Edited by Brian Birnbaum and an update of my Amazon deep dive.

1.0 The CapEx Ghost Fades Once Again

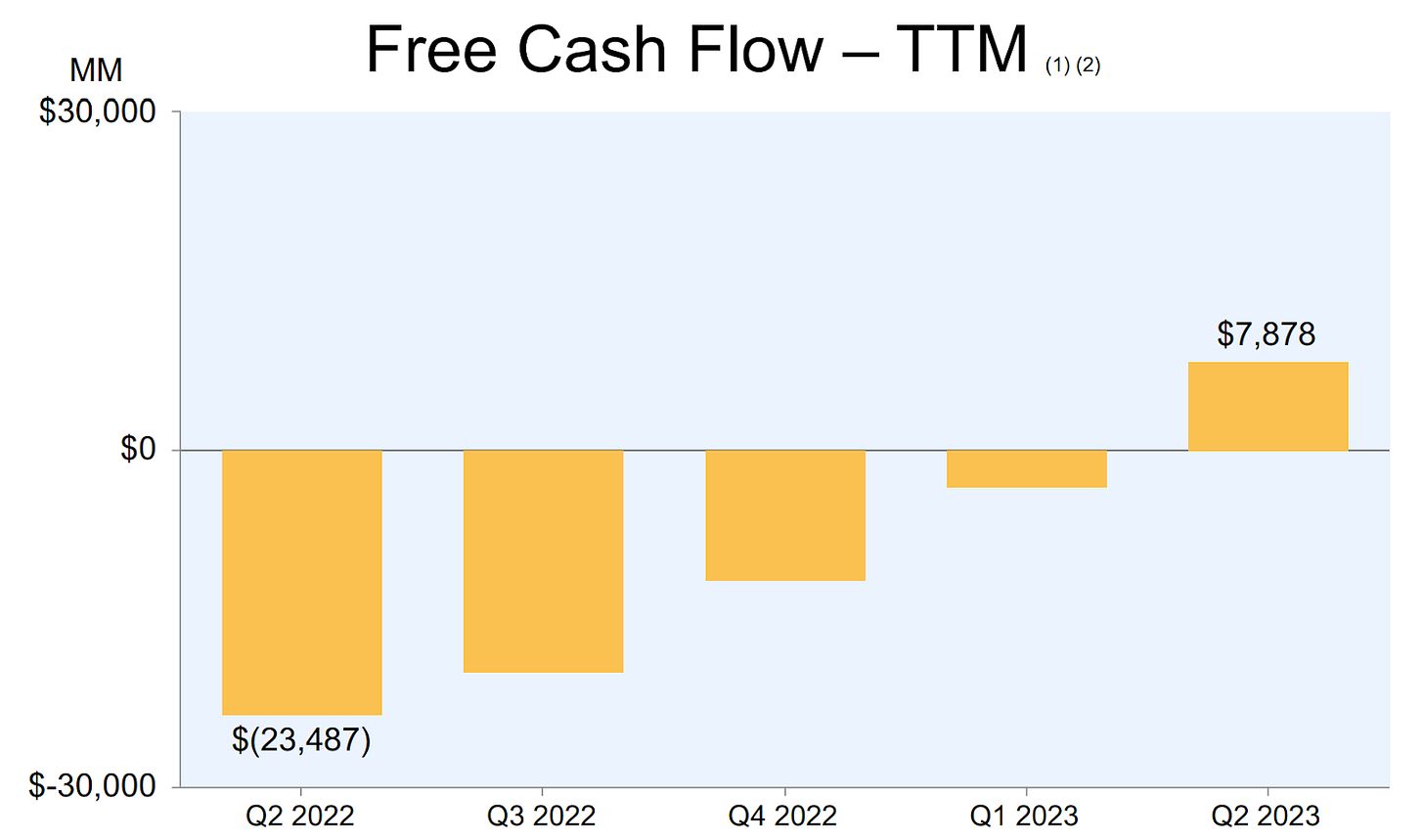

Amazon´s free cash flow and operating income are bouncing back.

In my original Amazon deep dive, I outlined a mental model that led me to believe, with a great degree of certainty, that Amazon's operating income and free cash flow were (and still are) poised to reach new highs in the coming years. In this quarter, I see the thesis evolving successfully.

The aforementioned deep dive contains the following mental model:

Amazon ramps up CapEx every once in a while to attain a greater operational baseline.

Every time it does that, operating income and free cash flow take a hit.

Wall Street–being Wall Street–gets scared by the specter of increased expenditures, believing that this is the new norm and calling for the end of Amazon’s dominance.

But Amazon–being Amazon–eventually yields record levels of operating leverage off the backs of their newly minted property, plant, equipment, and intangible assets.

As a result, operating income and free cash flow reach new highs on the other end of the cycle.

During this process, the market frequently gets spooked–thus my coining of Amazon´s “CapEx Ghost.”

From roughly early 2022 to early 2023, Amazon has doubled the size of its network. This is an unprecedented operational delta for them and, therefore, operating income and free cash flow have crashed spectacularly. However, we now see both metrics rocketing higher than ever.

Going forward, as Amazon continues to gain operating leverage on its expanded capacity, the two metrics will continue trending up and, ultimately, so will the share price.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc