To make the most out of this deep dive, I recommend you read this post I wrote two years ago to learn the basics about biology.

Time spent learning biology will likely be worthwhile, since biotech is now arguably were computers and semiconductors were in the 1950s. Worst case scenario, you’ll be much more interesting to talk to.

Edited by Brian Birnbaum and credits to

for the recommendation to study this company.TL;DR Abcellera is building a platform with the capability to address any human bodily disorder and the company seems to be very well managed.

This deep dive takes you through the science, so that you can gain a first-principles basis understanding of the platform.

An industry of this complexity can only be truly understood via first principles, much like the semiconductor industry (read my AMD and Nvidia deep dives for that).

No time to read the deep dive? Watch/listen for free on Spotify or Youtube:

1.0 An Introduction to Antibodies

Antibodies have many revolutionary applications, but they’re too hard to make via traditional chemical processes. Abcellera has created a platform that leverages the power of the immune system to create antibodies a la carte that can then be administered to patients.

By adding new and high-leverage components to the platform, Abcellera is gearing up to be a sort of Palantir of biotech.

Antibodies are important because they can treat a vast range of health conditions quickly. For example, once injected, a vaccine can take weeks to generate immunity, but antibodies work immediately.

The human body is essentially made of proteins that interact with each other via weak electrostatic attraction (formally known as Van der Waals forces). A protein of a specific shape will come to match with another protein that has the inverse shape–like LEGOs.

Every single process in the human body is the result of proteins interacting in this manner.

For instance, a virus can be neutralized by introducing an antibody that binds to the protein that the virus uses to dock to and infect cells. With the antibody wrapped around said protein, the virus can no longer enter cells.

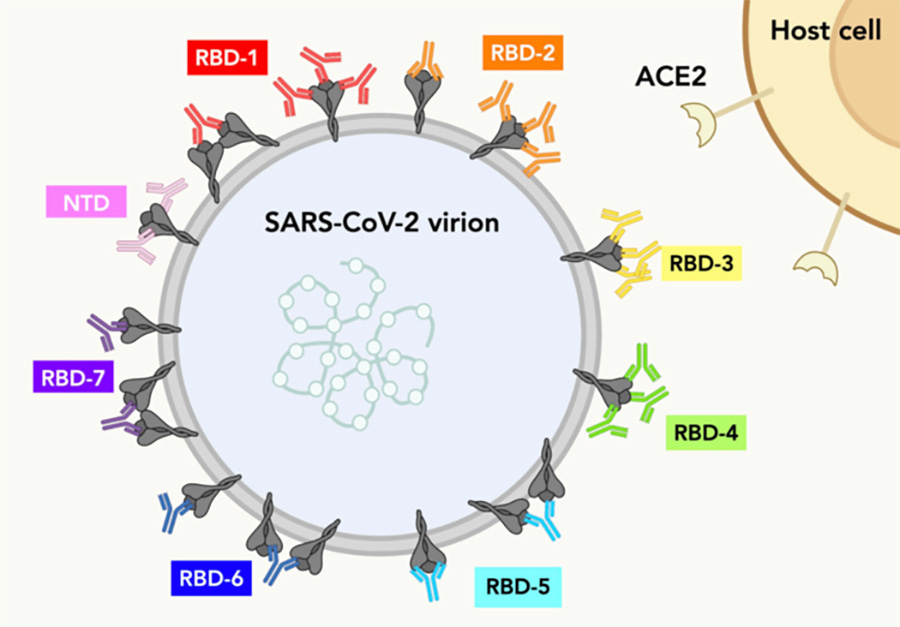

In practice, the shape of such a protein is highly complex, with many protuberances. For this reason, many antibodies can potentially match onto a given viral protein.

In the figure above, you can see that many different antibodies (RBD-1 to RBD-7 and NTD) can bind onto the SARS-CoV-2 spike protein. Without any antibodies wrapping around it, the spike protein connects to the ACE2 receptor present in human cells to offload the malicious genetic material.

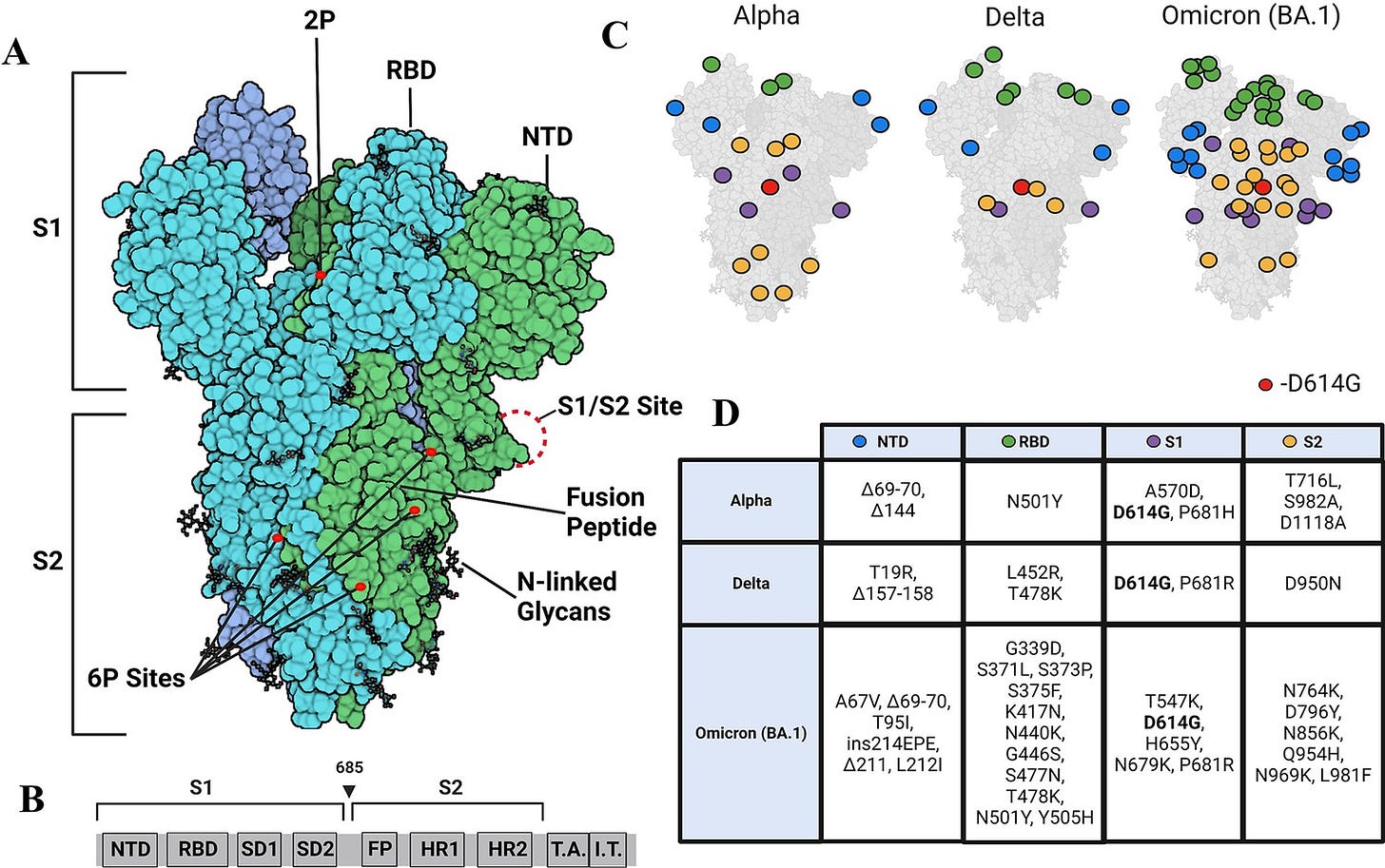

The spike protein is a trimeric glycoprotein, meaning it has three identical subunits. Each subunit has two domains that carry out a specific task:

S1 subunit: This subunit contains the receptor-binding domain (RBD), which is responsible for binding to the ACE-2 receptor.

S2 subunit: responsible for mediating membrane fusion, a critical step for viral entry into the host cell.

The exposed RBD on the S1 subunit has a specific binding pocket that perfectly fits the shape of a domain (bunch of proteins) on the human ACE-2 receptor. Since the two shapes match, the spike protein and the ACE-2 receptor naturally match.

Making antibodies is a computationally intensive task because antibodies are far larger molecules than the ones we can make via the traditional chemical processes that have propped up the pharmaceutical industry to date. An antibody weighs 1,000 times more than an aspirin molecule, for example.

This is why, despite their many applications, we have not been able to leverage antibodies at scale in the healthcare industry. They are too hard to alchemize, and small deviations in the final shape of a given antibody can lead to devastating consequences.

A small change in the shape of a protein can vastly alter its function. Specificity is therefore vital for successful clinical applications.

What’s particularly interesting about Abcellera is not only the science they have leveraged to solve the specificity problem at scale for a broad range of antibodies, but also how they’ve gone about creating the platform. The latter is mostly the result of acquisitions, which I find appealing, which I explain in more detail below.

2.0 Abcellera’s Platform

A series of acquisitions is largely responsible for rapid progress in the company’s key performance indicators. In turn, rising royalty fees since 2015 point to pricing power.

