Note: this is an update to my Amyris deep dive. Below, you can find the format of this post and as always, feel free to skip to any section of your interest.

1.0 Market Commentary and Long Thesis Recap

2.0 The Results

2.1 Explosive Top Line Revenue Growth

2.2 Vertical Integration and Financials

2.3 MG Empower and Influencers

3.0 Framing the Investment

1.0 Market Commentary and Long Thesis Recap

During yesterday´s session and following Q1 earnings, $AMRS stock was down more than 30%. A spectacular move which begs the question, is there something seriously wrong with the company?

Before we look at the results, a quick recap on the company´s bull case. The $3.4T chemicals market is based on cost effectively putting molecules together to produce useful end products that organizations and people are willing to pay for. Amyris makes these molecules through biology, which in its maturity enables a cheaper and more sustainable production of the latter than via traditional means.

What makes Amyris valuable is:

Its ability to make these molecules through biology (figuring out what genetic code to insert into what cell, to obtain the desired product).

Being able to do so at scale, when no one else in the industry is close.

As I wrote in my last quarterly take, as Amyris vertically integrates, it should see costs come down and eventually (years down the line), we may see a profitable business emerge. Through time Amyris can become very valuable, as it continues to leverage the power of biology to take on industries beyond chemicals and eventually synthesize more than just molecules.

In my view, one of the things that has brought the share price down over the last decade is management´s inability to correctly forecast the business. Still, as I have been saying since I started covering Amyris, this business operates in outer edge of science, so it is kind of hard to merge that with the quarterly Wall Street circus. The point is, the correct way to look at Amyris is with a venture capitalist hat on. What I look for in Amyris on quarterly basis is:

Continued top line revenue growth

Gradual signs of vertical integration / costs coming under control

Financials staying out of the danger zone

When I first wrote about Amyris, the share price was at about 4$ and I highlighted what seemed to be an arbitrage situation, in that you could buy the company for less than the sum of its parts. I also entertained the idea of the stock dropping to current levels, given the difficulty of the task ahead and the friction between pushing science forward and pleasing analysts. The question is, does it really make sense to average down here?

2.0 The Results

All in all, my take is that whilst revenue growth is evolving very well, costs and cash burn seem to be out of control this quarter.

In the rest of section two, I will be exploring what I believe are the two most important aspects of the business: top line growth and vertical integration. i have done my best to analyze the company objectively - muting out both the price action and the bias that I naturally have, being long the company.

If you notice a bias somewhere, please feel more than free to call me out.

2.1 Explosive Top Line Revenue Growth

Consumer is growing exponentially and technology access seems to be turning into a reliable cash source.

