This is an update to my original Amyris deep dive, Q1 2022 ER digest. Below, you can find the format of this post and as always, feel free to skip to any section of your interest.

1.0 Thesis Recap and Digest Summary

2.0 Top Line Growth and Sephora Dependency

3.0 Vertical Integration and Operational Optimization [[most relevant]]

4.0 Framing a Green Bottom Line

5.0 David Beckham and Other Personal Brands

6.0 Financials

7.0 Conclusion

1.0 Thesis Recap and Digest Summary

Amyris is pointing at a future in which we make scarce things abundant and cheap, by leveraging biology’s superlative ability to put atoms together and make useful things. The opportunity ahead in this sense is as large as the internet. The company is uniquely positioned to bring this superpower to the world for two reasons :

It has the science.

It has the manufacturing prowess to operate the science at scale and actually make things that it can sell with a margin in the marketplace, unlike other companies in the space.

I see AMRS 0.00%↑ as a venture capital play in the public markets. It is a risky pick and I do not think of it in conventional terms. On a quarterly basis, I look for two things:

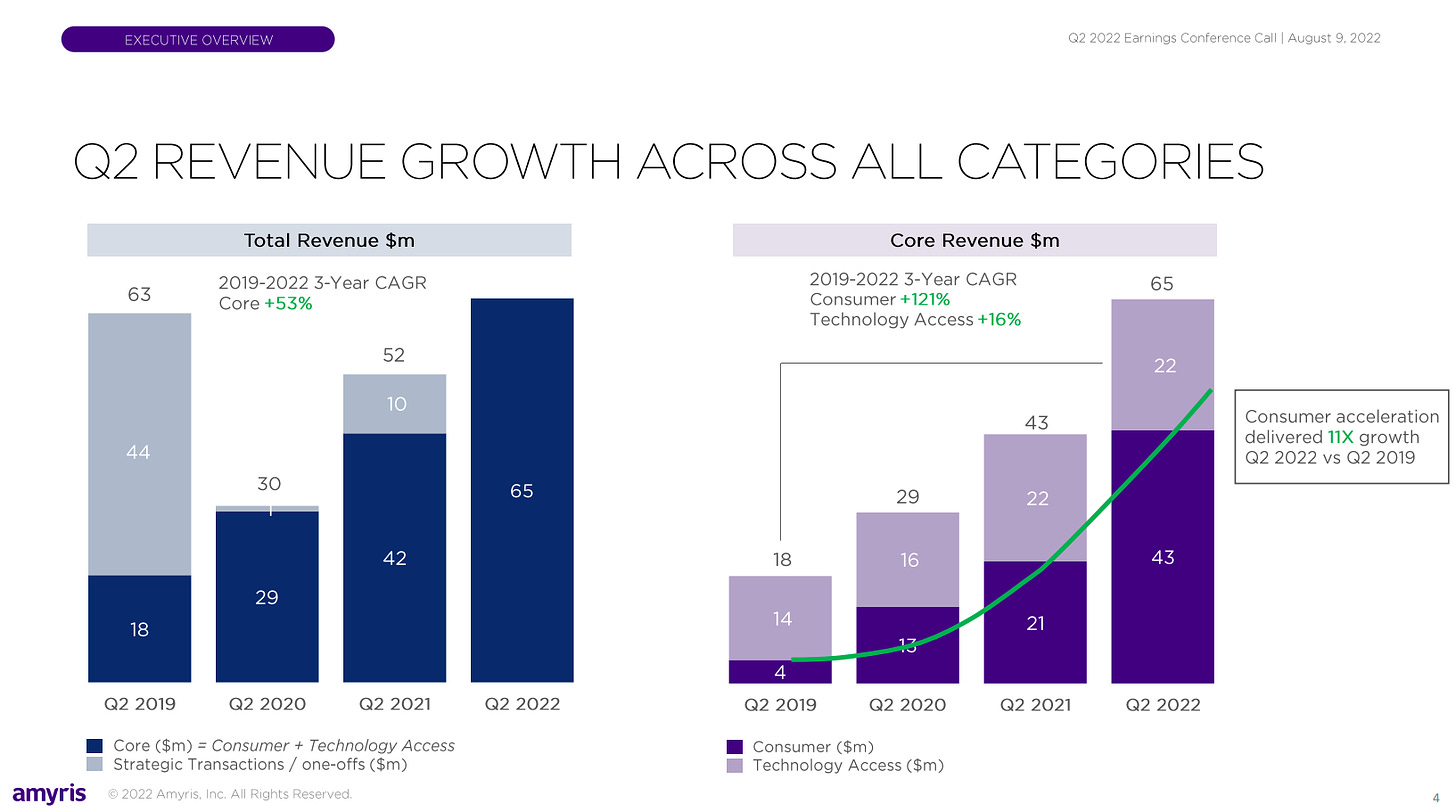

Continued exponential growth of its top line, fundamentally driven by the world transitioning towards sustainability.

Gradual vertical integration and operational optimization, to bring costs under control and get the bottom line to turn green.

So long as these two metrics progress adequately, the company will do fine. In Q2 2022, I see continued exponential top line growth and notably, very big steps forward in terms of bringing costs under control.

The company is also low on cash (with plenty of visibility on a range of non-dilutive cash sources, according to management), so the risk of permanent loss of capital remains higher than in other picks of mine, with strong balance sheets.

The situation remains as I outlined it initially in my deep dive: I can lose 100% of my money on Amyris, but I can also make 100-1000X over the decade/s.

2.0 Top Line Growth, Sephora Dependency and the Lipstick Effect

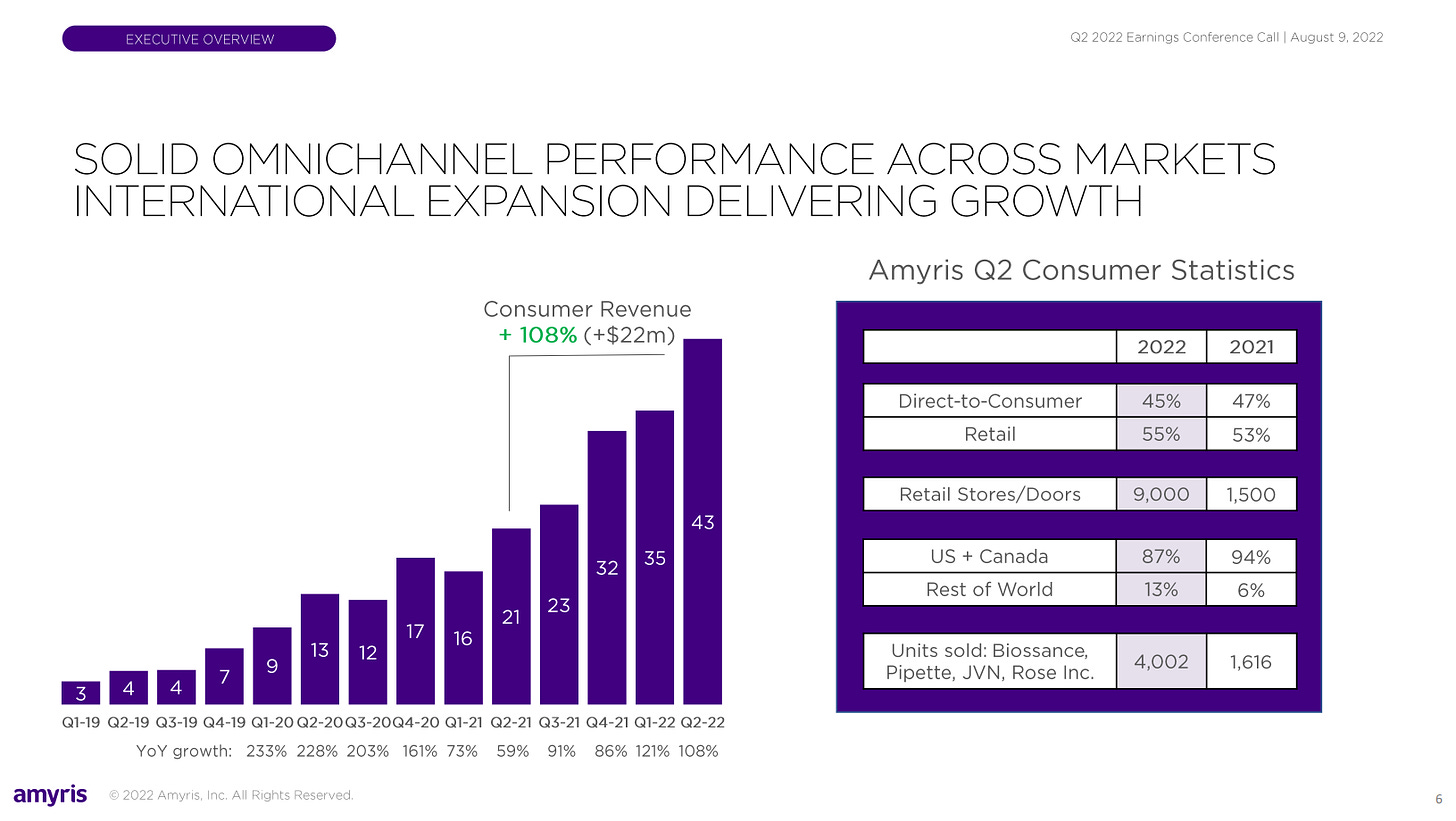

Sales continue to grow satisfactorily, driven by a strong product-market fit. Amyris continues to bring sustainably produced molecules to market and brands and consumers continue to want them. Management claims that the growth is mostly organic:

“We have now completed 14 consecutive quarters of revenue growth with our consumer business, principally from organic growth.” - CFO, Han Kieftenbeld Q2 2022 ER

Simultaneously, the company is ramping up its Consumer S&M spend, so we have not yet come out of the woods in terms of unit economics, but I fundamentally believe that the demand for sustainable molecules is in its infancy. As sustainability becomes an increasing concern for end consumers, they will be increasingly responsive to brands that serve them in this sense and at good prices.

Throughout the call, management says time and time again that the company is selling all it can produce. I believe this is just a taster of what we will see in 10 years, when sustainability will be the norm:

“We've got a backlog of hemisqualane that I've never seen in my life because when we launched Jonathan Veness, just about everybody brand that mattered and every hair care brand that matter started inquiring with us about how they could access hemisqualane.”

“Our core molecule farnesene is a great example. We have not had the farnesene to support our major customers.” - CEO, John Melo Q2 2022

In terms of sales channels, I celebrate that the largest one is the company´s D2C infrastructure, which enables a good level of control. On the other hand, the company´s second biggest distribution channel is Sephora, which on the one hand is great news but on the other presents a relatively large dependency and hence vulnerability, which management says yields around 50% of D2C customers:

“Consumers discover new brands at Sephora and then they build a long-term relationship with the brand assuming the product works.”

“As a matter of fact, a little factoid that we don't talk about much, about half of our direct-to-consumer traffic is our customers who discover the brand ads, the four to begin with. We see our channel structure expanding and we see Walmart becoming a third leg, our DTC Sephora, and Walmart.” - CEO, John Melo

I personally have no insight into how Sephora functions, but I know for sure that too high a dependence on one particular outlet will eventually lead to choking of some kind. The third leg must grow fast and other legs should be added soon too, because for now bringing costs under control with an exponential top line is a luxurious situation, but it can turn sour fast.