The most common thing to see in the biotech space is very cool science with very little business acumen. Abcellera stands out in that they get the science right–and it’s mostly the result of astute capital allocation that includes the successful acquisition and integration of new platforms and companies.

Although I’m far from initiating a position, this trait makes the company more fundamentally investible than others in the space. They have plenty of capital (as I will review in the financials section), and they know how to allocate it.

In the graph above, notice how the number of molecules (antibodies) in the clinic starts climbing quite rapidly in 2020. Abcellera defines this metric as “the number of unique molecules for which IND or equivalent application has been approved based on an antibody that was discovered by us or by a partner using less and step cellular technology.”

I have identified two drivers for acceleration, which are the aforementioned series of acquisitions together with an evolution of the business model. We’ll get into the acquisitions in a bit.

The business model involves engaging an ever increasing number of co-development programs at ever-increasing stakes.

Per management’s comments in Q3 2023, the shift towards co-development and thus higher incentives seems to have made a considerable impact on the molecules in clinic metric:

Over the past 3 years, we've started to evolve that business model to include co development programs. We have a bigger stake.

And for the last 5 years, we have been working consistently on technology projects that are now yielding wholly-owned potential 1st in class and best in class assets that we're taking forward into the clinic.

-Abcellera CEO, Carl Hansen.

To understand the relevance of Abcellera’s acquisitions, one must first understand the platform in its current state.

Essentially, Abcellera puts B cells (the cells that generate antibodies) in micro-fluidic chambers with antigens (like the spike protein) that are attached to fluorescent beads. When a B cell makes an antibody that binds onto an antigen, the fluorescent bead lights up.

Abcellera then uses computer vision to automate the detection of the lit beats, so that it can scale this process and do it at a high speed. The company does this in plaques which are the size of a credit card that contain many micro-fluidic chambers, as depicted below.

Abcellera then screens the selected antibodies to obtain their exact genomic sequence, which can then be used to manufacture the antibodies in question. For this system to be productive, it must have high throughput, since most of the output molecules will not have a clinical application.

To illustrate, a B cell produces around 2,000 antibodies per second, and they’re all fairly different.

In Q3 2018 Abcellera acquired Lineage Biosciences for an undisclosed amount, because Abcellera wasn’t public back then. By onboarding the capability to perform immune repertoire sequencing, Abcellera can analyze vastly diverse antibodies produced by the immune system in a high-throughput manner.

In other words, this acquisition was pivotal for Abcellera. The name of the game is finding the antibody that best binds to a given target. Without being able to process diversity, the end goal would be much harder to achieve.

In Q4 2020 Abcellera also acquired Triani for $90M, which specialized in developing genetically engineered mice specifically designed for generating diverse panels of human antibodies. These mice can do two very important things, which “normal” immune systems cannot:

Express smaller antibodies, known as heavy-chain only antibodies, that can access target sites conventional IgG antibodies often struggle to.

Break immune tolerance, thus producing antibodies that can target previously inaccessible molecules. This is because a normal immune system will not print antibodies that potentially lead to the immune system attacking itself.

In the above graph, notice how the “Fab” component of a heavy-chain only antibody is much smaller. FAB stands for fragment antigen binding, which is the component of an antibody responsible for specifically recognizing and binding to antigens.

The FAB is smaller, which means that heavy-chain only antibodies can reach targets that the larger antibodies cannot. This is how Triani’s mice unlock novel treatments at a marginal cost, allowing Abcellera to produce more versatile antibodies with its existing platform.

These two acquisitions have brought the company a competitive ability to identify antibodies with real clinical applications that are not easily targeted via normal antibodies. In the graph above, you can see how the mean royalty fee and its interquartile range has increased considerably since these two acquisitions were made.

The above evolution denotes that the acquisitions have worked and that Abcellera is brewing at least a form of pricing power. I thus begin to envisage a management team that can compound the platform’s earning power over time.

This may indeed be a coincidence, but I believe not.

The majority of M&A (mergers and acquisitions) operations fail because of cultural mismatches between the companies involved. A management team that succeeds consistently on this front is unusual. In the next section, I cover the emergence of further signs of successful M&A.

3.0 The Palantir of Biotech

Abcellera has made two additional acquisitions which have vastly expanded the applications of its platform. With some early signs of success, the streak of laudable M&A seems set to continue.

At a lower level, antibodies are just proteins, which in turn are just molecules. It thus follows that molecules with inverse shapes will attract - just like LEGOs. By constantly improving the process of isolating the right molecule for a particular target, Abcellera is poised for a future in which they can target any component of the human proteome.

This sets Abcellera to potentially treat any kind of ailment in the human body. Abcellera has made meaningful strides in this direction via the acquisitions of OrthoMab in Q3 2020 and Tetragenetics in Q3 2021.

OrthoMab allows Abcellera to create bi-specific antibodies that can bind to two different targets simultaneously. This enables the platform to create an antibody that targets a cancer cell and also activates an immune cell, for example, promoting tumor destruction more than otherwise.

With this ability Abcellera can generate more effective treatments.

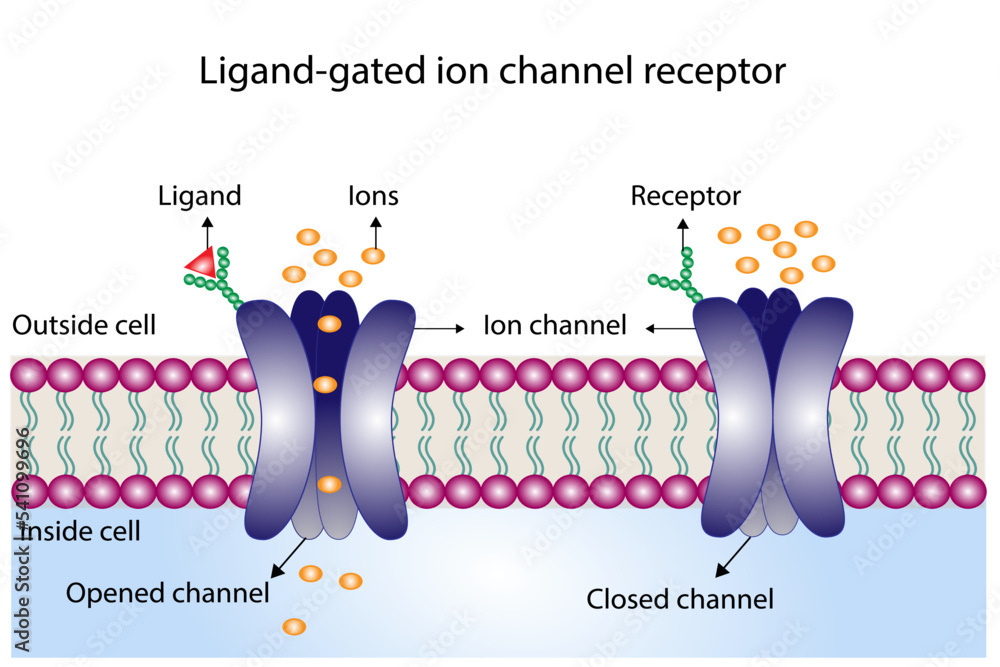

In turn, Tetragenetics allows Abcellera to produce the proteins required to target and manipulate GPCRs (G protein-coupled receptors) and ion channels. The latter two simply sit at the cell membrane (the wall of the cell) and, when a specific protein binds to them, they carry out a series of processes that are vital for the function of a cell.

Therefore, by producing proteins of a given shape, Abcellera is able to manipulate GPCRs and ion channels to induce changes inside the cells of a human body and not just outside via antibodies. Such a concept vastly expands the application of the platform, and at a marginal cost.

The science may seem daunting, but a high-level comprehension is more than affordable.

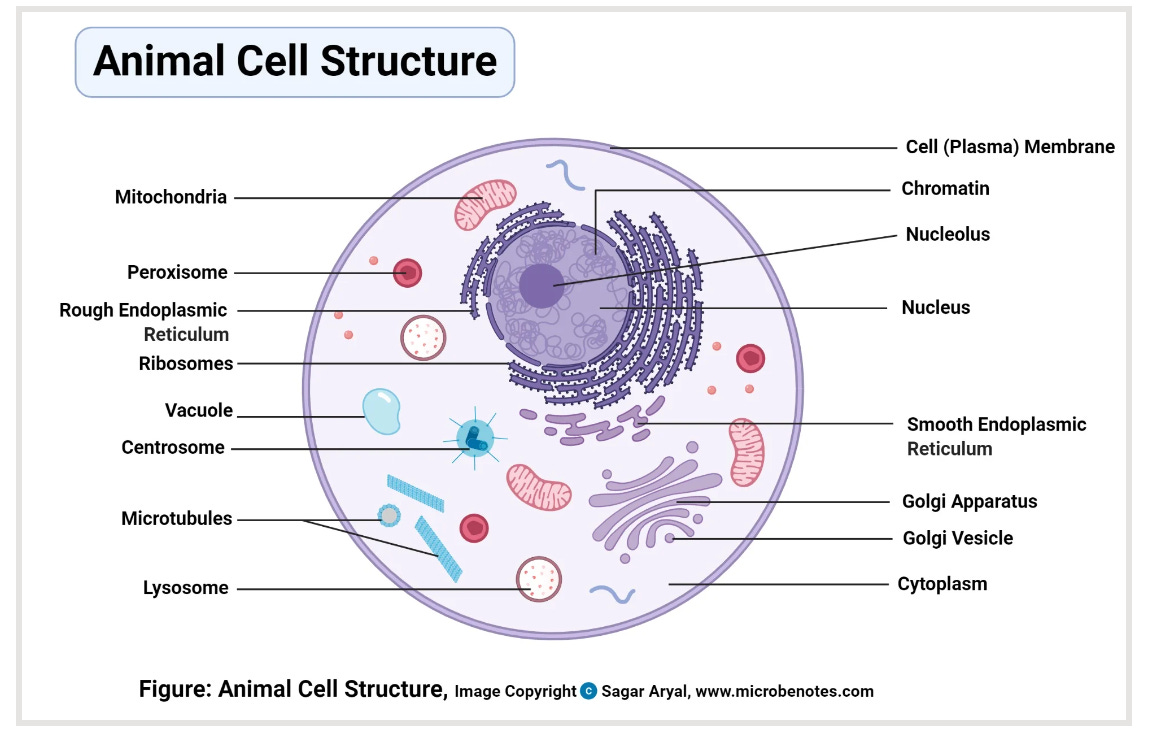

GPCRs are found within the cell wall, such that they see both the outside (extra cellular) and the inside (intra cellular) of the cell. Below you can see what an animal (human) cell looks like.

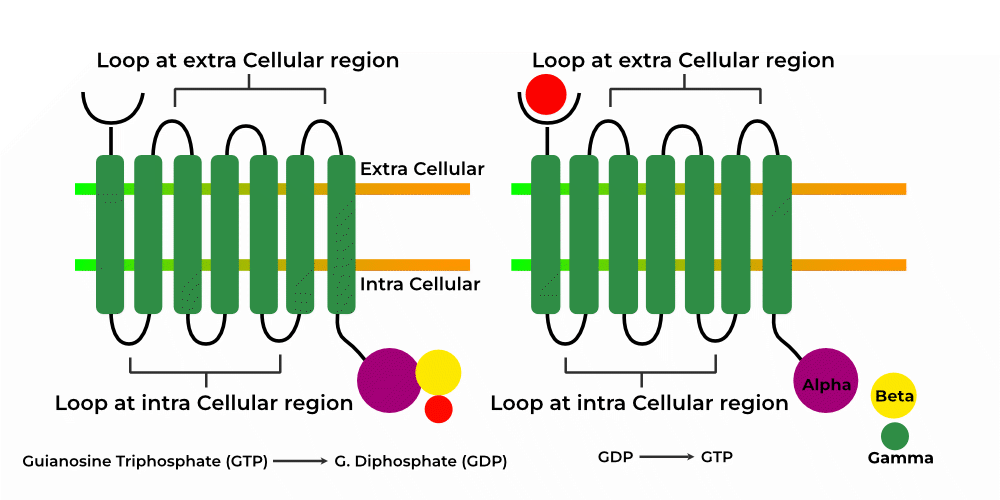

Inside the cells there are G proteins, which consist of three subunits known as the alpha (α, purple), beta (β, yellow), and gamma (γ, green) subunits. These G proteins hang around the GPCRs, listening for changes.

When a GPCR is inactive, with no ligand (protein, in red) attached to it, the nearby G protein is at rest. The alpha component is attached to a molecule known as GTP (guanosine triphosphate) and thus remains attached to the beta and gamma subunits.

When a specific ligand (protein, red circle) binds to the receptor of the GPCR, it triggers a change. In 50 milliseconds the alpha subunit breaks off from the GPT and binds to GDP (guanosine diphosphate), breaking the bonds with the beta and gamma subunits.

The separate alpha-GDP and beta-gamma subunits now venture away into the cell, effecting changes. Separately and in combination, these subunits regulate processes like neurotransmission, hormone action, sensory perception, immune response, cellular growth and differentiation and homeostasis.

In turn, ion channels sit at the cell membrane too and regulate the ions that come in and out of the cell. Minerals like magnesium, calcium and potassium are essential for the body and they travel around it in an ionic form (having lost or gained an electron).

If an ion has gained an electron, it has a negative charge. If it has lost one, it has a positive charge.

When a ligand of a specific shape binds with the receptor of an ion channel, it opens up, allowing specific ions to move through. By enabling negative ions to flow into the cell, for example, it makes the cell’s charge more negative and vice versa.

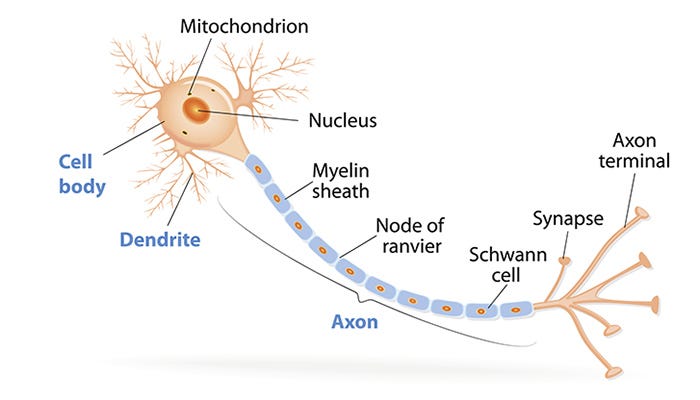

This creates the action potential that yields a rapid and transient surge of electrical activity that travels along the axon (the portion of a cell that carries impulses) of a neuron. It acts as the fundamental unit of communication within the nervous system, allowing neurons to transmit information to other cells, like muscles or other neurons.

In short, Tetragenetics allows Abcellera to tap into transcendental aspects of the human proteome. By combining Orthomab and Tetragenetics, Abcellera can conceivably use its antibody platform to, for example, target a tumor while regulating your hormones, or eliminate chronic pain and enhance your overall immune system.

The point is, these acquisitions set Abcellera up to do amazing things, way beyond simply delivering antibodies for pandemics.

What’s even more interesting perhaps is that there are some early signs that these acquisitions are working. According to management, the drugs ABCL635 and ABLC575 are now expected to enter clinical trials in 2025.

ABCL635 is a therapy for “metabolic and endocrine conditions”, while ABLC575 is positioned to be the “second OX40 ligand” in the market after Sanofi’s Amlitelimab. I’m unaware of whether these two drugs involve bi-specific antibodies, but they certainly involve GPCRs and ion channels.

Although it is early, this seems to be another instance of successful M&A, which adds to my goodwill toward the management team. Additionally, Abcellera is now making efforts to vertically integrate.

4.0 T Cell Engagers

The evolution of Abcellera’s TCE (T cell engager) platform will be a good test of the company’s innate ability to evolve its platform. Thus far, although progress in the lab has been good, the TCE platform has had no clinical success, while the GPCR/ion channel platform is well on the way.

There are two types of T cells: cytotoxic and helper T cells. The former kill cancerous cells while the latter help orchestrate the immune response by releasing signaling molecules (cytokines) that activate other immune cells, such as the B cells that make antibodies.

In Q1 2023 CEO Carl Hansen announced that Abcellera had launched an internal program 18 months before the call to build a platform (leveraging the existing Abcellera platform) to “rapidly” create TCEs (T cell engagers). TCEs are the molecules that allow T cells to bind onto cancerous cells and kill them.

By creating a TCE with a specific shape, you can instruct it to kill a specific (cancerous) cell.

Notice how, by default, T cell engagers are bi-specific molecules because they bind onto two different targets. Remember that Abcellera acquired the ability to synthesize bi-specific antibodies (proteins, molecules) via the acquisition of Orthomab, which I discuss in depth in Section 3.0.

If Abcellera succeeds in bringing real clinical applications via this platform, this will be a strong signal of the company’s ability to get things right. However, in Q4 2023 CEO Carl Hansen admitted that the company did not manage to complete a major partnership in 2023 on the TCE front.

Management did expect to achieve this in 2023, per their comments in Q3 2023:

We also said we would advance our T-cell engager platform and expected to enter into a significant transaction in 2023.

The science and the development of this platform continue to progress as expected and, tomorrow, our team will be presenting new data at SITC in San Diego.

While we haven't completed a transaction yet, we have increasing conviction in our TCE platform, both in its potential to generate internal assets and as a basis for strategic partnerships.

-Abcellera CEO, Carl Hansen.

Although we did not complete a major partnership on TC last year as we had anticipated, our conviction in this effort is undiminished.

-Abcellera CEO, Carl Hansen, during the Q4 2023 ER call.

In practice, TCEs present two types of problems:

The over- or under-stimulation of T cells. It’s hard to get a CD3 binder to activate a T cell to the optimal level.

TCEs can be highly toxic if they are not specific enough. If the engager connects to a cell that is not the cancerous one that you want to kill, this can lead to unwanted tissue damage.

The first can be solved via CD3 binders, which enable the manipulation of T cell activity.

In Q1 2023, management said that Abcellera had built the industry’s largest collection of CD3 binders with more than 500 unique antibodies. It seems that in the lab, this library of antibodies allowed Abcellera to control T cell activation against a few targets.

Abcellera believes that this validates the hypothesis that indeed engagers can be used to target cancers. It shows that once you get a T cell to connect to a specific cancerous cell, you can control it at will.

CD3 binders are not directly involved in antigen (the stuff that differentiates cancer cells) recognition by T cells. They are not TCEs themselves and do not actually bind the T cell to the target in question.

Instead, when the receptor in a T cell binds to a specific antigen, CD3 binders are activated together with other co-signaling molecules. This triggers a cascade of events in the T cell which culminates in the activation of the T cell and ultimately the apoptosis (death) of the cancer cell.

Second, this panel allowed us to effectively control T-cell activation against both targets and to achieve the desired profile of potent tumor self-killing with low cytokine release.

Third, in all cases, the resulting TCEs had superior properties as compared to those built with a commonly used SP34-2 CD3 binder.

And fourth, that the performance of different TCEs depends on the tumor target and the level of target expression on the cancer cells. Together these results support our hypothesis and demonstrate the potential of our platform to quickly generate TCEs that are engineered to have optimal properties.

-Abcellera CEO, Carl Hansen, during the Q4 2023 ER call.

The second challenge can be solved by targeting peptides that are present in cancerous cells, but not in healthy cells. Peptides are little molecules, made of between 2 to 50 aminoacids. These peptides can be targeted by engineering TCRs (T cell receptors).

The difference between TCEs and TCRs is that the former are the natural recognition molecules on T cells, allowing them to identify and respond to specific antigens. Instead, TCRs are artificial tools that leverage the activation capabilities of T cells by bridging them to target cells, even if the T cell wouldn't normally recognize the target cell antigen.

The other possibility is creating antibodies known as TCR mimetics (essentially, antibodies that imitate TCRs). By engineering antibodies of a specific shape, Abcellera can target the peptides that are present in the cancerous cells only.

In Q1 2023 CEO Carl Hansen announced that during the quarter Abcellera had “quickly generated antibodies against a well-validated cancer specific MHC peptide target derived from the protein MAGE-A4, for which there has been a clinical stage TCR mimetic.”

In short, Abcellera seems to have the ability (at the lab level, for now) to solve the two main problems associated with TCEs. It will be very interesting to see how the platform evolves going forward, since it will reveal much of the company’s ability to innovate and bring real solutions to market.

5.0 Vertical Integration

Abcellera’s unusual track record makes betting on its successful vertical integration more likely than otherwise.

Since inception, the company’s core output has been the genetic code for high-performing antibodies. Now it wants to produce the antibodies themselves. Abcellera’s vertical integration efforts can be appreciated via the evolution of CapEx over the last few years.

CapEx is expected to remain at the current levels throughout FY2024, while facilities are expected to come online in early FY2025. Once they do, management believes that CapEx levels will decline as the company shifts its focus towards operating the facilities.

There’s no telling whether Abcellera will succeed in vertically integrating, but the company’s track record makes me think that odds are favorable.

Firstly, the ability management has demonstrated in successfully orchestrating the previously mentioned M&A operations is formidable from a mere science perspective. The number of molecules in clinic are growing exponentially.

Secondly, from a business perspective, Abcellera has shown that it can make money when the opportunity presents itself. In FY2021 and 2022 Abcellera printed plenty of cash from operations, as a result of selling antibodies for Covid.

By Q4 2020 alone, these antibodies had been administered to more than 400,000 patients, which demonstrates a remarkable ability to scale operations. This was accomplished in partnership with Eli Lilly, which focused on manufacturing, while Abcellera provided the immune repertoire sequencing capabilities.

As part of its business acumen, Abcellera seems specifically adept at partnerships. In Q3 2021 Abcellera announced a new collaboration with Moderna, in which Abcellera was going to provide the genetic code for six RNA vaccines that Moderna could then produce and distribute.

RNA vaccines contain genetic code that, once injected in the body, human cells read to then print the antibodies in question. A few days ago, I saw news of Moderna advancing five vaccines for latent viruses such as the Epstein-Barr, Varicella-Zoster virus, and Norovirus to clinical stage.

Although Abcellera has not commented as of yet on the new release, it’s quite a coincidence. Regardless, I get the sense that Abcellera can generally move the needle. Its vertical integration efforts should bear the same footprint.

Additionally, insiders own just over 28% of the company, which means that the operators are highly aligned with shareholders. A risky venture already, Abcellera would, in my opinion, be a gamble without a founder operator with skin in the game.

6.0 Financials

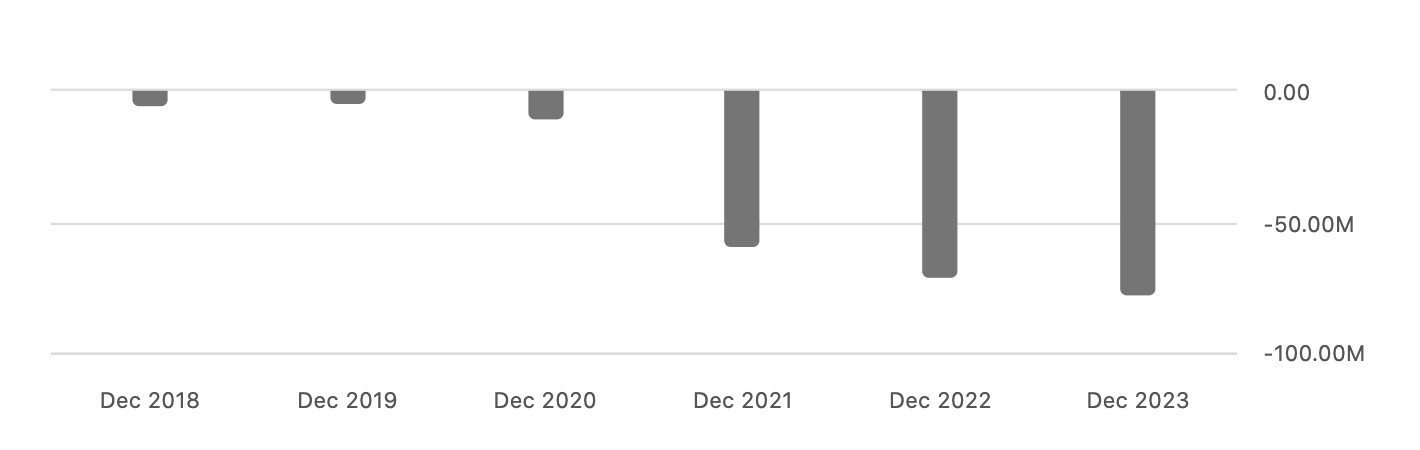

The balance sheet is excellent. The income statement is such that any drug that hits would be highly accretive to the bottom line. However, I have little visibility on the drivers of the top line.

Balance Sheet and Cash Flow Statement

Abcellera’s apparent business expertise is quite tangibly seen in the evolution of the balance sheet. The company has no debt and total cash and equivalents came in at just over $780M at the end of Q4 2023.

The strength of the balance sheet makes a bet on vertical integration non-binary. Following the Covid boom, the business is no longer producing great volumes of cash from operations, but it is not quite burning copious amounts of cash either. CapEx also seems to be under control, as the company builds out the fabs.

Income Statement

I don’t have a great deal of clarity about how the company is making money after the covid boom. I understand that they charge others to sequence antibodies or similarly functioning molecules, but I have no visibility on how that market works and what factors drive demand.

This is a massive blindspot for me in the thesis.

However, as Abcellera continues to compound its platform, integrations, and number of molecules in clinic, odds of generating a wonder-drug continue to increase over time. Everything about the company points to a constantly-improving machine, with said odds increasing at the same time.

I think it’s likely they will eventually come up with something big. But I certainly need to learn more about the business and overall market. After my experience with Amyris, I have learned to spend more time understanding the demand drivers, versus just jumping in for the tech.

Additionally, I need to understand what differentiates Abcellera from competitors and other biotech businesses with overlapping missions and operations.

The company’s net income hovers just under zero, which is an interesting structural property because it means that any drug that truly works will be highly accretive to the bottom line, as was the case for the Covid antibodies.

7.0 Conclusion

My blindspot about the company’s top line drivers, together with a scarce understanding of the competitive environment make the company un-investable for me, for now.

I’ve had an amazing time studying Abcellera’s platform. It’s perhaps the most interesting phenomenon I’ve studied over the last few years. I’m quite passionate about biology and, since its mastery will redefine our world, I’m more than happy to invest time learning more about it.

Abcellera has great potential. The organization seems to be excellent. It has a rare combination of high performance on both the science and business sides, which is quite appealing to me. For this unusual set of traits I think the odds of success in the vertical integration endeavor are enticing.

The balance sheet greatly de-risks the thesis, but I have little visibility on the quarterly drivers of the top line. By this I do not mean that I would like to predict the evolution of the top line every three months, but rather that I do not know what is stopping the company at present from having no revenue over a 9 month period, for example.

Although I am not initiating a position at present, I am far more impressed with Abcellera than with competitors such as Gingko Bioworks, for example. I look forward to learning more about this company and the space in which it operates.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Thank you for your deep dive. Very interesting, I will hold an eye on this company. This reminds me on Immunitybio, only in oncology, but also with several platforms (bispecific antibodies, Car-NK and adenovirus platform). But in contrast to ABCL IBRX does have a PDUFA date for the first drug Anktiva this month. I did a deep dive in their platforms and summarised it here: https://optionicity.com/biotech/ibrx/platform.shtml . Feel free to use the data also from the many clinical trials.

Happy to have inspired you 🙏

Looking forward to reading accurately and discuss it with you!