Edited by Brian Birnbaum.

AMD management has pushed their chips into the middle for the next decade–pun intended.

I have been an AMD shareholder since 2014. Initially, what attracted me was their focus on parallelizing computation. In my recent deep dive on the company, I explained how the acquisition of Pensando and Xilinx set AMD up to become an AI giant over the next decade. AMD now wields the ability to infuse its product lineup with Xilinx´s FPGAs, providing deeply integrated synergies and the basis for an entirely new platform that will transcend the traditional C/GPU perimeter and bring AI to the world at scale.

ASICs are chips designed to carry out a specific computation, making them far more efficient than general C/GPUs. FPGAs are essentially ASICs that can reconfigure themselves on the go. Thus, an FPGA can turn into any ASIC to perform any specific task and outperform C/GPUs. For example, a CPU with an FPGA pegged to it can outperform a GPU when it comes to making an inference via an AI model.

The potential combinations are endless. The optionality fuses with AMD´s core enabling technology, Infinity Fabric, which allows it to seamlessly connect computing units. AMD gains a structural edge over its competitors as AI begins to saturate the economy. Still, I believe the situation remains quite cryptic in the eyes of the market. In the Q4 ER conference call, Lisa Su ratified my thesis:

“In addition, we are seeing substantial new revenue synergy opportunities as we combine Xilinx's industry-leading adaptive products and 6,000-plus customers with AMD's expanded breadth of compute products and scale.”

“Over the next several years, one of our largest growth opportunities is in AI, which is in the early stages of transforming virtually every industry service and product. We expect AI adoption will accelerate significantly over the coming years and are incredibly excited about leveraging our broad portfolio of CPUs, GPUs and adaptive accelerators in combination with our software expertise to deliver differentiated solutions that can address the full spectrum of AI needs in training and inference across cloud, edge and client.”

I also explained in my deep dive that the proliferation of east-west traffic in data centers has paved the way for DPUs (that AMD got its hands on via the Pensando acquisition). In turn, DPUs are paving the way for intelligence to move beyond the computation unit (C/GPU) and out into the data center and beyond. Together, with FPGAs fused into their product line up, AMD marches in the direction of generating and selling insights in addition to raw computation power.

I have been a Tesla shareholder since 2016. I am quite vigilant of their advances on the hardware side of computation. I have seen the company go in the same direction as AMD, aiming to leverage specialized chips. I do not seek validation of my AMD thesis for the decade ahead, since only time and the market can do that. However, seeing Tesla pursue this path is encouraging. During the Q4 call, Elon shed some light on the topic:

“[…] we think Dojo will be competitive with the NVIDIA H1 at the end of this year and then hopefully surpass it next year.”

“And we think probably -- we said this already actually at AI Day 2, so it's not new information, but we do see potential for an order of magnitude improvement relative to GPU, what GPUs can do for Dojo, which is obviously very specialized for AI training. It's hyper-specialized for AI training. It's not -- wouldn't be great for other things, but it should be extremely good for AI training. So just like if you do an ASIC or something, it's going to be better than a CPU.”

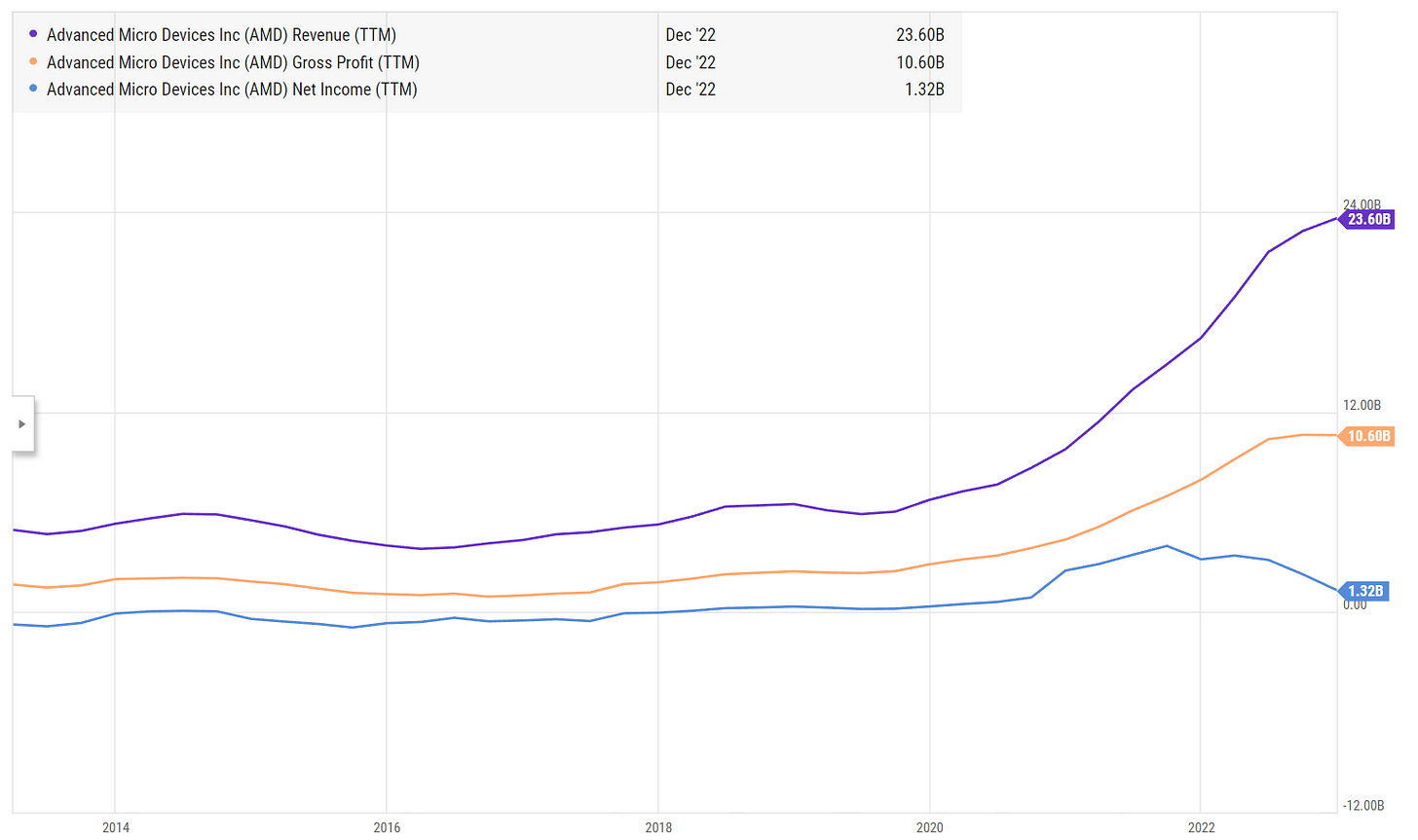

Regardless of whether the above materializes, the Xilinx acquisition has been accretive. AMD is a far more diversified company now than it was just a few years ago. Whilst the client and gaming segments have plummeted with consumers pulling back across the board, the embedded and data center segments “account for more than 50% of overall revenue.” They’re also helping to buoy the company, driving margins and growth:

Data center revenue grew 42% YoY to $1.7B, led by “increased adoption of our EPYC processors by cloud providers”.

Embedded revenue increased YoY to a record $1.4 billion. “We had record sales across a number of our embedded markets, including communications, automotive, industrial and healthcare, aerospace and defense”.

Combined AMD & Xilinx pro forma revenue was $24.1B, up 20% YoY.

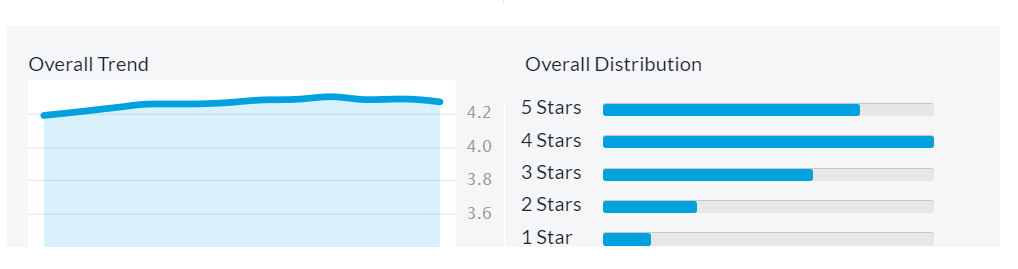

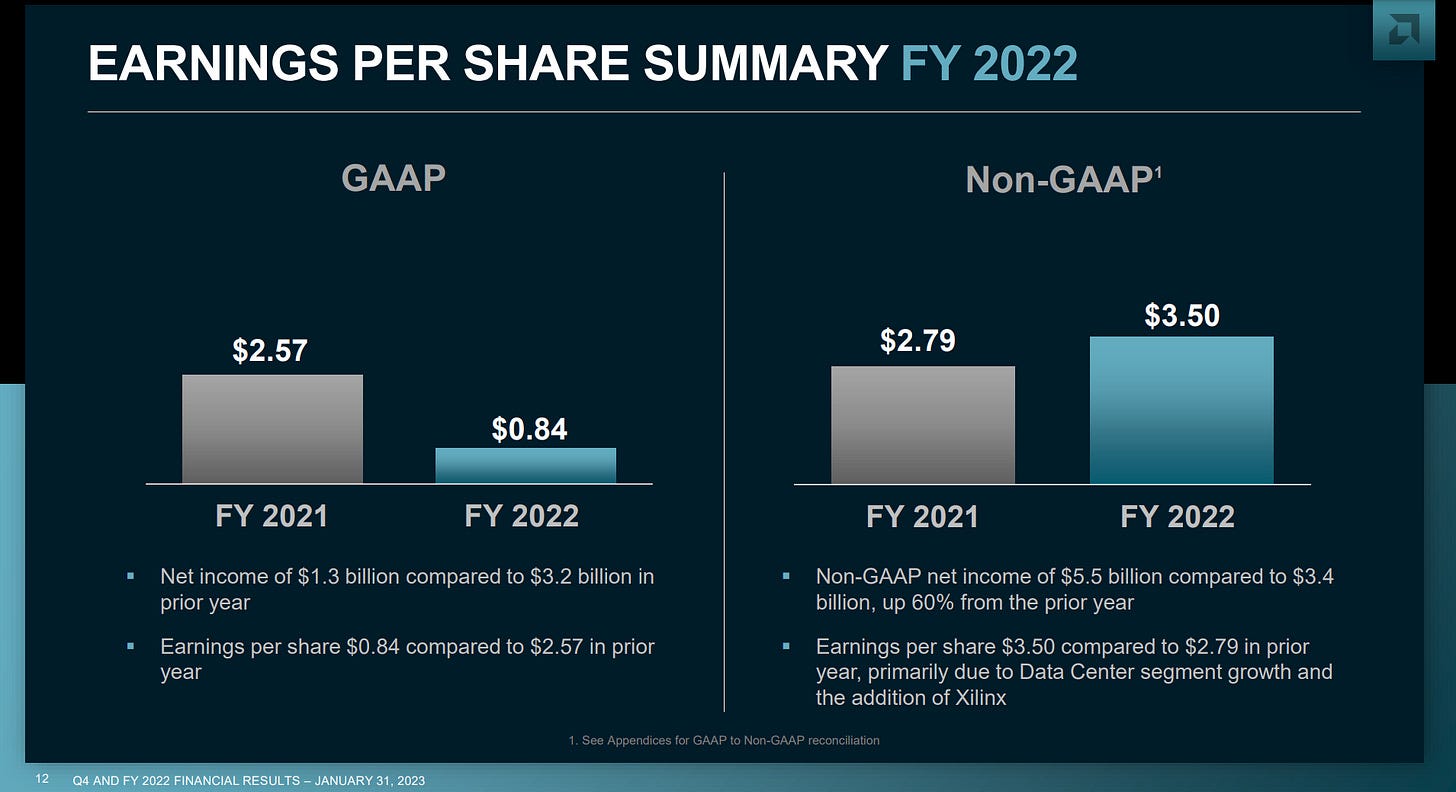

AMD is still actively amortizing the Xilinx acquisition and this is dampening GAAP metrics. The client and gaming segments are bringing down both GAAP and non-GAAP metrics QoQ. On the other hand, non-GAAP metrics (which exclude amortization costs) are progressing adequately YoY, and this is a more accurate depiction of the company’s financial health. Per the advancements on the product side, the integration seems to be progressing well. It is still very early days, however, and I need more time to assess the situation to make a more definitive judgment. Glassdoor reviews look stable, which is encouraging.

“Ryzen AI is powered by the highly scalable XDNA architecture, which is the first integration of AMD and Xilinx IP, less than a year after closing the acquisition.” - Lisa Su, CEO @ Q4 2022

$AMD Glassdoor reviews.

Management claims that some cloud customers have high inventory levels. Accordingly, they’re guiding for a weak H1 in FY2023. Management also believes that Q1 will be a bottom for the PC market. Thus the long-term thesis remains. Computation will continue transferring to the cloud at rapidly increasing rates. Consumers will eventually resume discretionary purchases as well, feeding into AMD’s retail sales.

