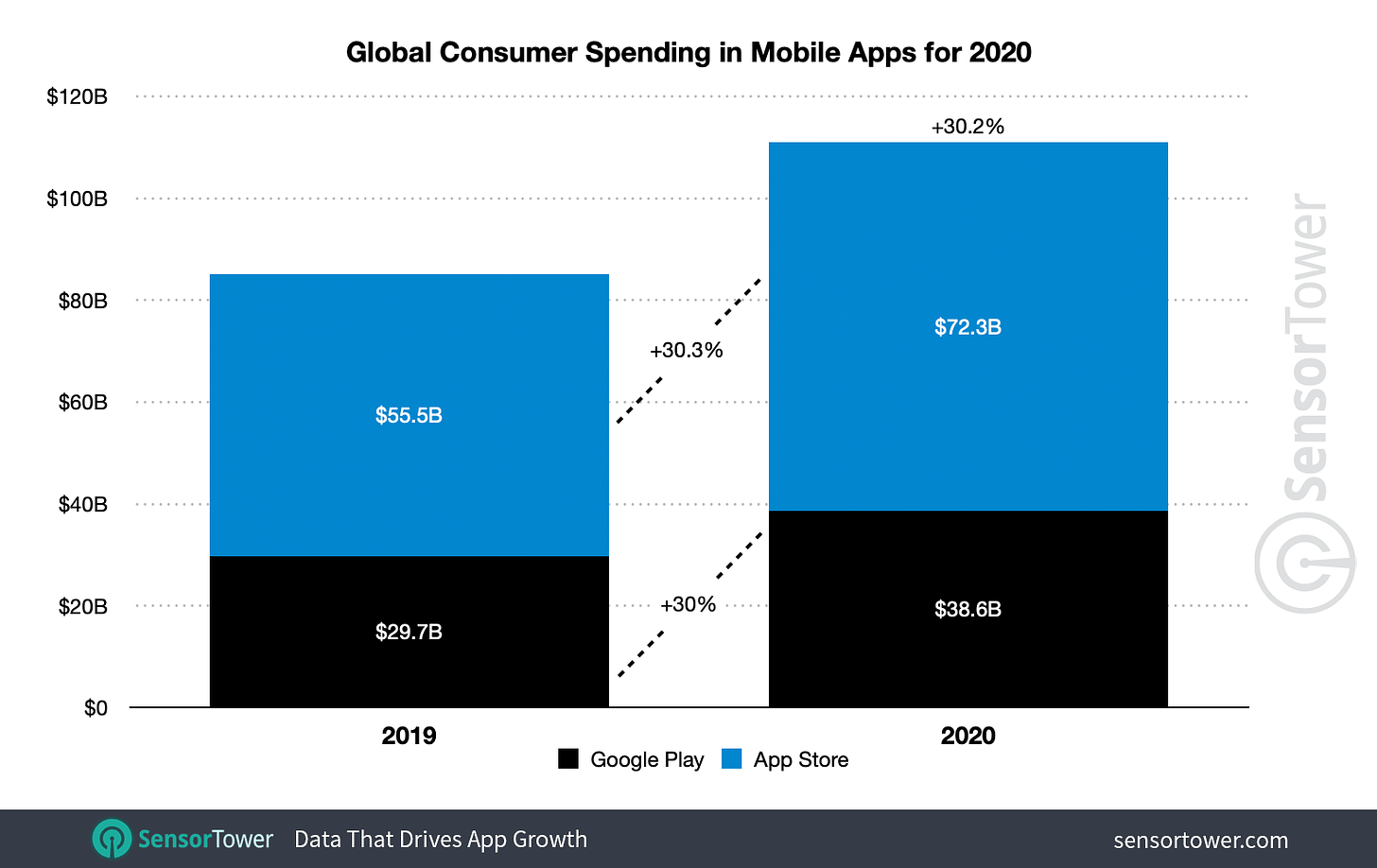

Android has a market share of close to 73% in the smartphone OS space.

I think it is fair to say that we are increasingly living our lives inside our phones and this inevitably leads to increased spending in apps. Given $GOOG´s dominant position in the smartphone OS market, this sets it up well to capitalize on increased app spending. Global consumer spending in mobile apps reached a record $111 billion in 2020, up 30% from 2019.

G Mail

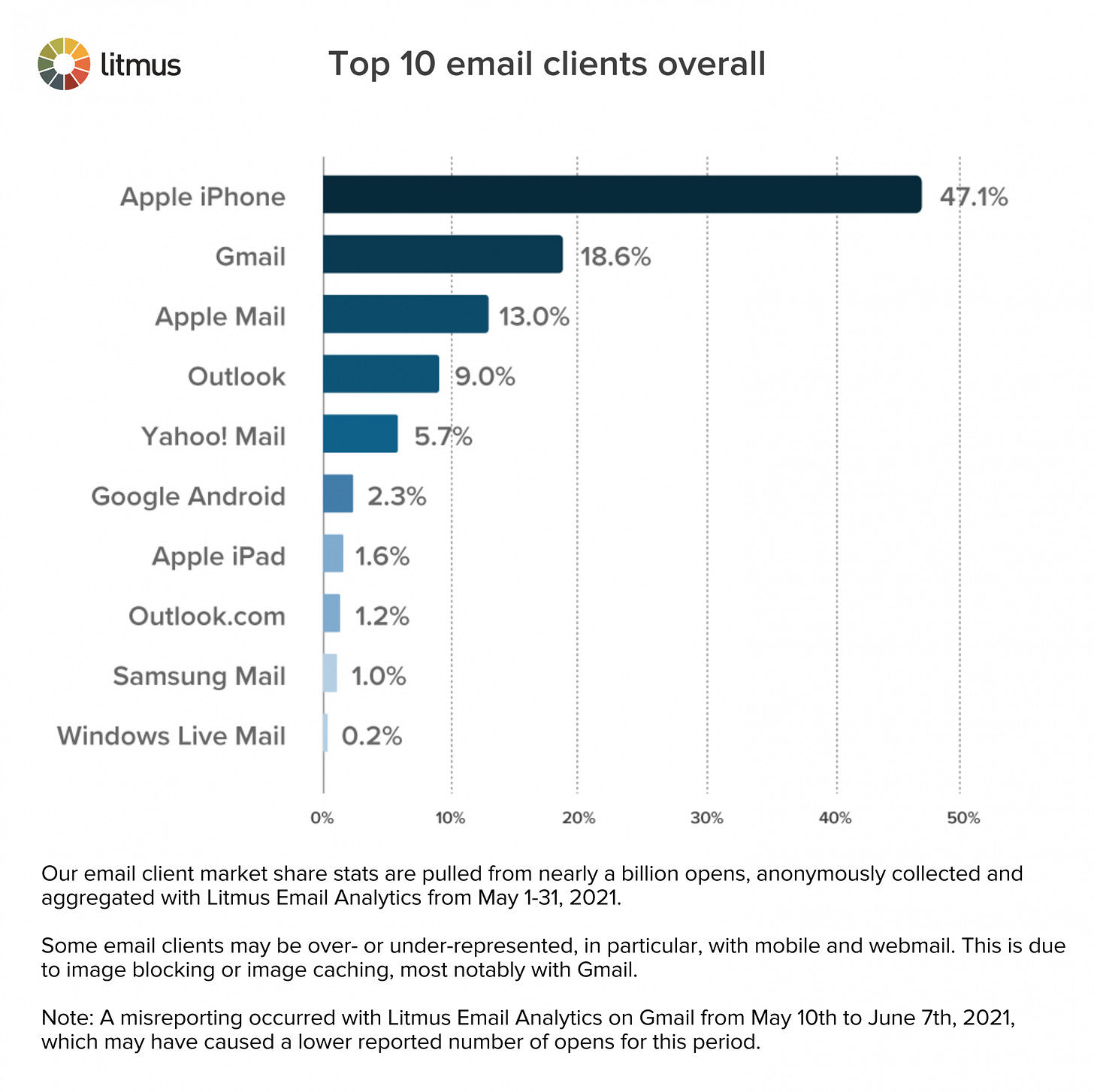

Gmail serves 1.5b inboxes, whilst Apple in fact continues to dominate the email space.

Chrome

Chrome has 2.65b users and seems to dominate the internet browser space, in terms of market share. Since $GOOG´s main business stems from its search engine, 2.65b users on Chrome are incredibly valuable to it, because it just funnels all the users into Google´s search engine.

Prime Internet Real Estate

As the internet becomes whatever it has to become, we know people are still going to want to move around, use their smartphones, send emails and browse the web. In the context of the internet, the services that Google offers to satisfy the above needs is in essence prime real estate. There are strong competitive forces acting against the relative dominance of these Google services, but in the TTM it has spent 29b$ on research, which if I am not mistaken is the second highest research corporate budget in the world. This helps maximize the chances that its prime internet real estate continues to be so, until we encounter some considerable technological shift that changes the rules of the game. Until then, matching Google´s prowess in these areas is going to be tough and even if someone does, $GOOG can just buy them out.

Further Dynamics

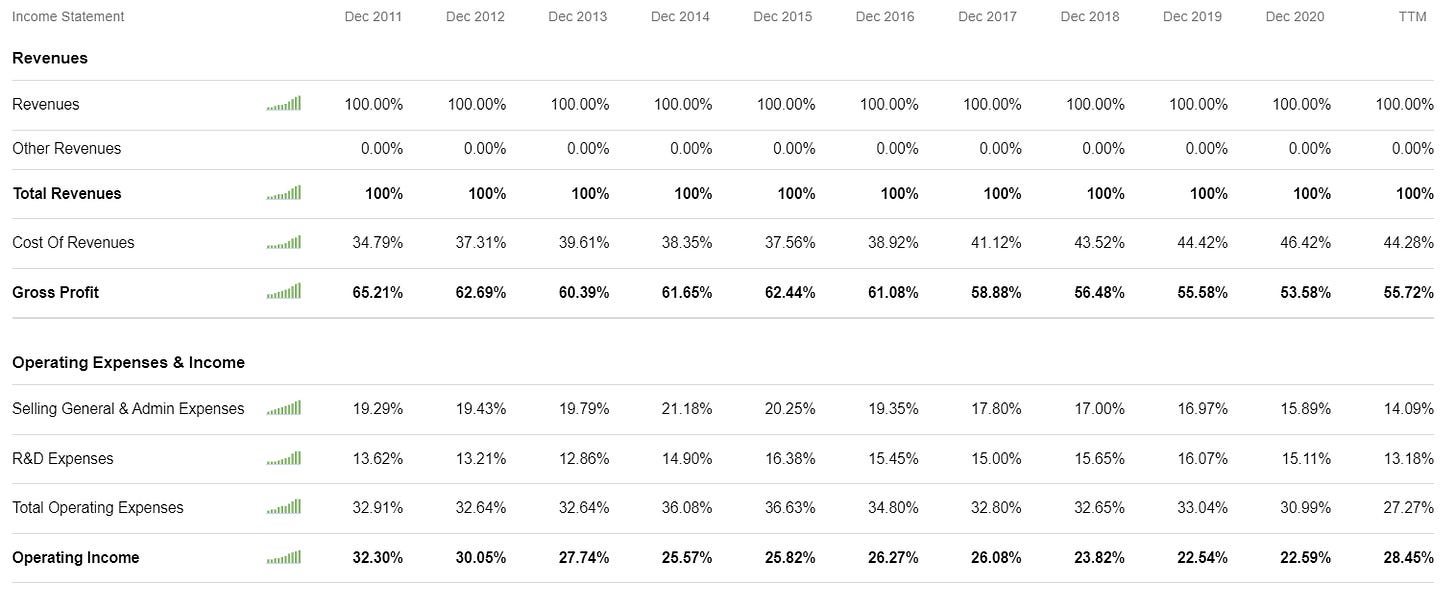

In terms of further dynamics that are worth keeping in mind, let it firstly be noticed that in the I/S $GOOG has 2 things going on:

A growing cost of revenues

A leaner OPEX profile

#1 is due to the fact that traffic is coming to Google from a growing range of devices. At the beginning of Google´s life, traffic was only coming from desktop and traffic acquisition was mostly organic. Now Google has to pay other market players to show up in their devices (such as Apple) and so this is driving up the cost of traffic acquisition. This is something to bear in mind going into the future, but in my opinion not a significant threat to the search business. A lot of the traffic acquisition cost is also related to $GOOG paying for content to exclusively distribute on Youtube, to kick start Youtube Shorts.

“Our total cost of revenues was $26.2 billion, up 41%, primarily driven by growth in TAC, which was $10.9 billion, up 63%, followed by growth in Other Cost of Revenues, which was $15.3 billion, up 29%, the largest driver of which was content acquisition costs.” - Sundar Pichai, CEO Alphabet & Google, on the Q2 2021 earnings call.

#2 I believe is very healthy, so long as it is not at the expense of R&D expenditure. In the long run, I much prefer a company with a tendency to control costs rather than let them run loose and so I like to see this.

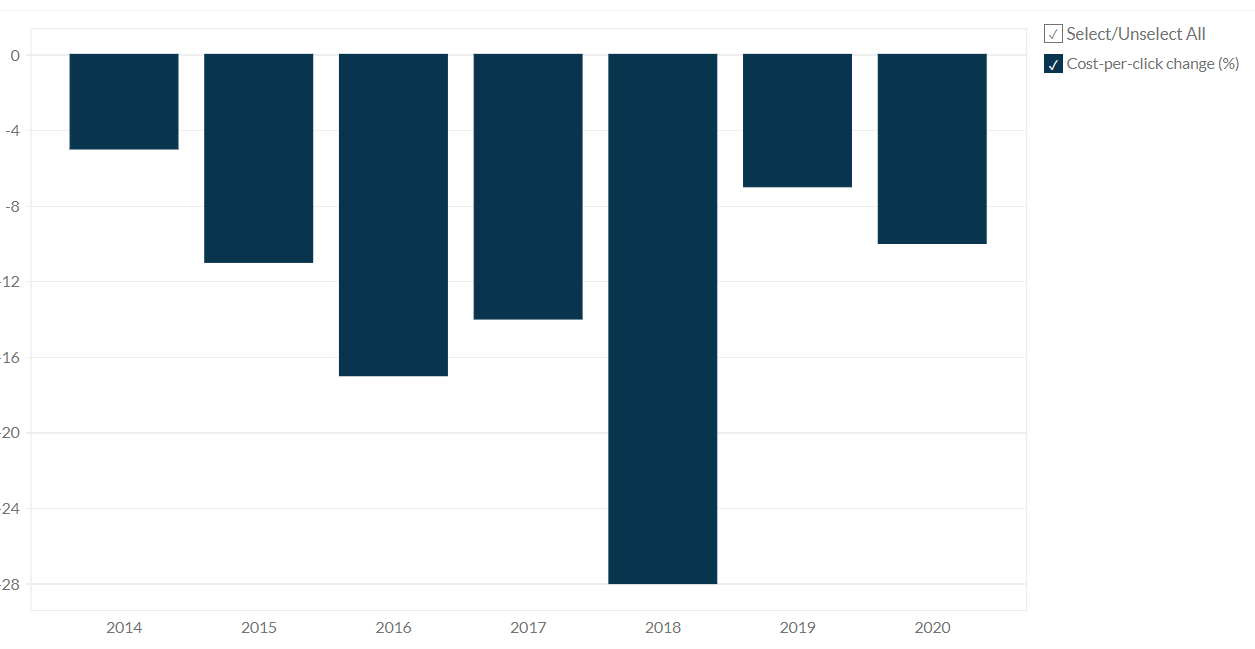

Further, cost per click is going down yearly. $GOOG makes its advertising money by charging advertisers every time a user clicks on an ad. Advertisers bid for their ad to show up. There is a number of ways to look at this:

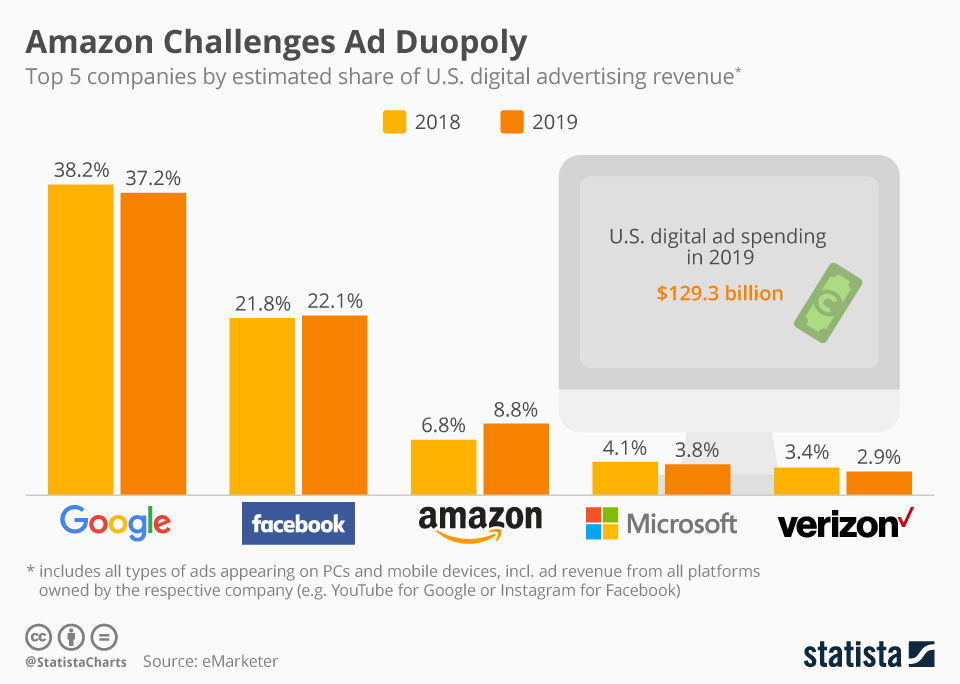

Ad dollars have a growing number of places to go to. In the ad business, Google competes with a broad arrange of players. The surface area here is growing yearly, whilst previously $GOOG essentially pioneered the space. In this context, a decrease in cost per click seems like a natural evolution in the industry. Regardless, you can see that $GOOG dominates the space.

$GOOG seems to point to the fact that this is because their automatic bidding system works well. This system does the bidding on behalf of the advertisers and in theory should optimize the customer´s spending. “These examples also underscore the value of AI and automation in a world that’s changing fast. We know today that more than 80% of our advertisers use automated bidding. Using ML, our ads products are more efficiently connecting businesses with their customers – taking the guesswork out of getting the right message, at the right time, to the right customers – all in a privacy-first way”.

Ultimately, all we know is that it is going down and that this is a dynamic to bear in mind. It is still early to discern really what is going, but so long as online advertising makes sense, it looks like Search and Youtube are going to continue being good businesses.

Risk Factors

At the moment, Google seems infallible to the world. I am very wary of companies held in such high regard. I am studying Web 3.0 daily to make sure I catch incoming technological disruptions.

Google is subject to plenty of regulatory scrutiny. I do not have enough experience on this matter to have an opinion on it.

Ad blocking technology may interfere with the advertising business.

The public´s sentiment regarding data harvesting could rapidly change to the very wary side of things, leaving $GOOG in a much tougher position to learn from search queries and therefore to continue improving its ad business, let alone build a world class AI.

Censorship on $GOOG´s behalf may lead to reputational issues.

Larry Page and Sergei Brin own 51.5% of the voting power, limiting the influence that stockholders have to influence corporate matters. They have not been bad custodians to date, however.

Valuation

So we basically have an advertising business with a largely dominant position, wrapped around in prime internet real estate. It has some dynamics that need to be watched, a number of experiments strapped to the side of it and a further 40% of the world´s population to work its way through. We are not done looking at the business, because some of the experiments it is working on I think will be quite relevant in the future. Nonetheless, understanding that most of the business comes from advertising and some adjacent very well moated services, we can address the valuation now, without getting caught up in excessively forward looking thoughts.

$GOOG´s revenue has recovered strongly from the pandemic and with it, the P/S multiple. Relative to $AMZN and $FB, it looks fairly valued. It´s current P/E ratio is below the current SPX P/E ratio of 34.02. At a P/E ratio of 29.79, with its income statement well into the maturity phase, it´s a more than prudent buy.

Most importantly, however, the business does not look overvalued on its own given its world class characteristics. $GOOG:

Has one of the strongest and if not, the strongest moat on earth.

Is critical infrastructure for the expansion of the internet and is very likely to continue growing along with it, as the remaining % of the population goes online and as engagement increases.

Despite the fact that the stock has risen considerably this year, looking out into the long term it looks to me like the stock has plenty of upside left, as online engagement continues to increase and the remainder of the population gets online. On top of this, I believe AI is going to at the very least further cement $GOOG´s moat and I believe we will see $GOOG suddenly dominating unexpected spaces in the future. Now, I will proceed to take a look at other more secondary business components, with a relatively small revenue today but nonetheless very interesting going forward.

Cloud and Other bets

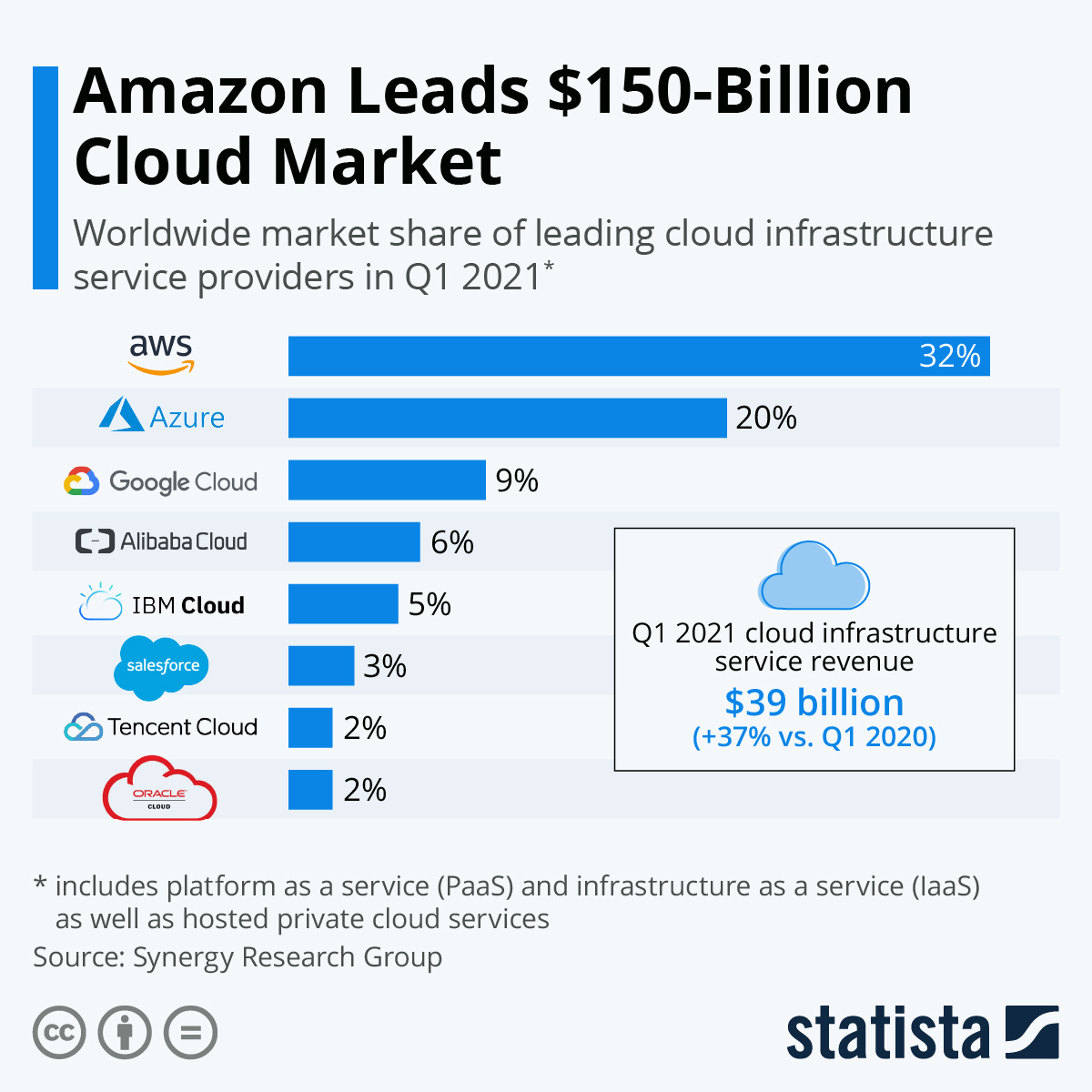

Cloud

Cloud is a very competitive space, but is likely to keep growing for a long time because it makes good business sense for enterprises to put their computing on the cloud. It is safer, cheaper and more flexible. I have used the Google Cloud platform to train deep learning models myself, along with AWS and Azure and they all seem quite similar. $GOOG is currently #3 in terms of market share. In terms of buying shares today, I would not buy for the cloud play alone, but I certainly don´t mind the potential upside at today´s prices.

As the internet continues to go deeper into our lives, I think businesses will continue putting their computing on the cloud and eventually, the cloud biz could turn out to be quite profitable for $GOOG.

Other Bets

When Google bought YouTube it didn’t seem like it was going to turn into one of the core components of its business. No matter how far fetched some of $GOOG’s other bets may seem, some may pay off. I find that the most interesting alternative bets actually build on top of $GOOG´s core competency which is dealing with information, or more specifically, neural networks. I also think that each of the bets I am going to go through below further advance $GOOG´s ability do deal with data and in turn, retro-feed each other. I find it fascinating to see how fast so many of our most relevant industries are becoming information games and it continues to surprise me how far ahead $GOOG is in this sense with respect to the rest of the world.

Deep Mind

The other bet that has caught my eye the most is Deep Mind, because it has the world´s top AI talent. AI is quite complex at its core and acquiring the right talent is hard for organizations. $GOOG, with its profitable ad business, has managed to shower in cash and retain more than 1000 world class AI experts. I like that I can get a share of Deep Mind under my belt by acquiring the core business at a fair price today. If Deep Mind does not strike as relevant, consider AlphaFold.

Living organisms are made of proteins, which in turn are made by passing a genomic sequence through a ribosome. Ribosomes are little machines found within our cells that read genomic sequences and translate them into proteins. When a genomic sequence passes through a ribosome, what actually comes out at the other end is a chain of aminoacids. Different parts of the aminoacid chain have different electromagnetic charges, which attract each other and so the chain ends up folding into itself, forming a particular shape. This particular shape is a protein. The shape gives a specific protein a specific function within an organism.

It follows that theoretically, we could predict what protein shape is going to emerge from what genomic sequence. Scientists have struggled to solve this problem for more than 50 years. Deep Mind has been able to solve it using a particular neural network model, known as AlphaFold and they have effectively mapped the human proteome to its corresponding genomic sequences.

This inverts the traditional pharma model. The function of proteins within the human body is all about the specific shape of a given protein, which in turn determines how it interacts with other proteins. To fix things in the body, we had to try different molecules with different shapes to obtain the desired results. Now, we can synthesize a protein of a specific shape directly, to fix whatever it is we need to fix. Deep Mind is sharing the results with the world for free.

The point here is that in its short life, Deep Mind has been able to solve one of the hardest questions in science. This I believe is a taste of things to come, in terms of the impact $GOOG will have on the world with AI. It is not just the talent at Deep Mind, but the combination with $GOOG´s deep and wide dataset that is very promising. It is likely that we will see $GOOG continue to make notable advancements in the industries that it sets its sights on.

Calico

Calico is trying to figure out how we can extend our life spans. It is interesting because not only do the most promising up and coming technology platforms (AI, genomics / proteomics, blockchain) rely on semiconductors, but they also rely on each other in some cases. As it refers to Calico, in order to figure out the biology they need to figure out to make us live longer, they need AI, which Google is incidentally getting very good at. For instance, why does a squirrel live for 20 years, whilst a rat lives 2 years, when they are quite similar animals? In effect, what Calico would to answer this question is map the genomes of the two species to emergent biological properties, in order to pin down the differences at the genome / proteome level explain this difference in lifespan. To process all that information, you need neural networks or similar technologies.

This is actually something I am quite bullish on, since I understand that complexity in the universe stems from very simple rules. This makes me feel like eventually we are going to find a number of simple and elegant switches at the genomic level that are going to extend our life spans. The name of the game is information and if someone is good at dealing with it, that´s $GOOG.

Further, fixing aging necessarily implies bringing longitudinal medicine to the world, because there is no other way to test whether the anti-aging treatments work or not. Longitudinal medicine per se has the potential to switch the healthcare system from being reactive to being preventive, which would enhance life quality on Earth significantly. Longitudinal medicine is about picking up data from patients through time and obtaining insights from that data, to enhance healthcare by maximizing chances of preventing illness to present itself in the firsts place. Today´s healthcare is mostly reactive to symptoms and data is only collected sporadically, when patients already present some form of malaise. Calico can do a lot for healthcare by just focusing on fixing aging.

Waymo

Again, the underlying technology that enables driverless cars is deep learning (neural networks). To get a car to drive on its own, you “simply” fit it with neural networks that learn to predict what a human would do on the road. To date, “Waymo’s autonomous driving technology has driven over 20 million miles on real-world roads since 2009”. Whilst it seems that the idea of driverless cars has gone through somewhat of a disillusionment trough, it is again having a fundamental understanding of the underlying technology and how the universe works that makes me feel we are going to see driverless cars happen at some point in the not so distant future. Driving is just processing information and moving atoms around accordingly. Neural networks are at their infancy and if we already have some degree of autonomy in cars, it seems almost inevitable that this is just the beginning.

Summary

I have not developed the kind of conviction that I feel in my bones on $GOOG as of yet. Having dived deep into a company, it usually takes me some time to figure out whether it is something I want to get involved with and to what degree. However, it looks to me like if there is a common sense long term investment opportunity out there today, $GOOG is very likely to be it. It has a long way to go, is very healthy financially speaking, is very moated, it trades at a fair price and it has a number of cheap implicit call options on two big trends, which are Cloud and AI.

To add some final wild thoughts, I am beginning to get the feeling that humanity is on the post-capitalism launch pad already and that $GOOG is going to do a lot of the thrusting. As we digitize everything, we are exponentially enhancing our ability to unlock new beneficial atom configurations and we are going to reach a point where we can do so at a very low and if not negligeable cost. $GOOG is really far ahead in this direction and I would not be surprised to see a world in 50-60 years time in which we only have companies that are uniquely focused on dealing with information, $GOOG being one of them. Whilst these speculations materialize or not, today $GOOG presents quite a compelling investment case.

If you enjoyed this article, remember to subscribe for free to my newsletter for more!

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Do you think that Google Search Moat could be deccreased by the AI Agent? (Reducing Ad spaces, Time Spent, etc)

Excellent walk through Antonio - You are really good a looking at the big picture and make sense of it to the reader!

I also see their foresight of buying Youtube as a good indication of their ability to think ahead. Imagine how cool it is that you can livestream a feed of SpaceX sending satellites into space. It so awesome and feels like science fiction tbh.

Im long in Google for the reasons mentioned above but also because of their stake in SpaceX which is yet another call option with potentially unlimited upside given monopoly in space flight! that's the kicker for me.

You mention their biggest strength is the moats but I also see this as their greatest threat as this could easily lead to public/regulatory scrutiny. Likewise in regards to their data harvesting/data handling – take Facebook as an example. Reputational risk is ever so present

How I look at it is they seem to keep hiring staff even though software should be close to zero marginal cost. It is almost as if they a intentionally bloating, in order to no be too profitable.

And nowadays it seems that antimonopoly is put in the background for national strategic concerns vis-a-vis China. I think that's Google's luck.

In sum, I see their business model as exceptional well and in fact that is their greatest weakness.