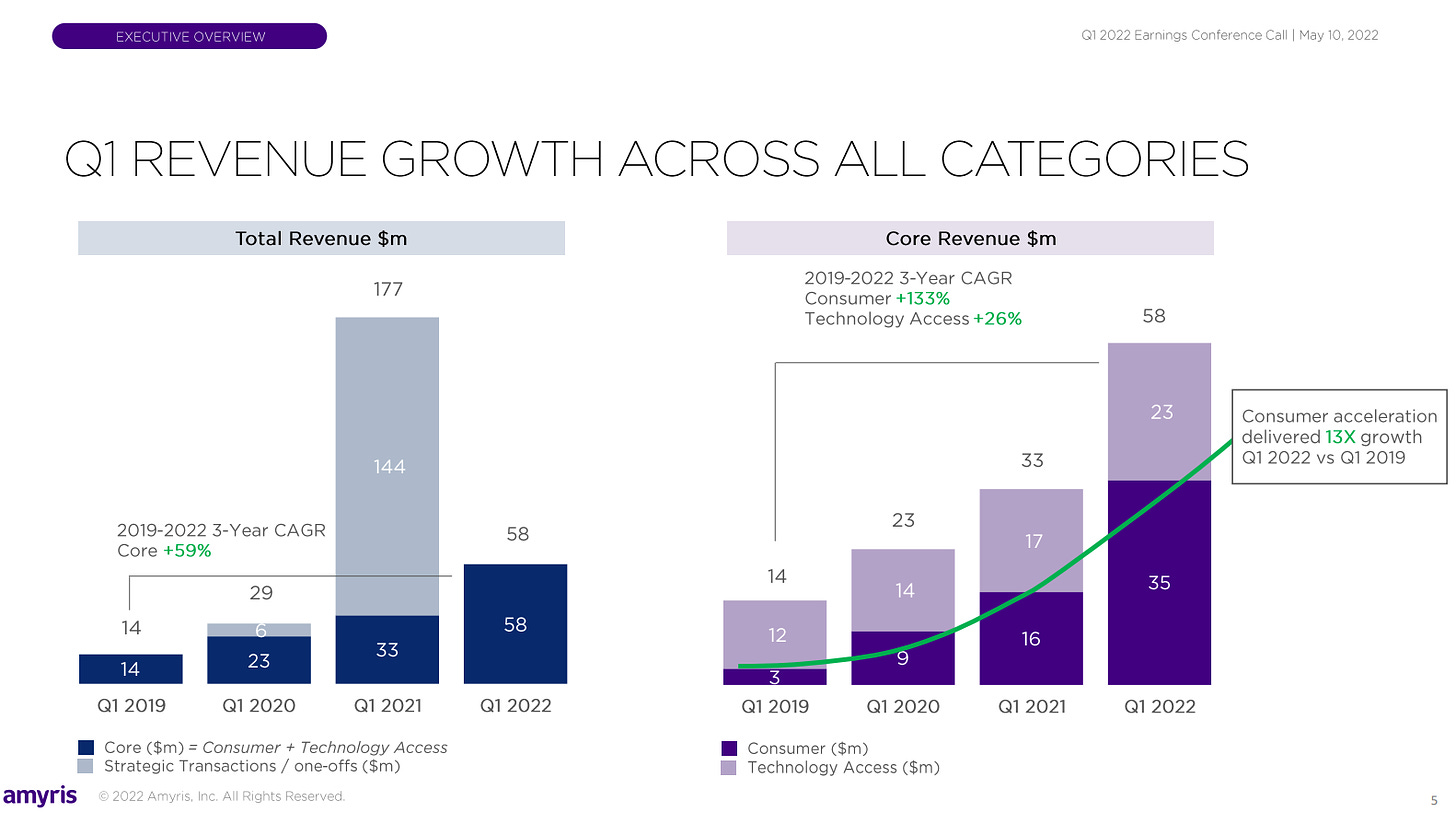

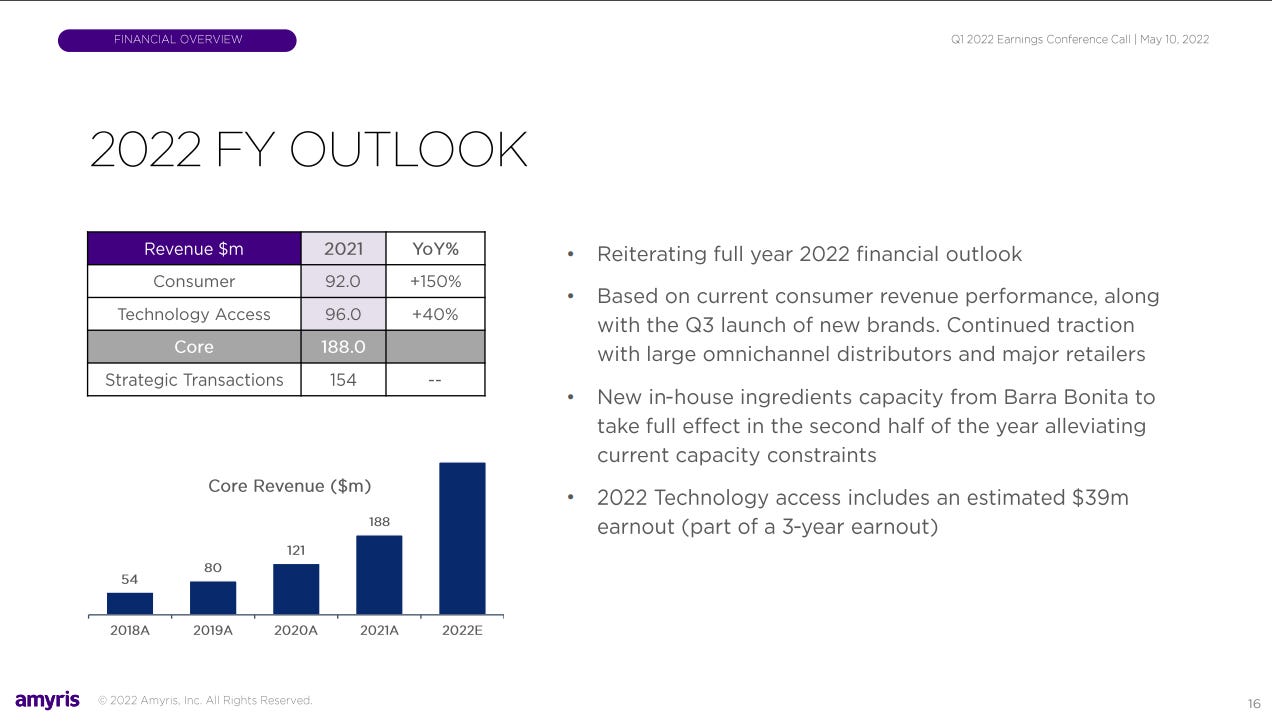

Top line growth continues to grow well, as evidenced by the graph below. We see consumer (proprietary brands) and technology access (ingredients / molecules sold to other companies) growing exponentially. Core revenue (which excludes strategic one-off transactions, like the one we saw in Q1 2021) is up 75% YoY.

The company is now operating 10 brands versus 3 a year ago and the information in the call suggests we will see even more growth going forward. Amyris is now developing “an across-category brand of sustainable beauty and wellness products for Walmart. This brand is expected to ship to Walmart in the fourth quarter.”

In general, it seems that the company is going to meaningfully expand its retail footprint, bringing its D2C to retail footprint ratio closer to 50:50, from 57% of sales via D2C today. Apparently sales in the beauty sector are bouncing back after the pandemic too:

“And I can tell you that what we are seeing across the beauty retail footprint is significant retail traffic more than any of us expected. So first point is there is a very robust consumer right now buying beauty. But when you look at history, especially in times of uncertainty, or in times of war, what we have seen is that the beauty market actually thrives.”

Listening to the call and reading the transcript in detail, I get the feeling that management is really seeing the ingredients business pick up and will be a source of cash going forward. In fact, Melo said the following:

“And you know, we have a significant portfolio of molecules to continue doing this for the foreseeable future and this is how we expect to self fund. I didn't say it explicitly, but I just want to repeat where we are capitalizing on shift to sustainable ingredients".

As I mentioned, last year they close a $144m one-off ingredients transaction and this year they expect to be closing another one of $250m. I am not sure if I am managing to convey this well enough, but I get the feeling that management has gotten quite comfortable with this part of the business as a form of cash:

“So I think the model for us is just to ensure that we develop, we scale, in these particular molecules, they are molecules that we have really complete control over. So if you think about a model to maximize value is keep control yourself that is what we have done. Ensure that the molecules have good market traction and number three, ensure that the molecules are such that the only way to make these molecules and support the end markets is through our technology.”

As consumers are gradually shifting over to more sustainable products, the companies that serve these customers are forced to default to Amyris for the principal components (molecules). I can sense this not just by management´s words but by the way they talk about it.

Another datapoint about this topic is how long it takes for Amyris to achieve a certain market share in a given ingredient - they have gradually figured out how to be much quicker. For Squalane, it took them quite long. For Vitamin E,, it took the, 36 months to achieve a 25% market share. In the case of Vanillin, it has taken them 24 months to become the leading supplier of natural vanillin in the world.

“So it varies quite a bit and a lot of it is around, how fast the market can switch, how close our profile is to the current material. And then the economic advantage our advantage, the economics are of our supply versus the alternative. When you get all three of those right, like in vanillin or like in Vitamin E, the market shift is significant and fast.”

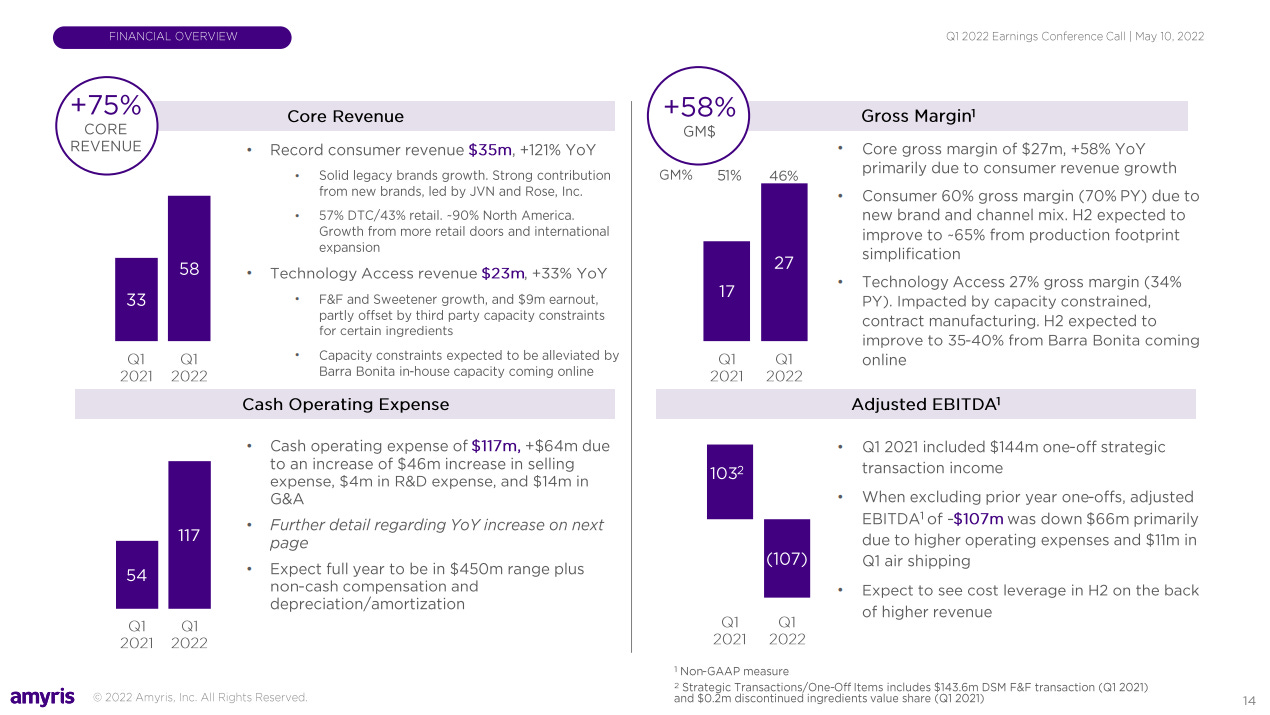

Naturally, the consumer business is much better. Consumer gross margin and technology access (ingredients) gross margin were 60% and 27% respectively, but so long as ingredients keep enough cash coming in then the company can continue executing towards its long term vision. I think they have this under control. It also helps that commodity prices are rising, putting Amyris´s ingredients further above break even.

“And in Vitamin E, we have had a lot of help because of the crude oil prices, right. I think I have disclosed in prior calls, we are breakeven with crude oil at $30 as $50, were advantaged. So you can imagine that $100 crude, the advantage in actually using farnesene to make Vitamin E versus crude oil to make isophytol.”

All inventory was shipped during the quarter and demand exceeded supply by $7m (across consumer and ingredients). The demand dynamics are looking very healthy and Amyris currently does not look like a business that is struggling to liquidate inventory. The fact that customers are now gravitating towards sustainable solutions together with Amyris being a strong supplier in this realm, means the company enjoys some robust demand - both in ingredients and consumer.

Lastly, it seems that Immunity Bio has already started the trials with its Amyris powered COVID vaccine. If that works out, it will be another noteworthy source of cash.

2.2 Vertical Integration and Financials

The company has burned through a lot of cash this quarter and this is concerning. On the other hand, Amyris continues to execute well towards vertical integration and remains a decade ahead of the competition.

What is concerning about this quarter is that costs have gone through the roof. It has always been the case that Amyris´key challenge was to vertically integrate and bring costs down enough to yield a profitable business. This was the big ? in my thesis since the start, but in Q1, opex increased notably by $63.5M QoQ. As a result, EBITDA is down big time too (note that the EBITDA from Q1 2021 includes the on-off deal).

In a market like this, this news has obviously not delighted the jury. The company is left with $288m in the balance sheet, when it has burned $195m cash this quarter. At this rate, the company is bankrupt by Q2.

People expenses are related to increased headcount (now operating 10 brands, versus 3 last year). Non people expenses include ”a brand investment in paid media and advertising, growth-driven consumer order fulfillment and shipping expense, and the pre commissioning activity at Barra Bonita”. Air freight has also taken a toll.

So, unpacking this quarter´s incremental expenses, Melo said that they do not expect to repeat $60-70m of Q1´s opex and that $20-30m of it is due to supply chain issues. Whichever way you look at it, the situation looks dangerous. Top line growth is doing great, but we still do not have any tangible evidence of the company being able to control costs. We do have a number of relatively telling datapoints, nonetheless.

Firstly, this is not Amyris´first rodeo. The company has been inching along for a while now, living through numerous crises in the capital markets and the business is in the best shape it has been to date. It would be quite ironic for the company to go bankrupt now and, so long as the ingredients business moves forward, the management seems quite confident that they will not need external financing:

“We have no plans to do any future equity financing or financing of the company, mainly because of the robustness we have in the portfolio and the amount of demand we see today for ingredients that we have, that we can do marketing rights, just like we are doing with the two that we are actively working through right now.”

Secondly, the Barra Bonita plant is already up and running and commercial production will begin in the current quarter. A lot of the opex is due to supply chain issues and so this facility should help to solve a lot of that. Additionally, they acquired a new consumer production facility in Brazil this quarter, which is expected to be un full operation by the end of this year. Yes, the company has been using cash, but the key elements for vertical integration are being correctly deployed.

We now have some details on what kind of manufacturing capacity Amyris is expecting to have. According to management, “into the fourth quarter, we would expect about 70% to 80% of our consumer demands to be met by our own manufacturing capacity -the rest are unique components that they need to buy”. Whilst it is unclear just when Amyris will bring costs under control fully, I think this is an excellent step forward, specially considering that competitors are way way behind.

What I like even more is that Amyris not only continues to take giant steps versus the competition, but that the manufacturing capacity they are deploying is highly modular and iterable - relatively “easy” to evolve. See Melo´s comments on this topic:

“…the way the site's laid out, it is like building blocks. So every utility, everything from the air compressors to the water treatment to the power generation site is modular, where we can actually keep adding compressors. Keep adding units to add tanks and enable more. And we already are bringing in, I think, four 600,000 liter tanks, which are massive as a way to expand, manufacturing some of our bigger molecules that a year ago, I wasn't so keen on.”

If you have read my Tesla deep dive, you will see that I believe a large part of Tesla´s success is due to its ability to continuously optimize processes, which stems from its unique culture combined with its digital twin architecture (it´s a great learning exercise just to check it out). Amyris is very far away from that, but the fact that they are laying out the factory in this way is a good start. Another detailed that I really liked that I learned from Randy Baron on the phone last week is that the science department has a 5% employee churn - rather low.