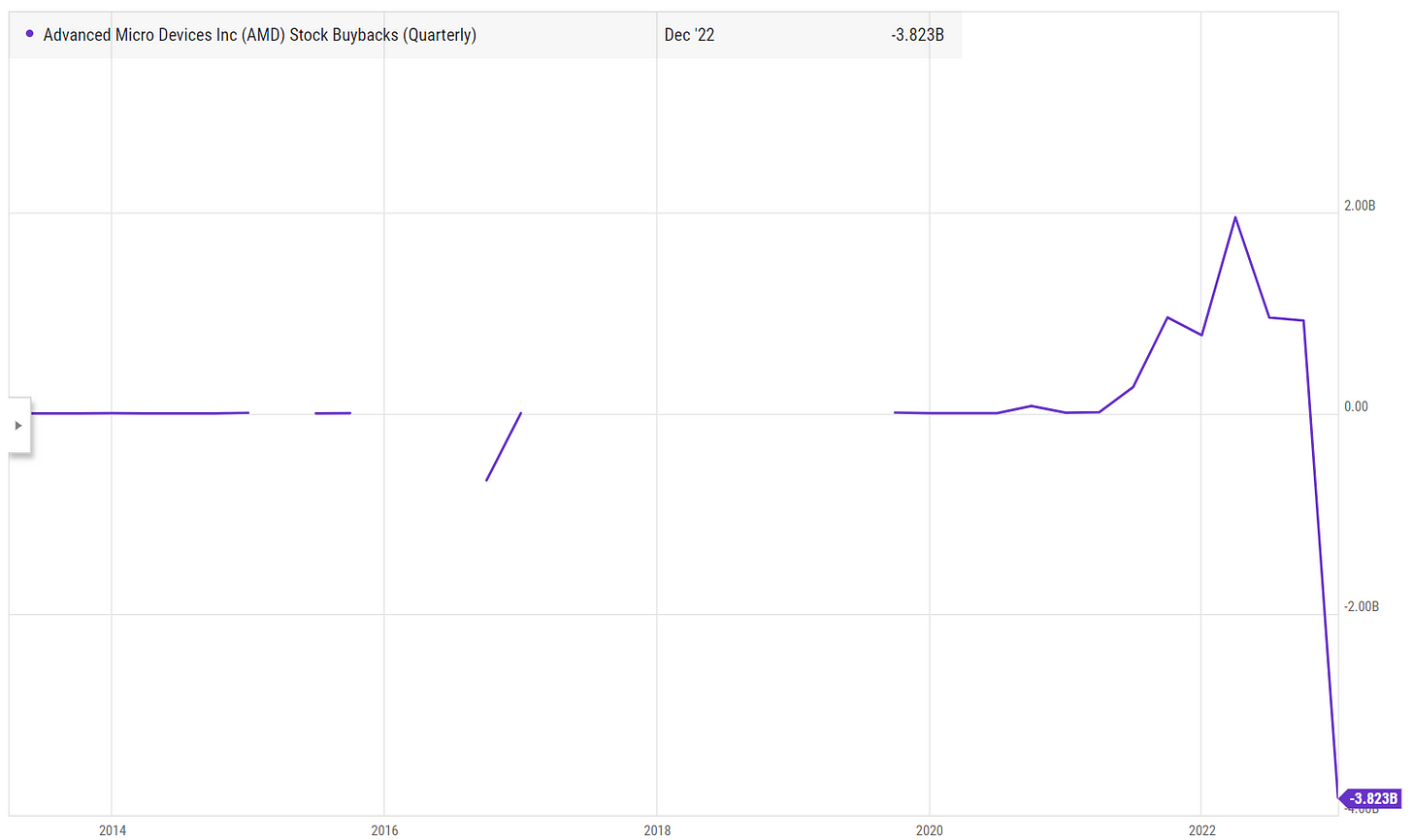

I also liked to see AMD buying back $3.7B in stock in Q4, the equivalent of 119% of FY2022 FCF. This will only reveal itself as an even better capital allocation with hindsight. The buyback also continues to signal management´s shareholder friendliness, which is essential to the long-term thesis.

