Amyris remains a binary play, with exponential upside. Having framed the investment as a venture capital bet, I judge management and its execution differently. In essence, the company operates at the frontier of science, but the (public) market wants it to execute quarterly in a highly predictable and linear manner. These two are not compatible and this is not confined to Amyris, but to innovation across the board to varying extents.

A year ago, investors were making overly optimistic bets and today they are making overly pessimistic bets. Whoever attempted to pierce through the veil one year ago was labelled as a doomsayer and today, whoever does not mindlessly participate in the bearishness is labeled as a fool. However, as every instance in human history, the middle way is the way and innovation, regardless of the cost of capital, is the future.

A rising (for now) cost of capital takes a big toll on companies and so any company with a weak balance sheet is now potential cannon fodder. This unfortunately includes Amyris, that ended Q3 with just $25M in cash and $822M in debt. The company is burning through cash very fast and this has put it into a critical situation. On the other hand, all the relevant qualitatives are pointing in the right direction, with the company getting better every quarter at bringing clean and sustainable molecules to the world.

This begs the question, what is good management in this context? The market demands to be appeased, but we see managers in the tech space like Mark Zuckerberg, Daniel Ek and others sticking their middle finger to it. They prioritize long term value creation over short term satisfaction and as an investor, this is what you want. Melo is burning through cash very quickly, which is not desirable, but Amyris is vertically integrating by the quarter and revenue is growing very fast.

As long as Melo does not bankrupt the company, which he may, I say let him continue. Per my view of the world, I think that the demand for sustainable molecules will continue to tow the company forward and that it will be able to fund itself by selling molecule rights. 40 years ago this was indeed the case with chip designers and manufacturers, but it was not obvious at the time and today´s situation with molecules is more than reminiscent of the early chip days. Things can go wrong, but I did not initiate this position to mitigate risk, but to win big. The bet is still on.

What I look for in this company, on a quarterly basis, are signs of:

Continued exponential top line growth.

Continued efficiency gains, via vertical integration.

1.0 Top Line Growth

Revenue continues to grow fast and Amyris seems to have found a way to optimize its marketing spend, which is vital going forward.

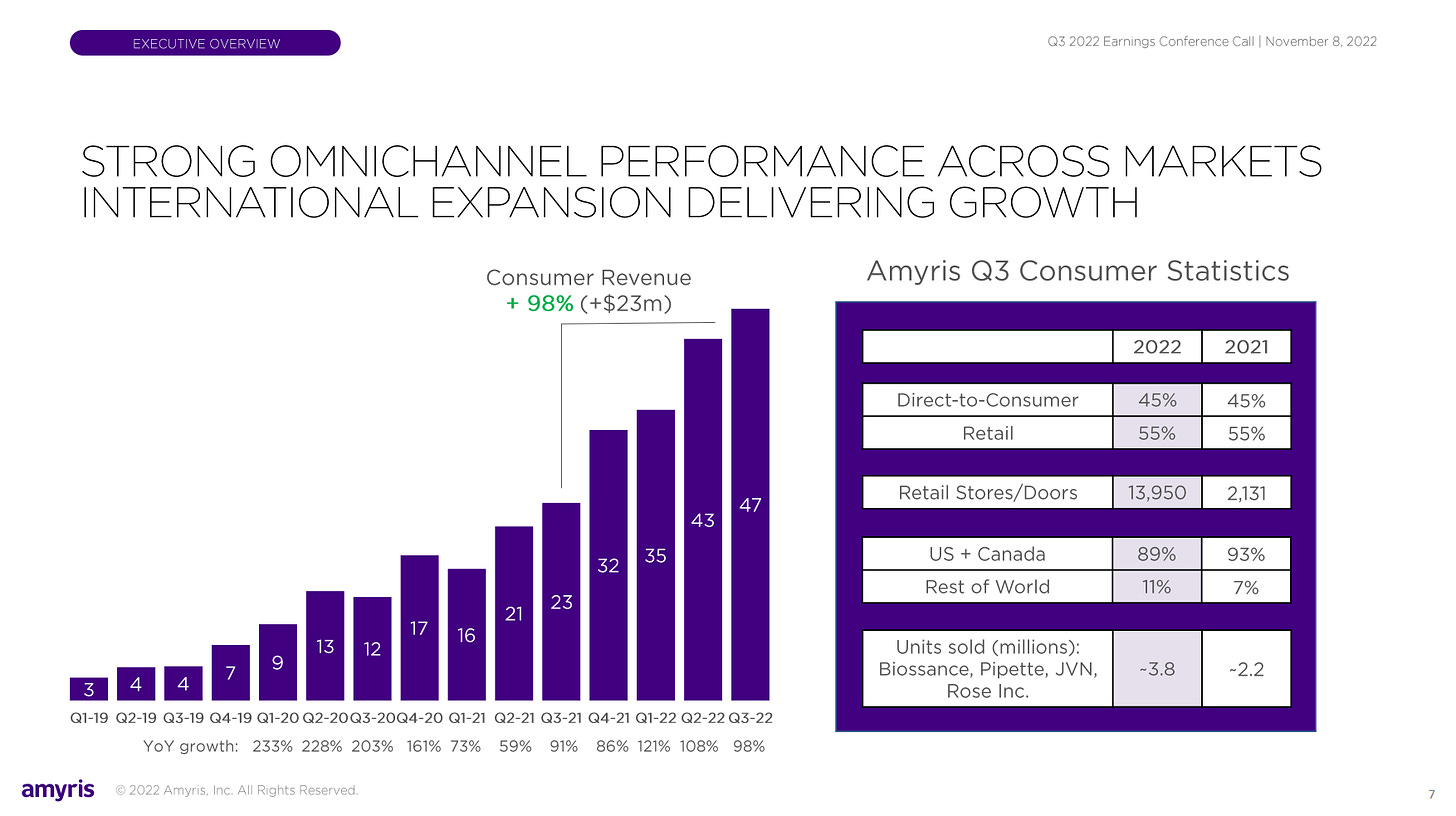

Revenue continues to grow very fast, with the company´s proprietary brands showing particular signs of strength. Thus far, the growth on the consumer side is a mix of paid marketing and organic pull, but qualitatively it seems like the brands continue to gain real traction in the market. What I am picking up across the board, however, is that the demand for sustainable molecules is getting hotter every quarter.

“Costa Brazil, JVN and Rose Inc. are all up more than 300% for the year-to-date. And Biossance continues to be the best growing brand in clean sustainable skin care powered by science. Biossance is also our first brand to exceed $100 million in revenue in a single year.” - John Melo, CEO @ Q3 2022 ER

“Demand for several of our brands is higher than anticipated, and we are prioritizing spend and investment to ensure we meet retail channel needs while also delivering on our cost savings initiatives.”

“Our ingredients demand has continued to outpace our capacity. We continue to sell all that we can produce and have a backlog of orders that are shipping in the fourth quarter.” - John Melo, CEO @ Q3 2022 ER

Below the top line, my main take is that the company is spending a lot of cash on dealing with supply chain inefficiencies and on growing the brands. The company now claims to be pivoting towards profitability, which will allegedly have it spend less on advertising and double down on the brands with efficient unit economics. This may make the top line look less attractive soon and would be another hard blow to stomach as things potentially get tighter in the coming quarters.

“We are focused on ensuring that our growth is profitable and making our company financially sustainable and attractive. We have a clear path to operating profitably. Our goal is to deliver 10% operating income on an estimated $200 million of revenue in the fourth quarter of 2023.” - John Melo, CEO @ Q3 2022 ER

Still, a more attractive bottom line can smooth things and to get there, the company has to vertically integrate completely (get rid of excess raw material and shipping costs etc, next section) and brands have to at some point continue growing organically, without much advertising spend. About the latter, it is interesting to see marketing expense coming down sequentially, as revenue continues to grow. Management claims this is due to the company leveraging “nano and micro influencers” (MG Empower) via some data science.

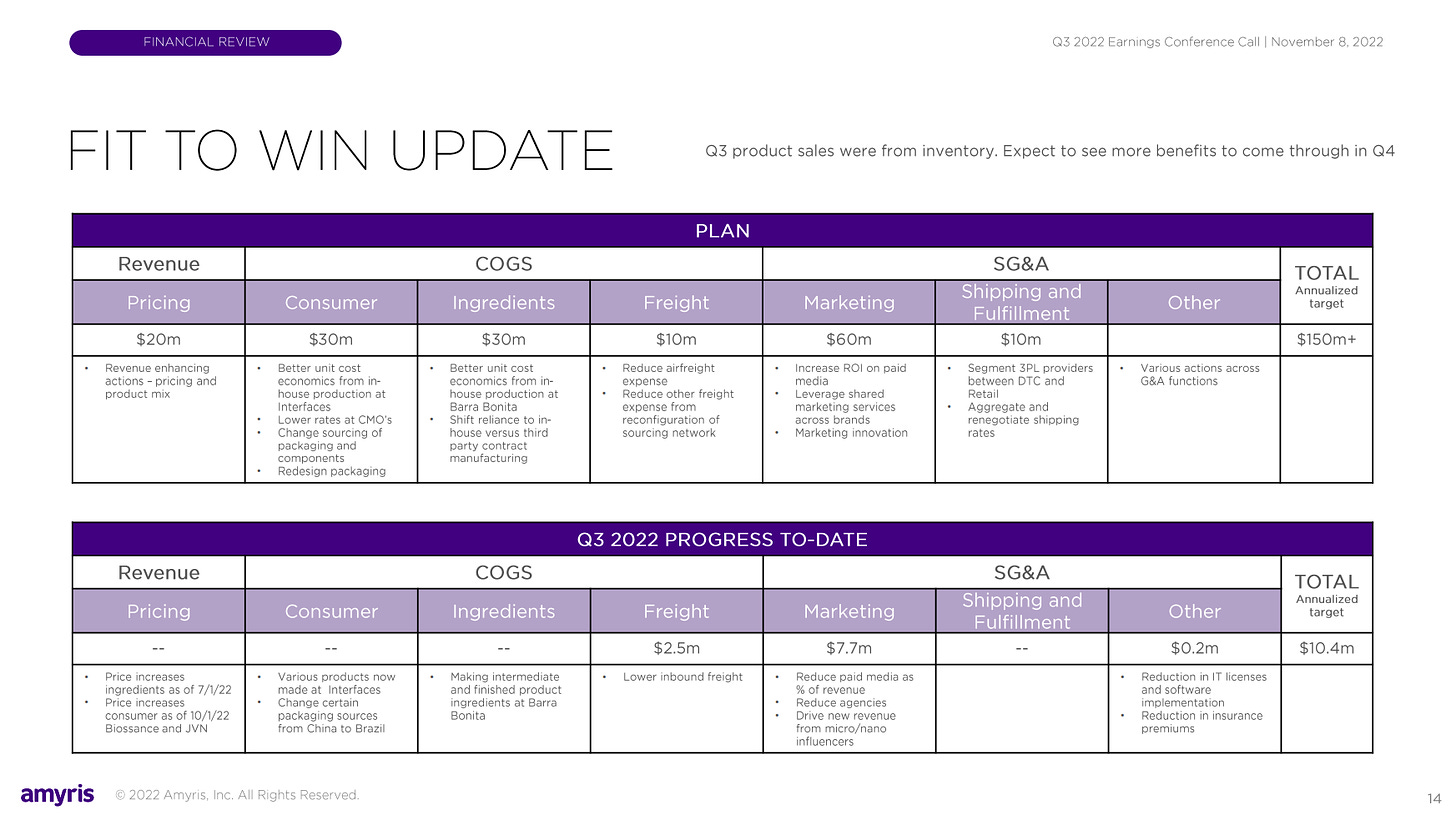

This reduction in marketing expense is actually part of the “Fit to Win” agenda, which I will discuss further in the next section, but over Q3 ´22 the company has saved up $7.7M in marketing with its new strategy. I would say that this is a great step forward which may enable the company to continue growing the top line in an increasingly lean manner going forward. This suggests the company is capable of innovating across the board too, which is a very powerful trait that I have pointed out previously in other aspects of the operation:

“So the idea of using technology to scan and find the right nano and micro influencer and then providing some reward to that nano and micro influencer, so they come and promote our brand has actually been a game changer for us in the economics of acquiring customers.” John Melo, CEO @ Q3 2022 ER

2.0 Vertical Integration and Margin Expansion (Fit to Win)

Amyris continues to vertically integrate successfully, with its Fit to Win agenda showing up in the numbers for the first time.

Assuming that the top line remains healthy and needs less and less marketing spend to keep it so going forward, which will be challenging, the number 2 concern is expanding margins. Amyris until very recently was making its molecules and turning them into salable products by scrapping together a complex network of third party providers, geographically interspersed enough for rising transport consts to wreak havoc in the company´s financials. This is changing as the company moves towards making its own molecules at Barra Bonita and packaging and shipping products at its other facilities.

Last quarter we got an insight from Eduardo Alvarez on just how much better Barra Bonita is than any other syn bio manufacturing plant on the planet, with the cost of producing farnesene being two-thirds less than otherwise, for example. In the Q3 ´22 ER we learned that Barra Bonita is now producing 5 molecules out of a total of 13 molecules that Amyris has in its portfolio. So, Barra Bonita is maybe at 40% of its loading process? The point being, the deployment of the plant is advancing well but it has some way to go to show in the numbers.

Much like I see the demand for molecules heating up into a secular, multi-decade run, I see Amyris increasingly as a successful optimization machine. As an organization, it has the capacity to set goals and iterate its way towards achievement. On top of its ability to get better at synthesizing and picking the right molecules that I have written about many times now, it seems to be able to extend this attribute to anything. The marketing efficiency gains described in the previous section are one such example, but we also see some further instances this quarter. The company seems to be executing very well on its Fit to Win agenda:

“We did more local sourcing, particularly on paper. We also started to leverage our production facility in in Brazil, where we did see a very material cost difference in the production cost compared to what we had done in contract manufacturing in the US.

And then the final thing that we did implement in the third quarter was a much more efficient pick, pack, and ship the back end, the outgoing portion of our supply chain where we really move to just a better model in terms of footprint, more nodes and also a far better productivity in terms of the level of automation that we had in the direct-to-consumer channel for consumers. So Korinne all told, I think we see very, very strong confidence in the Fit to Win initiatives against the cost of goods sold for our consumer business.” - Eduardo Alvarez, COO @ Q3 2022 ER

“… just on pick, pack and ship, which is a new supplier and model that Eduardo and his team implemented for our D2C business, that is about a 30% reduction in the unit.” - John Melo, CEO @ Q3 2022 ER

3.0 Conclusion

The balance sheet is wrecked, but the company is advancing very well too. Q3 burdens us with the task of holding two radically opposed ideas at once.

Whilst the balance sheet is looking dire, the company is actually executing quite well. I would obviously prefer management to be more conservative with cash spend, but I have serious doubts about whether this would be optimal at this stage. It is absolutely vital for them right now to get Barra Bonita 100% operational and for brands to achieve critical mass as soon as possible. Whilst cash is important for the company to survive, I would argue that the BB and brands are a priority right now and definitely far less fungible than cash.

Barra Bonita is a quantum leap in terms of manufacturing efficiency and this changes the dynamics of the business. Amyris is now able to isolate fermentation tanks and get the job done at hoc for third parties in a way that it was not previously able to. The consumer brands are a much better business, but I think that the market underestimates Amyris´current ability to monetize molecule rights.

“So instead of having take the facility down [Barra Bonita] and start all over for the whole facility focused on one molecule, we actually have multiple molecules running at the same time and the ability to isolate individual tanks to run individual molecules. And that's how we're able to do five molecules in a quarter, which has never been done before in our company, right?” - John Melo, CEO @ Q3 2022 ER

Melo said during the call that the $350M molecule rights transaction is pending board approval from both parties and that it should be closed by early December. Whilst he is losing credibility if judged by the standard public market lens, I think it will happen. Consumers worldwide clearly default to sustainable products when given the chance at a competitive price and Amyris is so much better today at satisfying that need than it was just 6 months ago. I believe this dynamic will prevail.

Also, I am starting to clearly see my original Amyris thesis play out in terms of the fundamentals, but in a dichotomous manner. The balance sheet is currently wrecked, but the company has considerably optimized its operations since I first wrote about it and is now positioned to potentially generate cash at some point in the coming years. The top line is growing and costs are beginning to be reigned in, with the company incessantly iterating its way through these two key components of my thesis.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Do you think they could just buy amyris I mean they did it with zymergen and amyris marketcap is 500m which is less than what ginko looses in a quarter?

And you always mention that amyris is like 10 years ahead but I feel that could change soon once a company is so desperate for money work becomes unplesant and if you have a competetor with better conditions things can change quickly.

Thanks for the article :)