Just to round off this section, I find it interesting that management is now guiding at what levels of SG&A find sufficient leverage to drive top line growth sustainably. According to Melo, second half annualized into next year, SG&A will be $450M. This seems to be the level at which the company can support its growth leaning on its platform, versus on external financing.

2.3 MG Empower and Influencers

The MG Empower move may not have been that silly after all.

In August 2021 Amyris bought MG Empower, a influencer marketing agency. The deal shocked the market and we have not heard much about it since. We have heard, however, about the evolution of two brands that point to why the move may have not been so awful.

Firstly, we have the case of JVN hair, which Amyris has built in partnership with Jonathan Van Ness - a famous influencer. The brand seems to be growing really fast per management´s comments:

“The JVN Haircare brand is performing much better than we expected. JVN is our most successful brands to date and is on target to reach profitability in 14-months or less since the start of commercial sales. JVN is also one of the lowest investment brands in our portfolio. Our investment in developing and launching JVN is about $2.7 million.”

So it cost them $2.7M to start up, but now they figure it is worth $400m? Either the numbers are fictitious or they really have a recipe for growth here. Another datapoint that seems to encourage this line of though is that, on the other hand, Terasana has not been doing as well for the following reasons:

“The brand's efficiency, in other words, the brand's ability to access new consumers and convert to purchase has not been good performance. In other words, it is taking us, it is taken us more investment than I would like to get the traction with the brand.

And we understand why. There is a couple of pieces in our playbook that we did not follow with that brand. We don't have a great launch partner. We didn't have a great retail channel lined up.”

In other words, they did not have a Jonathan Van Ness to get sales going quickly. For this reason, whilst we have not heard about MG Empower again, at least we can see that Melo is thinking relatively clearly. Influencers are a better way to drive sales than performance marketing (although per the company´s comment, it is also investing in that). Melo commented a bit more on this during the call:

“And if I think about, where's the highest return, the highest return is really, in using email, using affiliate marketing, doing direct selling sessions, and then focusing on what I would call social selling or social marketing, which is using micro-influencers to effectively reach their audiences”

3.0 Framing the Investment

When dealing with a venture that pushes the edge of science forward, quarterly estimates are a distraction. The share price is also irrelevant in the short term.

At this stage, it continues to be even more so the case that you can buy Amyris for less than the sum of its parts. You can look at this from many angles, but for instance during the call, Melo said that the JVN brand, per its current annualized run rate, is around $400m. It is in his own interest to say nice things of the sort, but looking at the company dispassionately it is becoming more apparent that, indeed, Amyris´proprietary brands are worth more than its mere ~$500M market cap.

Just to further comment on that, all the scientific and manufacturing value of the company is trading at a measly price. This science has the potential to bring material abundance to the world in the future and as a matter of fact, the rest of the synthetic biology space continues to struggle to deploy a fraction of Amyris´manufacturing capacity.

Still, the fact that the stock goes from around $4 to 1$ does not matter much. The company is now well embarked into a project of a binary nature: Amyris either brings syn bio to the world at scale or it will be no longer. In the same light, the earnings reports and the estimates are also irrelevant. The important thing is that the company continues to grow revenues and that eventually it bring costs under control.

During the call, management said that in 12-18 months they expect to deliver a 30% operating margin at scale. I do not mind if this happens in 36 months, for instance, so long as it happens. Whilst the company is somewhat walking the tight rope financially speaking, I think everything continues to advance favourable for the company to satisfy the bull case. You can lose 100% of your money on Amyris, but the potential upside is vast.

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Thank you for your insight. One quote that I think deserves to be questioned is the following:

"they are molecules that we have really complete control over. So if you think about a model to maximize value is keep control yourself that is what we have done."

Well that may be their intent, but I think they have not fully executed on that: viz the Lavvan lawsuit, which I gather could have been avoided entirely had Amyris had certain protections in place in the contract (pertaining to inability to deliver). It also sticks in my mind that there is another potential law suit waitingin the wings related to CBG. I forget what I heard about it, but I think another company is claiming ownership of the biosynthetic pathway.