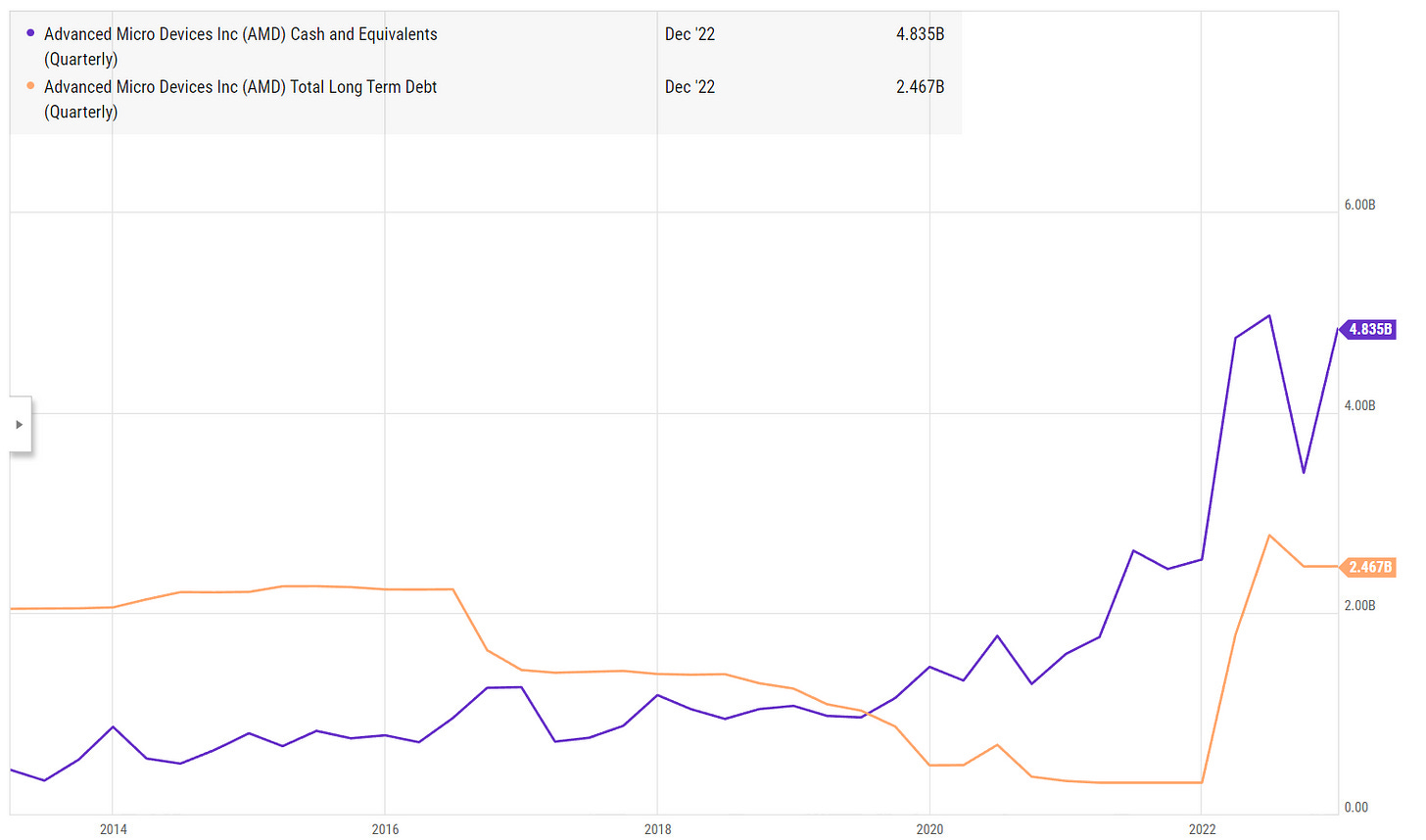

Despite the aggressive stock buybacks and unfavorable environment on the consumer side, AMD’s cash-flows and balance sheet remain healthy, the result of decisions that management made back in 2014, and in many cases even earlier. For AMD’s cash-flows and balance sheet to improve in 5-10 years’ time, the AMD+Xilinx+Pensando strategy has to work. This is why I spend so much time going over the qualitatives, trying to figure out what is really going on under the hood.