“We now have Pipette in over 4,000 Walmart stores. We are expanding rapidly in Walmart with Purecane, and we'll launch 4U by TMRE later this year.” - CEO, John Melo

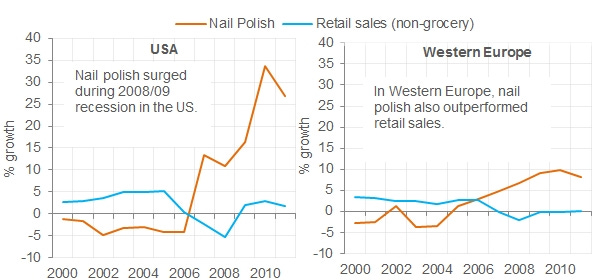

To finalize this section, I would like to comment on the lipstick effect, which sees consumers continue to spend on beauty through economically harsh times, because it seems that people continue to want to look good. So far, it seems to be coming into play (if we assume there is indeed to belt tightening on the consumer side):

“….based on its shelf and with its consumers, however, when it comes to beauty and personal care, they're [Walmart] not seeing that slowdown.”

3.0 Vertical Integration and Operational Optimization

In this quarter, I have seen the first clear signs of Amyris being an optimization machine and this is perhaps the most relevant takeaway. If you have been reading me for a while, you know that this is what I look for most in a company, because a company has to constantly minimize inputs and maximize outputs to produce shareholder returns (read this part of my TSLA 0.00%↑ deep dive to understand).

According to Alvarez (COO) and Melo:

The new Barra Bonita plant is seeing much lower energy costs than other proprietary facilities.

The cost of producing farnesene is now two-thirds less.

The cost reduction seen in farnesene is representative across the molecule portfolio.

The quotes, from the ER CC:

“We are seeing material improvements in the productivity and the scale of the plant. We see a lot lower energy costs than we have seen in our other facilities.”

“Farnesene alone, the cost of farnesene out of Barra Bonita is two-thirds less than what our cost of farnesene has been the first half of the year.” - CEO, Melo

“And that percent is not uncommon. I think that's a very material and very significant and representative change across the portfolio.” - COO, Alvarez

This actually merits some further context. The companies in the rest of the synthetic biology space have not synthesized one molecule at scale yet and Amyris is already pushing forward with optimizations. The company was 10 years ahead before Barra Bonita and now I think it is on an accelerated path towards building a process moat that will set it apart for, potentially, another decade.

A process moat is one that stems from a long, tedious process that culminates in thousands of value added components that conform a strong barrier of entry. This is how Toyota penetrated the US auto market - arguably the most competitive on Earth. Toyota enabled US competitors to examine its factories, but they were not able to replicate its processes. In this sense, a process moat is perhaps the most elusive kind to define or spot, but perhaps the strongest.

The plant´s utilization rate is currently in the “upper 70s%”, which is quite an achievement despite its very recent launch. What I am trying to convey here, is that Amyris (Alvarez, specifically) seems to have what it takes to turn Amyris into an epic success story. If this pace of optimization continues, the company will get very efficient and shareholders will probably be happy.

4.0 Framing a Green Bottom Line

Since I first wrote about Amyris, every conversation pivots to when the company will become profitable. Perhaps the data point that gives the most visibility on the matter is the following (revealed during the Q2 CC):

Packaging, picking and shipping represents the majority of COGS.

Ingredients is less than 1/3 of COGS.

So, in essence, the company does not have to go through some sort of scientific and operational odyssey to then perhaps achieve net profitability, because 2/3 of COGS is very much a “low hanging fruit”. Regardless, they seem to be advancing very well on both fronts and specially so on the ingredients side (which is the hard one), as outlined in the previous section.

“Just in packaging for the Biossance brand, which is our biggest revenue generator, we are in the process of implementing a change that will take out 30% to 40% of packaging costs.”

The tone in this call was one of moving on to capture returns on the investments that the company has been making recently (which mostly concern COGS for ingredients / consumer and shipping + fulfillment). Management seems confident that now they can now bring costs under control generating a positive impact on EBITDA of ~$50M for H2 and ~$170m for FY2023:

These goals, if achieved, imply some level of operational synergies between brands (marketing synergies, fulfillment), which was actually the main concern I laid out about the company in my deep dive. Amyris is actually a complex business: it is a research lab, a manufacturing company and a brand developer/operator. Today it is operating 8 brands and increasingly operating them as one is a requisite for success.

These improvements do not get the job done fully, but the direction the company is heading in is certainly a good one. As they continue to optimize costs and as the demand for sustainable molecules in the $4T chemicals industry goes from niche to mainstream, we have a good chance of seeing green numbers. On this matter, management said the following:

“This business is expected to deliver $250 million in 2022 revenue. Based on our current performance and quarterly growth rate, we expect to deliver core revenue of around $250 million in the fourth quarter of 2023 or think of it as $1 billion in annualized revenue run rate by the fourth quarter of 2023.

We expect this core revenue to operate with a gross margin in the 60% range, a more than 10% improvement versus 2022. This includes our core cost initiatives and current portfolio and channel mix. At this level of revenue, we would expect around a 20% operating profit margin in 2023, increasing to around 30% operating margin by the end of 2024.” - CEO, John Melo

Of course, there is no guarantee that such a demand will exist some years down the line or that the company will succeed in its optimizations, but the odds are very much in favor of this being the case. In 5-10 years time, people will likely continue to increasingly prefer sustainably sourced everything, Amyris will likely be way ahead of the competition in terms of actually making things and they will probably be much better at it than today.

5.0 David Beckham and Other Personal Brands

“…we have just completed an agreement with David Beckham to develop a leading men's clean skin, hair and wellness brand. David is a great addition to our current portfolio with over 75 million Instagram followers globally and a real passion for sustainability. We expect to have this brand in the market at the end of 2023.” - CEO, John Melo

It is quite formidable on its own that Amyris is driving most (75%) of its consumer growth with home-grown brands. You do not just start a brand and make it grow like that - this is something quite special and suggests that there is quite a bit of talent inside the company.

In the same manner, signing on David Beckham is further indicative of excellent business development, but also of the company´s unique selling point. Beckham is a legendary soccer player and a huge brand, whilst Amyris is unknown to the world. The combination of Beckham´s name with Amyris´ sustainable products can be explosive and other lofty personal brands will take note.

Everyone wants to leverage sustainability, but only Amyris can make it happen.

6.0 Financials

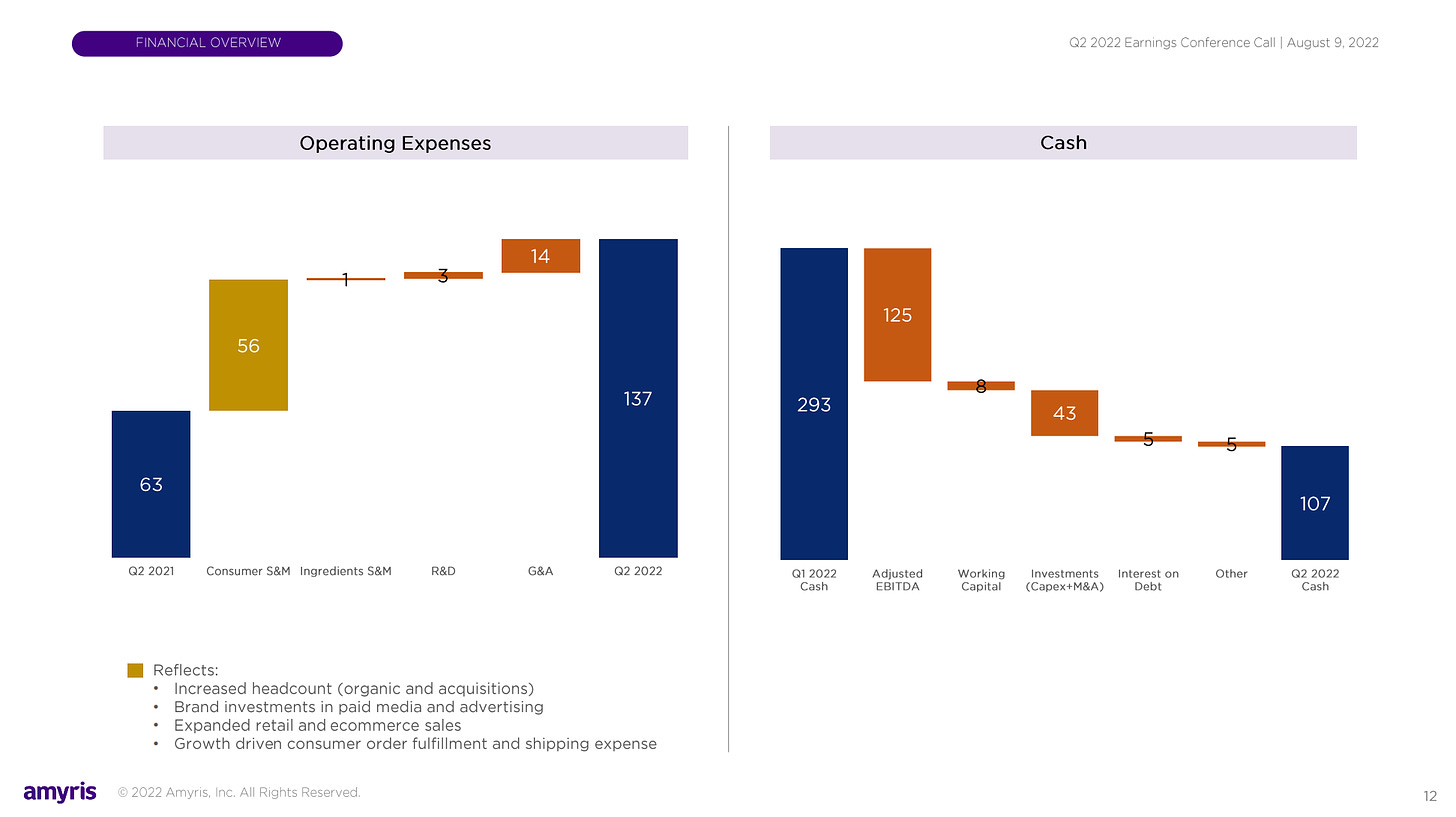

The main concern here again is cash. The company is spending it very fast, although for good reasons:

“[Cash] usage is up, principally due to investments in brand marketing of both new and existing brands. Additionally, we deployed significant cash for the construction of Barra Bonita. This was $33 million in the quarter that we self-funded.

We used $186 million, of which $125 million was related to EBITDA. We funded inventory for consumer goods, both in terms of packaging and finished material which was partly offset by a decrease in ingredients inventory and increased payables. “

Management claims to have visibility on $700M of non-equity funding and they all sound quite credible - but that is all. These sources of funding may work out or they may not (remember, venture capital), which is the major source of risk for the investment today. They are the following:

$250m of term loan financing.

$350m from selling rights of two molecules.

$230 million in earn- outs from the strategic transactions completed in Q1 and Q2 of last year.

Most notably, in the Q&A section management reveals that they also count with some key shareholder financing in case it all goes wrong (John Doerr, probably).

7.0 Conclusion

This remains a high risk, high reward situation. If the company manages to bring costs under control and keep its top line exponential, (given the current undervaluation) the pay off will be quite large. Per the way the company has succesfully deployed Barra Bonita, I would say the odds are very much on.

I look forward to tracking the company´s operations over the coming quarters. Hopefully we do see the outlined cost reductions and we continue to see Alvarez and the team do some magic on the operational side.

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Thanks for your work Antonio, very much appreciated!

Thanks for writing. This is a good, balanced case for AMRS.