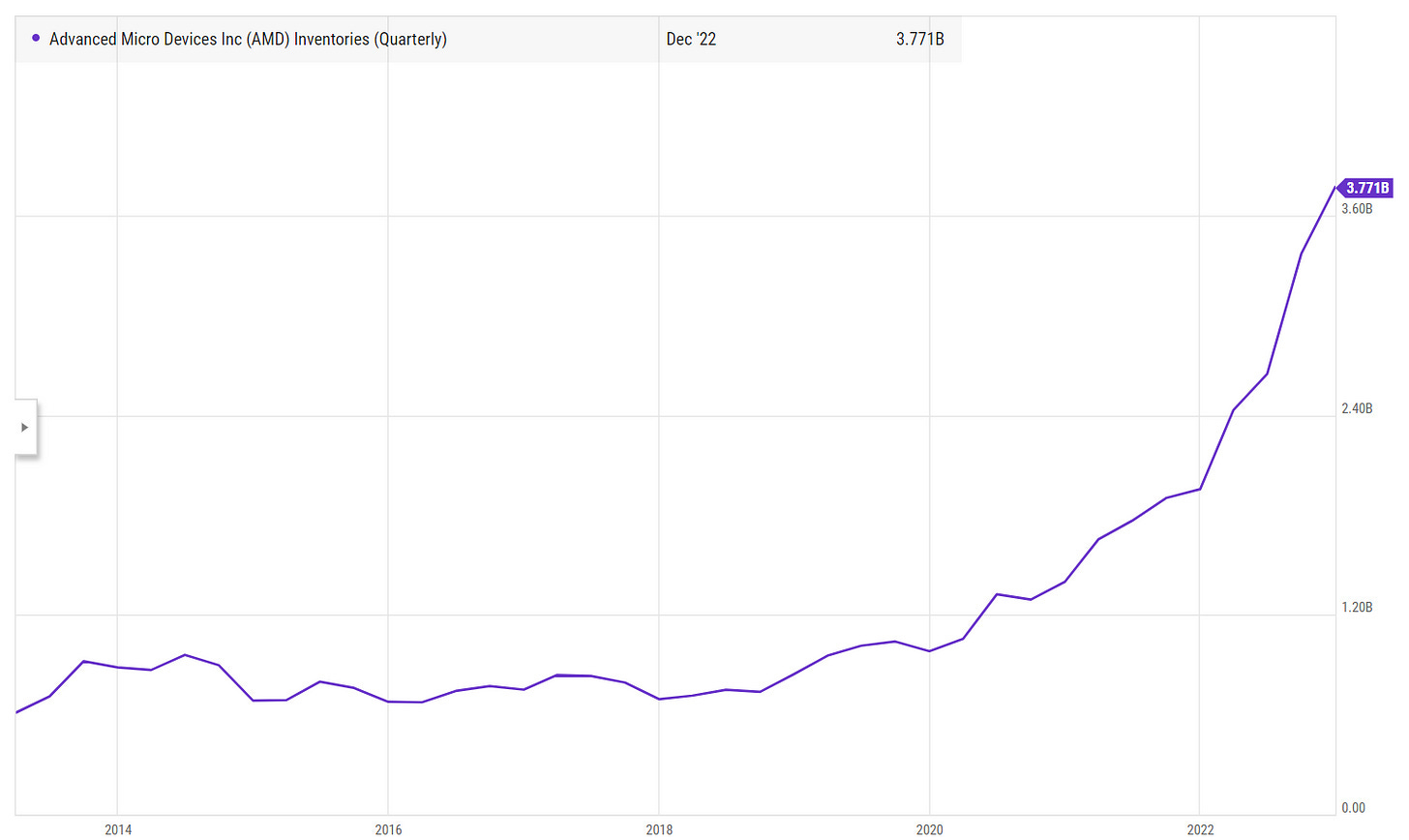

Another thing caught my eye in the CC: AMD “invested approximately $1 billion in long-term supply chain capacity in 2022 to support our expectations for future revenue growth and increase market share.” When asked about this during the Q&A, management eschewed the idea that they carry significant risk “as it relates to COVID future outbreaks.” Not much detail is available here, but I suspect the company has done some great work in this area.

In researching the semiconductor industry, I have found that inventory cycles are natural and recurrent. Inventory was up $402M QoQ, which impacted quarterly free cash-flow. In Q3 and Q4, AMD was shipping under consumption on the client side to reduce downstream inventory. There is in fact no way to foresee how the economy and consumers will evolve over the coming year, but I like to see management being prudent here.

“When we look at the PC markets in the second half of the year of 2022, we were really trying to rebalance inventory, and I think we made progress exiting Q4.”

“And then on the gaming segment, again, we're coming off of a very strong 2022. And so, console demand has been actually quite strong. And given where we are in the cycle, we would expect gaming to be down on a year-over-year basis.”

- Lisa Su, CEO @ Q4 2022

In all, I believe the company is well positioned to continue growing. It has sufficient cash to weather major storms and a strong value proposition for a world moving towards AI. Going forward, I continue looking for signs of consummated integration of Xilinx. Having held AMD for almost a decade now, I remain a happy shareholder.

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Thank you!

Great read.